Unveiling Types of Crypto Derivatives: Your Ultimate Guide to Digital Asset Trading

Ever wonder how savvy traders handle the wild swings of the crypto world? It’s all about mastering the types of crypto derivatives—a crucial tool for any digital asset enthusiast aiming to play the game smart. In this clear-cut guide, I’ll walk you through the foundational instruments like futures and options, and dive into advanced tactics that use swaps and perpetual contracts. As we unravel the ropes of effective risk management and get a handle on the regulatory side of things, you’ll gain the confidence to navigate the complex but rewarding landscape of crypto derivatives. Bonus: we’re also going to eye the latest in DeFi and smart contract-powered platforms, setting you up to trade like a pro. Strap in; you’re about to become the trader to watch!

Understanding the Basics of Crypto Derivatives

Exploring Crypto Futures Contracts

Think of crypto futures like a promise. They are deals to buy or sell an asset at a future date. But, here’s the twist: the asset’s price is set in stone today, no matter what it’s worth when the deal closes. It’s like agreeing to buy a bike at today’s price but picking it up next month.

You lock in the cost early to protect yourself from price swings. Let’s say you run a business that relies on Bitcoin. If you think Bitcoin’s price will shoot up, you can enter futures contracts to buy it later at today’s prices. That way, if the price does go up, you’re a step ahead!

Crypto futures are smart moves for playing it safe or for a bold bet on where you think the market’s headed. They’re big in the game for folks eyeing long-term plans, but who also stay sharp on daily price dances.

The Mechanics of Bitcoin Options Trading

Ever wish you could choose in the future to buy or not to buy? Say hello to Bitcoin options. They give you the right, but not the duty, to buy or sell Bitcoin at a price you pick ahead of time. But these options aren’t free; you pay what’s called a “premium” to get them.

Imagine you’re eyeballing a new phone that might go on sale next week. Buying an option is like paying a small fee now for the chance to buy that phone at today’s price, once next week rolls in. If it’s cheaper then—great, buy it in the shop! If not, use your option to snag it at the lower price you locked in.

People love options because they can bet on Bitcoin’s ups and downs without too much risk. You can’t lose more than the premium you paid if things go south. Yet, if the price skyrockets, you could be in for a sweet payday.

Playing with Bitcoin options takes some know-how. It’s about reading the market and guessing what tomorrow holds. Tick the right boxes, and options can be your golden ticket in the trading world—just remember, it takes skill and a little bit of guts.

Advanced Derivative Instruments in Cryptocurrency

Strategies for Ethereum Swaps Market

When you dive into the Ethereum swaps market, you’re looking at a big game. Think of swaps like a tap dance. You trade one thing for another. This can mean swapping Ethereum for another digital currency without a fuss. Picture someone wanting to swap apples for oranges. In crypto, it’s swapping Ether tokens for other coins. These swaps don’t need middlemen. That keeps things quick and cuts costs.

Swaps are popular for hedging. Hedging is like an insurance policy for your investments. You reduce risk by making sure you’ve got a backup plan. For example, a farmer might use futures contracts to set a price for his crops in advance. If the market crashes, he’s got that locked-in price.

But swaps have risks. You could face a counterparty who can’t keep their promise. So, adopting swaps as a strategy means thinking ahead and playing it smart. Swaps can also boost your leverage in crypto. This means you could control a big pile of coins with less money down.

The Role of Perpetual Contracts in Crypto

Now, let’s chat about perpetual contracts in crypto. These never expire – that’s why they’re “perpetual.” Unlike traditional futures, these are not bound by time. They mimic a spot market but with added oomph from leverage. It’s like letting you take a swing at a baseball with a bigger bat. You only need to put down a small initial margin to get started.

So why use them? It’s straightforward – they help you bet on future prices of Bitcoin or Ether without setting a close date. You’re free to hold the contract as long as you like. Think of it as being on a playground swing. You can keep swinging as long as you keep pushing your legs – it never has to end unless you decide to stop.

But hold on, more risk comes with that freedom. Markets in crypto can swing much harder than actual swings. You must keep an eye on your trade or it might just wipe out your margin. And – no shock here – there’s always the worry about the counterparty in these deals. Can they pay if they lose? It’s essential to think about these risks when trading perpetual contracts.

Trading perpetual contracts also depends on liquidity. Imagine a fruit stall. A stall heaped with apples is more likely to sell you one or buy one from you. In crypto, a market with lots of activity (liquidity) makes it easier to enter and exit trades. It’s vital for perpetual contracts to work smoothly.

Remember though, trading derivatives is not a walk in the park. With big rewards come big risks, especially in the lightning-fast world of crypto. Staying sharp, understanding each move, and respecting the risks are key in these advanced instruments. Go in prepared and keep learning – your trading journey depends on it!

Risk Management and Regulatory Landscape

Hedging with Crypto Swaps and Options

Risk lurks in every corner of the crypto market. It’s like a video game; but here, we play with real coins. Crypto swaps and options are two shields you can use. These tools let you lock in prices or trade without owning an asset. You hedge—our fancy term for protection—against the wild swings of the market. Imagine you’re holding Bitcoin, and you fear the price may drop. With Bitcoin options trading, you can buy an option to sell at today’s price, even if tomorrow’s price falls. It’s like an insurance policy for your digital coins.

Ethereum swaps work a bit differently. You swap Ethereum for another asset at agreed-upon terms. You set the date and price today, shaking off future price swings. The Ethereum swaps market is growing, with more people looking to trade. By using swaps, you can manage your risk without giving up potential gains. Smart, right?

Crypto futures are similar but with a twist. You agree to buy or sell at a future date at a set price. Cryptocurrency futures explained in simpler terms: It’s like betting on a horse race, where you lock in your bet before the gates open. These futures contracts can be on Bitcoin, Ethereum, or other altcoins.

Keep in mind, leverage in crypto derivatives amps up both wins and losses. Higher leverage means a smaller move in price can have a big impact on your wallet. You could make a bundle or lose your shirt. Pricing crypto futures is no guesswork. It’s about reading the market and knowing the trends.

And here’s something cool: perpetual contracts in crypto don’t have an expiry date. So, you can hold on to your bet for as long as you like, till you’re ready to settle.

Now, understanding crypto options and swaps means also knowing the risks. You must consider things like counterparty risk in crypto derivatives. This is where one party might not hold up their end of the deal. Initial margin in crypto trading is what you put up front, and it serves as a buffer for your trades. Always remember, in the world of crypto, the initial margin can change quickly.

Navigating Crypto Derivatives Regulation

Crypto derivatives regulation is a hot topic. Governments and companies are trying to set rules to keep the game fair. Every player in the blockchain-based derivatives must follow these rules. Think of them as the referees of our digital asset trading world. They’re there to ensure no one is cheating and that everyone understands the stakes.

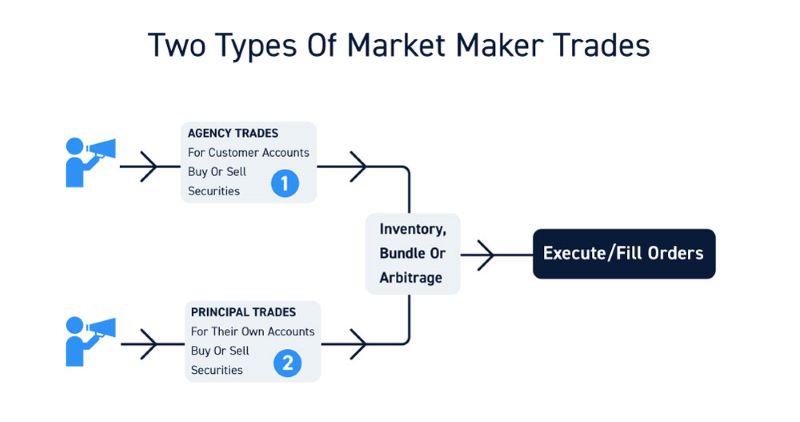

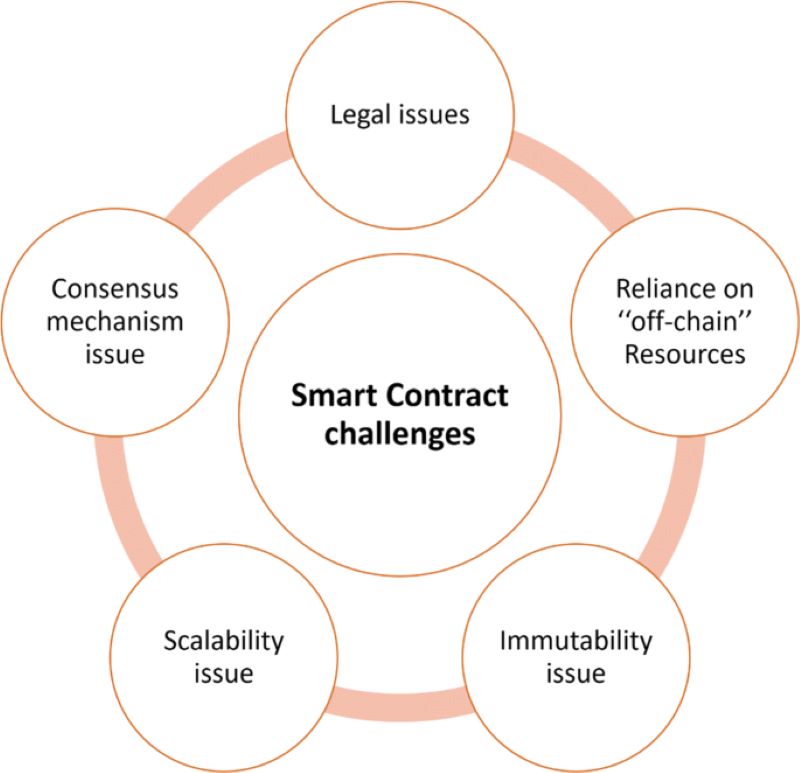

DeFi derivatives platforms have joined the scene, changing the way we play. They use blockchain tech to create a trustless system where you don’t need a middleman. The pricing of cryptocurrency options premiums, liquidity in these platforms, and synthetic assets in blockchain—all hinge on smart contracts. These smart contracts automate trading, making it faster and less prone to human error.

But wait, there’s more to consider! Crypto derivatives tax implications are a real thing. You need to know how your trades will affect your taxes.

For those building a crypto fortress, knowing the landscape is key. You can’t ignore the regulations and risks. But with the right strat, crypto derivatives can be a powerful tool in your arsenal. Keep learning, trading, and staying ahead of the game. Happy trading!

Cutting-Edge Developments and Trading Platforms

The Emergence of DeFi Derivatives Platforms

DeFi, or decentralized finance, is changing the game for crypto trading. It uses tech that cuts out middlemen like banks. This means you are in control of your money. DeFi platforms for derivatives let you trade directly with others. You might think of it as peer-to-peer trading on steroids.

These platforms are not just new; they’re a leap forward. They offer things like crypto futures contracts. A futures contract is a deal to buy or sell an asset later, at a set price. This can help you if you’re worried about price drops. You can lock in a price now, without the stress. It’s like saying, “I’ll sell my Bitcoin for $50,000 in December,” no matter the current price.

Leveraging Smart Contracts for Derivative Trading

You might wonder, ‘What are smart contracts’? They are like super-powered deals written in code. They run on blockchain, the tech that powers Bitcoin and Ethereum. These coded contracts do the work, so you don’t have to.

Let’s talk about how they help in trading stuff like Bitcoin options. An option gives you the right, but not the duty, to sell or buy at a certain price. It’s kind of like a coupon that says, “You can buy this ice cream for $2 anytime this month”. With smart contracts, these options work like clockwork. No need to trust the other guy. These contracts make fair play the only way.

Smart contracts also make it easier to play the field in places like the Ethereum swaps market. Here, you can switch one asset for another. Think of it as trading your skateboard for a scooter directly with a friend. Swaps can help you hedge, which means protecting your investments from big losses.

Another cool thing here is that you don’t always need lots of cash up front. But be careful, because that can make losses bigger too. This is what we call leverage in crypto derivatives. It’s like using a small stone to move a big rock. It makes your trading power stronger.

DeFi platforms use these smart contracts to automate everything. They connect buyers and sellers, figure out pricing, and make sure everyone gets what they were promised. All this, without a bank or broker taking a cut. It’s pretty amazing stuff.

Derivatives can be tricky. There are rules and risks that you need to know. But the payoff can be big if you learn how it all works. It’s a world where you can bet on prices, protect your investments, and play in markets across the globe, all from your computer. It’s like having a financial superpower, with smart contracts as your trusty sidekick. Just always remember to trade smart and understand the risks. Because even superheroes can take a tumble if they’re not careful.

In this post, we dove into the world of crypto derivatives. We explored basics like futures and Bitcoin options trading. Then, we looked at advanced tools such as Ethereum swaps and perpetual contracts. We also discussed key ways to manage risks and comply with regulations in the crypto derivatives market. Plus, we touched on the rise of DeFi platforms and smart contracts for trading.

My final thoughts? Crypto derivatives are complex but vital for traders looking to hedge bets or profit from market swings. As you step into this arena, remember to balance keen strategies with a strong grip on risk management. Stay informed on regulations to keep your investments safe. Happy trading!

Q&A :

What are crypto derivatives and how do they differ from traditional derivatives?

Crypto derivatives are financial instruments that derive their value from the performance of underlying cryptocurrency assets. Like traditional derivatives, they allow traders to hedge against price volatility, speculate on price movements, and leverage their positions without owning the actual asset. However, crypto derivatives differ in that they are based on the blockchain and digital currency markets, often featuring higher volatility and 24/7 trading accessibility.

What types of crypto derivatives are commonly traded?

The most commonly traded types of crypto derivatives include:

- Futures contracts: Agreements to buy or sell a crypto asset at a predetermined price on a specific future date.

- Options: Contracts that give traders the right, but not the obligation, to buy (call) or sell (put) a cryptocurrency at an agreed-upon price before a certain date.

- Swaps: Agreements to exchange cash flows between parties, often used to swap variable interest rate payments for fixed rate payments.

- Perpetual contracts: A type of futures contract without an expiry date, allowing positions to be held indefinitely.

How can investors leverage crypto derivatives for their portfolio?

Investors can leverage crypto derivatives to:

- Hedge exposure: Using derivatives as insurance to offset potential losses in their crypto holdings.

- Speculate on price movements: Predicting the future price of cryptocurrencies and entering contracts that profit from these predictions.

- Diversify their portfolio: Including derivatives to spread risk across different types of investments and not just spot market crypto assets.

Are crypto derivatives regulated, and what are the risks involved?

Crypto derivatives are regulated to varying degrees depending on the jurisdiction, with some countries implementing strict rules, and others having a more lenient approach. The risks involved with trading crypto derivatives include market risks from volatile price swings, operational risks from exchange security, and regulatory risks pertaining to the changing landscape of cryptocurrency legislation.

How do I start trading crypto derivatives?

To start trading crypto derivatives, one should:

- Research to understand the various types of derivatives and their mechanisms.

- Choose a reputable cryptocurrency exchange or derivatives trading platform that offers the desired type of derivative.

- Ensure compliance with all regulatory requirements, including KYC (Know Your Customer) and AML (Anti-Money Laundering) protocols.

- Develop a strategic trading plan to manage risks effectively.

- Begin with a demo account if available to practice without financial risk before transitioning to a live trading account.

RELATED POSTS

Peaq Crypto: A disruptive Blockchain platform

Peaq Crypto, a high-performance layer...

Blockchain Revolution: How Is Blockchain Used In Different Industries

How is blockchain revolutionizing finance,...

Emerging Trends in Blockchain Security: Next-Gen Safeguards Unveiled

Emerging trends in blockchain security:...

Blockchain Ballots: Revolutionizing Voter Fraud Prevention Systems

Examples of blockchain-based voter fraud...

What are ledgers legit emails?

What are Ledgers legit emails?...

Physical Bitcoin: The truth about the top digital currency

Have you ever heard of...

How to Make a Safe Crypto Wallet: Fortify Your Digital Gold

How to make a safe...

Who Invented Blockchain? Unraveling the Mystery Behind the Tech Revolution

Who invented blockchain? Unveiling the...

Can blockchain track pharmaceuticals throughout the supply chain?

Can blockchain track pharmaceuticals throughout...

BlockMesh Airdrop – From Idle Bandwidth to $BMESH

BlockMesh Airdrop helps turn idle...

How does blockchain technology help organizations when sharing data

Wondering “How does blockchain technology...

Moonwalk Fitness Airdrop – Guide to Participate and Receive Rewards

Moonwalk Fitness Airdrop offers a...

Mining Cryptocurrency how to? How to read trading charts cryptocurrency?

When venturing into the world...

Predictions For The Future Of Blockchain Technology: Trailblazing Tech Transformations Ahead

Blockchain technology is shaping the...

Latest Developments In Blockchain Technology: Unveiling the Latest Tech Advances

Latest Developments in Blockchain Technology:...

Explanation of Proof of Work: How PoW Secures Blockchain Innovation

Explanation of Proof of Work...