Ever wonder why you can buy or sell crypto without waiting for an age? That’s the Market Maker in Crypto working its magic. They’re the invisible hands that keep your trades flowing by providing the crucial liquidity we all count on. Now I’m here to pull back the curtain and show you just how these market wizards shape the world of cryptocurrency. From their pivotal role in keeping exchanges bustling to their high-tech tools that govern the vibes of digital currency markets, it’s a fascinating journey. Ready for a deep dive into the craft behind the crypto market’s liquidity? Let’s unleash the secrets together.

Understanding the Vital Role of Market Makers in Cryptocurrency

Clarifying the Role and Functions of a Crypto Market Maker

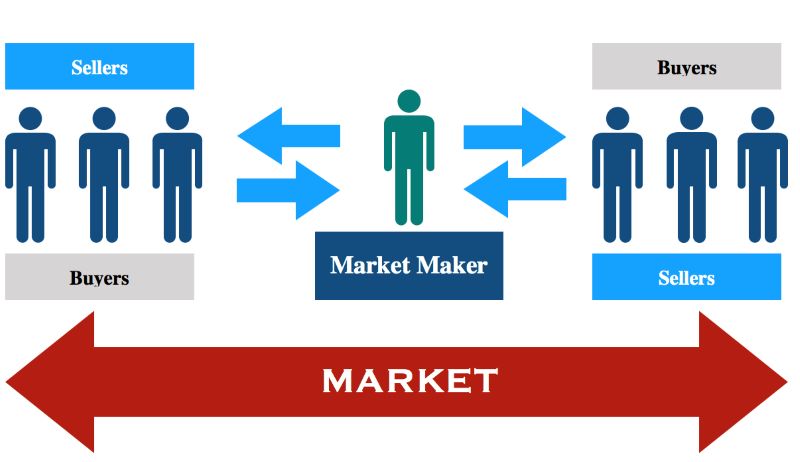

Ever wonder who makes sure you can buy or sell digital coins any time? That’s me – a crypto market maker. My job is to make trades flow. I buy and sell to give options to traders. I am the unseen force behind the numbers on the screen. Without me, trading crypto would be tough. You might wait ages to find someone to trade with.

I set the bid-ask spread. That’s the difference between buying and selling prices. This spread is how I make money. But it also helps the market. It makes sure prices don’t jump too much. This offers a smooth trading ride for everyone.

I use something called an automated market maker crypto system to do it fast. This sort of system works all day and night. It uses math to pick prices. This way, trades happen without a hitch. Tech makes my role way easier.

The Interplay Between Crypto Market Making Strategies and Exchange Ecosystems

My strategies are big news for exchanges. Exchanges are like markets. They connect buyers and sellers. My job is to keep things moving. To keep trades happening. When I do it right, everyone gets a better deal.

To do this, I study how trading works. I watch the crypto exchange order books. These tell me what folks want to buy and sell. I learn what makes prices move. Then, I use special tactics to offer good deals, without risking too much money.

I also look out for arbitrage opportunities in crypto trading. That means I buy low from one place and sell high somewhere else. This can happen fast. It can mean good money, but also risks. I must be careful.

Part of my work is also about understanding crypto market liquidity. Liquidity means how easy you can buy or sell without shifting prices too much. High liquidity is good. It means you can trade quick and easy. I help make that happen.

Crypto market making has meaty challenges too. Prices can swing big in a short time. This makes things risky. I must use smart tactics to avoid trouble. Some tactics are high-frequency trading and algorithmic trading for digital currencies. They let me act lightning fast.

In DeFi, my role shifts a bit. In this space, there are things called liquidity pools. I use these to help me trade. I might even earn some rewards for using them. This is called liquidity mining.

My work shapes how you trade without you seeing it. I make it easy to trade your coins. I help keep prices stable. In the wild west of crypto, I’m like the sheriff, keeping peace. Without market makers, the crypto town could face a bit of chaos. So, I stay sharp. I use brains and tech to keep the crypto world on the right path.

The Machinery Behind Market Making: Algorithms and Automation

The Impact of High-Frequency Trading on Crypto Liquidity

High-frequency trading, or HFT, is huge in crypto. It uses super-fast computers to trade lots of orders in seconds. This helps markets move smooth. More trades mean more chances to buy or sell crypto. This is important. It makes sure prices stay fair for all. But HFT can also cause big price swings when lots of orders hit at once.

HFT makes a tight bid-ask spread. That’s the gap between what buyers want to pay and sellers want to get. A small spread is good. It means you don’t pay a lot extra when you buy or sell. HFT also helps with order flow. So, when you want to trade, there’s often someone on the other side. That’s all thanks to HFT keeping things moving.

How Algorithmic Trading Programs Shape Digital Currency Markets

Now, let’s talk about algorithmic trading programs. They’re smart programs that follow rules to trade crypto. These rules can be simple or complex. They look at stuff like past prices and volume to make decisions. These programs work all day and night. They don’t miss a beat because they don’t sleep like us!

Algorithmic trading keeps liquidity up. That means it’s easier to trade without moving the price too much. This is key when you’re dealing with something as wild as crypto. These programs also spot arbitrage. That’s when you buy low on one exchange and sell high on another. This helps keep prices similar across different places.

These programs use a lot of data. They look at crypto exchange order books, where all buy and sell orders are listed. This data helps them figure out the best times to trade. They also use pricing strategies to set bids and asks just right.

Think of these algorithms like helpers. They work hard to make sure there’s always someone to trade with. They also help you get good prices, whether you’re buying or selling. It’s smart trading, without people having to do all the work.

In DeFi, or decentralized finance, things are a bit different. Here, we have liquidity pools. Traders add their coins to a pool. Then, others can trade against them. It’s like a big pot of money that everyone can use. Market makers in DeFi get special rewards, like fees or new coins, for adding their money in. This draws more people to join in. It’s kind of like getting paid to help out!

So there you have it. The craft of market making in crypto is loaded with smart tools and tricks. Algorithms and automation are shaping how we trade and how the market stays alive. It lets us trade when we want, at prices that are fair. It’s a bit of magic that makes the wild world of crypto a bit more friendly for us all.

Decentralized Finance (DeFi) and the Evolution of Market Making

Liquidity Pools and the Unique Nature of DeFi Market Makers

In DeFi, we see a fresh kind of market maker. Unlike the usual ones, these are coded into the DeFi platforms themselves. We call them automated market makers (AMMs). They use something called liquidity pools to help folks trade. People put digital coins into these pools and earn fees when others trade. This open, code-run system is a game-changer for crypto liquidity providers.

Let’s dig into how this works. Imagine you want to swap one digital coin for another. In the past, you’d need someone to take the other side of that trade. But with AMMs, you don’t wait for a match. You trade with the pool directly! The algorithm sets prices based on supply and demand in the pool. So, there’s always liquidity, ready for any trade!

But what’s in it for those who fund the pools? They earn a cut from the trading fees. That’s their reward for providing liquidity in digital currency markets. It’s a clever way to make sure there’s always money to trade. And it helps people buy or sell crypto without pushing prices too much.

Market Maker Incentives and Their Effect on DeFi Ecosystems

Now, let’s talk about why people become DeFi market makers. The first big reason is cash. Those fees we talked about? They can add up, especially in busy pools. Second, some pools offer extra rewards like new coins, which can be quite valuable. These incentives are a powerful draw for crypto market making strategies.

These bonuses help fuel the DeFi engines. When there’s more money in the pools, there’s less slippage. That means trades are smoother, with pricing that doesn’t swing wildly. It’s clear to see why having a strong role of market maker in blockchain is key.

Yet, with great rewards come risks. If prices move against them, liquidity providers can lose out. It’s a tricky balance but vital for a healthy crypto market.

In the end, DeFi market makers shape how easy it is to trade digital coins. They help us control slippage in cryptocurrency trading and the bid-ask spread in digital coins. With smart crypto market making strategies and the right incentives, they make sure our crypto trading is stable and swift. And that, friends, is a bit of market maker magic, turning chaotic trade into smooth sailing.

Navigating Risks and Rewards as a Crypto Market Maker

Balancing the Benefits with the Risks Faced by Cryptocurrency Market Makers

Let’s dive into the high-stakes world of being a digital asset market maker. Day and night, I keep an eye on the wild waves of crypto market making strategies. As a pro in this game, I’ve learned that balance is key. The rewards? Sweet! But the risks — they’re real too.

Imagine you’re a surfer. The ocean is the crypto market. Big waves are chances to make profits. They come fast, they’re thrilling, but wipe out, and it stings. As market makers, we’re surfing those waves like champs. We set the prices you pay for your crypto. That’s called making a market. When we buy low and sell high, we’re winning. But when things turn south, we can get caught in the tide.

Keeping an eye on crypto liquidity providers is my daily bread. They fill the pool, so trades don’t dry up. Without them, you’d wait ages to swap your Bitcoin or Ethereum. They also help keep prices stable. See a coin price jumping around? That’s when we step in, pumping more liquidity to smooth out the ride.

Automated market maker crypto? Major game-changer! Bots that never sleep, they match buyers and sellers in seconds. They’re like super-fast shopkeepers for the digital currency shop.

Best Practices for Sustainable Market Making in the Volatile Crypto Landscape

The crypto world is like a frontier town from a wild west movie. Rules are still being written. So, how do we make sure we’re the good guys? First, we must stick to our best practices. It’s simple: be smart, be quick, and never bet the ranch.

Understanding crypto market liquidity is where it starts. You’ve got to know how much cash you can throw around. Too little, and you can’t make big moves when you spot a golden chance. Too much, and a drop in prices could mean you’re holding a bag of losses.

Algorithmic trading for digital currencies helps keep things steady. We use fancy math to set up trading rules. This helps us make split-second decisions, like a chess grand master but at the speed of light.

High-frequency trading in crypto? That’s where you make lots of trades super fast. It’s like playing a video game, but with real money. You can win big but remember, there’s no reset button in this game.

Finally, being tight with crypto exchange order books is a must. These order books are the secret maps to where the market’s heading. It’s like seeing everyone’s poker hand at the table.

The risk of slippage in cryptocurrency trading — when your trade slips to a worse price than you wanted — is like a snake in the grass. We tackle it head-on, making sure trades go through smooth and quick.

And that bid-ask spread in digital coins? It’s the difference between what buyers want to pay and what sellers ask for. Market makers like us work to keep this gap small, so you get fair prices.

Being a crypto market maker is not for the faint of heart. But with a sharp mind and quick reflexes, we ride the wave, always aiming to keep the market a fair playground for everyone.

To wrap things up, we’ve seen how key market makers are in crypto, right from their roles to the smart tech they use. They’re like the engines that keep trade smooth, using fast trades and clever bots to make sure there’s always enough currency to go around. With DeFi growing fast, these players are also changing, finding new ways to pool money and keep the system fair. Yet, they’ve got to be sharp, balancing the perks with some serious risks to stay on top in the wild ride of crypto trading. Remember, their choices can really shape our digital coin world. So, there you have it – diving into the depth of market making has shown us the big impact these behind-the-scenes heroes have. Keep an eye on them; they’re shaping the future of how we trade and trust in our online coins.

Q&A :

What is a market maker in the context of cryptocurrency?

Market makers in the crypto world serve a vital role in providing liquidity to the market. They do so by continuously buying and selling cryptocurrencies at quoted prices, thereby allowing traders to execute orders quickly, without waiting for a matching buy or sell order from another party. Their activities help to ensure that spreads – the difference between buy and sell prices – are narrower, which contributes to a more efficient market.

How do market makers profit in the cryptocurrency space?

Profit for market makers in cryptocurrency largely comes from the spread between the buy and sell orders they set. Since they are providing liquidity and allowing for trades to occur instantaneously, they earn the difference between the price at which they’re willing to buy (bid) and the price at which they’re willing to sell (ask). Additionally, exchanges often provide rebates to market makers for their role in maintaining active markets.

Can anyone become a market maker in crypto, or are there specific requirements?

Technically, anyone with the necessary capital and understanding of the market can become a market maker in the crypto space. However, successful market making requires a sophisticated understanding of trading strategies and often, access to advanced trading algorithms. Some cryptocurrency exchanges also have specific requirements and offer market-making programs to entities that can prove substantial trading volume and the capacity to provide liquidity.

What are the risks associated with being a market maker in cryptocurrency?

Being a market maker involves several risks, such as holding large amounts of various cryptocurrencies which are subject to market volatility. They also face potential losses from rapid price movements that can occur in the relatively less regulated and more volatile crypto market. Additionally, technological risks such as system failures or cyber-attacks could impact the efficiency of market making operations.

How does market making in cryptocurrency differ from traditional markets?

Market making in cryptocurrency can be more volatile than in traditional markets, given that digital assets can experience rapid and significant price changes. This volatility affects the inventory risk market makers take on. Also, whereas traditional markets have specific trading hours, the cryptocurrency market operates 24/7, requiring constant management and algorithm adjustment by market makers. Additionally, the cryptocurrency market is still evolving, with a need for more regulatory clarity compared to the established frameworks in traditional finance.

RELATED POSTS

Security Measures: Outsmarting Blockchain Attacks with Cutting-Edge Defenses

Enhance your blockchain security with...

Decentralized Learning Platforms: Revolutionizing Education with Blockchain Tech

Discover how decentralized learning platforms...

Unveiling The Future: Benefits Of Using Blockchain In Different Industries

Benefits of using blockchain: transform...

Blockchain use cases: Unveiling 10 Innovative Real-World Applications

Transforming finance with blockchain technology:...

Real-world Applications Of Blockchain Technology: Beyond Bitcoin’s Buzz

Revolutionizing finance, trade, and security....

Initial Coin Offering (ICO) Boom: Unpacking the Digital Gold Rush

Explore the ICO phenomenon: Basics...

What is SDK in Crypto: Unveiling the Key to Seamless Blockchain Development

Demystify Crypto SDKs: Foundation of...

Platforms And Protocols For Connecting Different Blockchains: Interoperability Unlocked

Discover the Leading Interoperability Protocols...

Examples of blockchain transparency in action: Unveiling Impact

Examples of blockchain transparency in...

Challenges of Using Decentralized Learning Platforms: Is Blockchain the Solution?

Exploring the Challenges of Decentralized...

Casper Crypto: Exploring and evaluating growth potential

As the cryptocurrency market continues...

Latest Developments In Blockchain Technology In Financial Service

Latest developments in blockchain technology...

Forgotten Runiverse: A promising NFT Game on Ronin Network

Forgotten Runiverse is emerging as...

Can you short Bitcoin? – Exploring the Secret

Can you short Bitcoin? This...

How to Make a Safe Crypto Wallet: Fortify Your Digital Gold

How to make a safe...

Hashgraph Consensus Unveiled: Is Blockchain’s Future Unstoppable?

Explore the Hashgraph revolution. Discover...