Exploring Liquid Staking in Crypto: it’s not just a buzzword; it’s your ticket to unlocking 24/7 earnings potential. Imagine earning rewards around the clock without locking up your assets or sacrificing liquidity. With traditional staking models, your crypto sits idle, untouchable until the end of the term. But liquid staking changes the game. It merges the power of DeFi with the benefits of staking, letting you squeeze every drop of value from your digital assets. You’re about to dive into the heart of liquid staking and see how it’s shaping the future of decentralized finance. Ready to turn your crypto into a 24/7 money-making machine? Let’s get started.

The Foundations of Liquid Staking in the DeFi Ecosystem

Understanding Liquid Staking and Its Role in Decentralized Finance

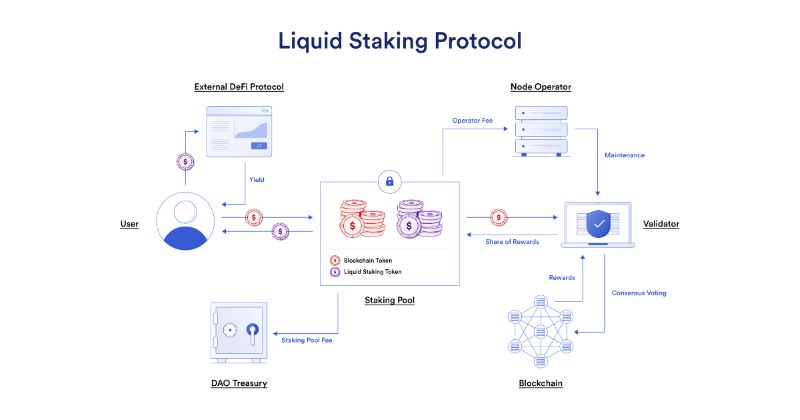

Decentralized finance, or DeFi, changes how we use money. It lets us lend, trade, and earn without a bank. Liquid staking is a big part of DeFi. Imagine earning money just by holding crypto. That’s staking. But, what if you could still use that crypto while it earns? That’s liquid staking.

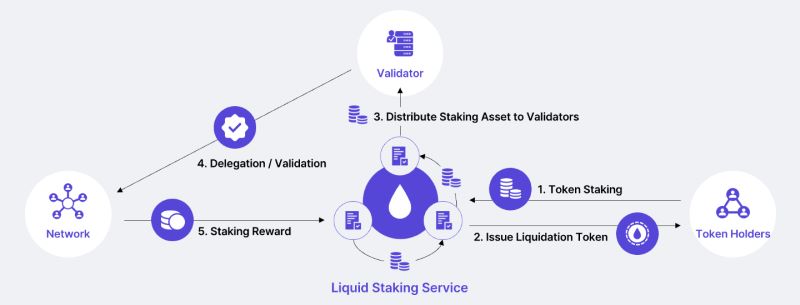

Liquid staking lets you stake tokens without locking them up. You get to earn staking rewards and keep your crypto liquid. So, you can use it any time. Staking in blockchain cuts out the middleman. You work directly with the proof of stake (PoS) system. This helps keep things safe and in your control.

This new staking way suits people who want their money to work non-stop. It’s like having a rental property but still being able to use it when you want. Liquid staking gives you that same freedom with crypto.

With liquid staking, you get a special token in return for your stake. This token represents your staked amount. Use it to trade or lend just like other crypto. Your original staking tokens sit safely, racking up rewards.

Comparing Liquid Staking to Traditional Crypto Staking Models

Now, let’s look at traditional crypto staking. In the old days, staking meant locking your crypto. You couldn’t touch it, but you got rewards for helping the network. This is fine for some. But it limits how you can use your crypto.

With liquid staking, your assets aren’t stuck. You stake but stay flexible. Picture it like this. Traditional staking is like putting your money in a time-lock safe. You know it’s growing, but you can’t reach it until time’s up. Liquid staking, however, is like having your money grow in your pocket. You can pull it out and use it anytime.

Staking in blockchain, especially with PoS, is all about helping the network. You become part of the system that checks and confirms transactions. This role is vital. And the network says thank you with staking rewards.

But, there’s a catch in traditional staking. Your money could sit still for a long time. Some don’t mind waiting. But if you want to move fast in the DeFi world, liquid staking is the way to go.

In a nutshell, liquid staking explained simply is freedom with responsibility. Your crypto earns while staying ready to use. This keeps the network healthy and strong because everyone’s in it together.

Decentralized finance, DeFi, is built on this teamwork. Every staker plays a part. Tools like staking pools let us band together, spreading out tasks and rewards. Bigger rewards often follow bigger stakes.

But, every choice has pros and cons. Liquid staking comes with risks and benefits. You must weigh things like safety, ease of use, and earning potential. Good choices depend on good information.

This means knowing about staking contracts, validator nodes, and rewards. You must understand slashing, where mistakes might lose you money. And think about liquidity in staking; can you move your assets when needed?

Getting into DeFi, especially staking, changes your role in crypto. You’re not just owning it; you’re powering it. Liquid staking turns crypto holding into active earning. And that’s a game-changer for many in the crypto world.

Assessing the Risks and Rewards of Liquid Staking

Analyzing the APY and Potential Earnings from Liquid Staking

When you stake your crypto assets, you lock them up to earn more. This is like earning interest in a bank, but for your digital coins. Liquid staking is different from normal staking. Why? You can still use your staked assets in other ways while you earn.

What is the APY for liquid staking? It’s the money your crypto can earn in a year. It varies and can be high. This APY can change often. A good APY means you make more from your staked coins.

With liquid staking, you can earn around the clock. This means your crypto works for you all the time. You can get staking rewards plus use your crypto for other things in DeFi. This is great for folks who like their money to always be busy.

Identifying and Mitigating the Risks Associated with Liquid Stakes

But hey, let’s talk risks too. Staking isn’t risk-free. One big risk? The value of your crypto can go down. When the market isn’t doing well, what you earn might not cover the drop in coin value.

Also, your staked crypto could be locked if the platform has issues. What can you do? Be careful where you stake. Pick stable and trusted crypto staking platforms, and don’t put all your eggs in one basket.

Another risk is something called “slashing.” If the validator node of your staked crypto makes a mistake, a part of your staked assets could be taken away as a penalty. Ouch, right? To avoid this, choose validators that have a strong record of playing by the rules.

Security is super important, too. Make sure the platform you use is safe and has ways to protect your assets. This helps you sleep at night, knowing your crypto is secure.

Liquid staking means you can get into other DeFi activities like yield farming. This can bump up how much you make. Pretty neat! But remember, this can also mean more risk. So know the game before you jump in.

Staking-as-a-service providers can be a big help. They handle the technical bits of staking for you. That’s good if technology isn’t your strong suit. But choose wisely and check how they work and their fees.

Finally, let me tell you about impact on token value. When you stake tokens, it helps the blockchain network run smooth. This is good for the network and can help the value of your tokens.

Thinking about liquid staking? Do your homework. Check the APY, the risks, and pick a good spot to stake. Always keep in touch with the DeFi world to stay wise and safe. Remember, staking smart means earning smart.

Liquid Staking on Ethereum 2.0: A New Era for Validators and Stakers

The Transition to Ethereum 2.0: Impact on Staking Mechanisms

Ethereum is moving from proof of work (PoW) to proof of stake (PoS). What does this mean for you as a stakeholder? You can now earn more by helping to run the network. In PoS, you lock up some crypto to become a validator. If you do your job, you gain staking rewards. It’s like putting money in a savings account that helps manage a bank.

But Ethereum 2.0 has pumped up the process. Now your locked-up funds, called staking tokens, can do more. With liquid staking, you can use your staked coins in decentralized finance (DeFi). While you earn staking rewards, your funds keep working across the DeFi world. You get a special kind of token that represents your staked ETH. You can use this token to make more money in DeFi.

This switch to Ethereum 2.0 has made things smoother for validators too. No more heavy computer equipment and high energy bills like in PoW. All you need is 32 ETH to stake, or you can join a staking pool with less. So, not only is it easier to get into staking, but it’s also good for the planet. What’s not to love?

Ethereum 2.0 Staking vs. Mining: What Investors Need to Know

Now, let’s talk about staking versus mining. In the old days with mining, you needed a powerful computer to solve puzzles. This used a lot of electricity, and only those with the resources could play the game. Staking changes this.

By staking in blockchain, especially with Ethereum 2.0, anyone with ETH can earn rewards. Your chance to validate transactions depends on how much you’ve staked. The more you put in, the more you might earn. It’s fairer, greener, and open to more people.

Crypto staking platforms have popped up to make it simple. They look after the tech side, so you focus on earning. It’s like having a pilot fly you to your favorite destination, letting you relax.

But it’s not all fun and gains. There are risks. Your funds might be locked away for a while, and they could lose value if the price of ETH drops. It’s like locking your money in a bank that has a chance of moving overnight.

Liquid staking solves some of these issues. It gives you liquidity, meaning you can access your value even when it’s staked. If you need cash quickly, you don’t have to stop staking and miss out on earnings. In a way, it’s like having a cake and eating it too.

The crypto world is moving fast, and Ethereum 2.0 staking is at the forefront. Staking is within reach for many, and with DeFi, the earning possibilities explode. Start with a solid understanding of the process, and dive into the DeFi pool of opportunities. Be sure to know the risks and plan for them. But most importantly, get ready for a wild ride on the Ethereum 2.0 rocket.

Advanced Strategies for Maximizing Returns with Liquid Staking

Exploring Non-Custodial and Compound Interest Strategies in Liquid Staking

When we dive into liquid staking, we unlock many ways to keep our crypto busy 24/7. Think of liquid staking like a super-charger for your digital assets. They earn for you even when you sleep! Now, I love the idea of my money working hard, so I use non-custodial and compound interest strategies to boost my returns.

First, what is non-custodial staking? Simply put, it’s when you keep control of your crypto while it earns for you. You don’t have to hand it over to someone else. This means more safety for your coins, and peace of mind for you.

Compound interest is another fantastic tool. It’s when your earnings get reinvested to earn even more. Over time, this can really help your staking rewards grow. It’s like rolling a snowball down a hill – as it rolls, it picks up more snow. Your crypto does the same with earnings!

Effective Staking Strategies to Enhance Liquidity and Asset Utilization

You might be asking, “How can I make my staked crypto work even harder?” Great question! Enhancing liquidity and usage are key. Liquid staking offers an answer. It gives you a token in exchange for your staked assets. You can use these tokens in the DeFi world like any other crypto.

This is huge because it solves a big issue in the staking world – having your assets locked up and unusable. Now, you can earn staking rewards and use those same assets for other investments or trades. It’s having your cake and eating it too, in crypto form!

Another top strategy? Staking pool comparison. Picking the right pool can mean the difference between good and great returns. Look for pools with high security, good history, and solid rewards. It might take some digging, but it’s worth it.

In short, liquid staking gives you more freedom and earning potential in the DeFi space. With non-custodial options and compound interest strategies, you can build a stronger, smarter staking game. And by boosting liquidity and usage, your assets never stop working for you. Keep these tips in mind, and you’ll be on your way to maximizing those crypto returns.

In this post, we’ve looked deep into liquid staking and how it changes the DeFi world. Starting with the basics, we compared liquid and traditional staking. Then we weighed up the pluses and risks. We showed you how to earn more and stay safe. When Ethereum 2.0 hits, staking will change big time. We’ve laid out what that means for you. Lastly, we shared top tips for gaining the most from your stake, focusing on control and smart money moves.

To sum it up, liquid staking is a game-changer, offering flexibility and better income than old staking methods. Yes, it comes with risks, but knowing the game can help you play it right. Ethereum’s new update will shake things up, but with our strategies, you’ll be ready. Dive in, stake smart, and make your crypto work for you!

Q&A :

What is Liquid Staking in Cryptocurrency?

Liquid staking is an innovative process in the crypto space that allows cryptocurrency holders to stake their coins while maintaining liquidity. Unlike traditional staking, where assets are locked up and inaccessible until the staking term ends, liquid staking gives you a representative token in exchange for the staked asset that can be traded or used within the cryptocurrency ecosystem.

How does Liquid Staking differ from Traditional Staking?

Traditional staking typically involves locking up your cryptocurrency to support the network’s operation and security, in return for staking rewards. However, your assets are not accessible until the end of the staking period. Liquid staking provides a solution by allowing stakers to receive a liquid token, representing their staked assets, which can be used for other activities, such as lending or yield farming, without sacrificing staking rewards.

What are the Benefits of Liquid Staking?

The benefits of liquid staking include increased liquidity of staked assets, continued earning potential through staking rewards, and the ability to participate in other DeFi activities concurrently. It offers more flexibility compared to traditional staking and provides holders with more opportunities to optimize their returns while supporting network security.

Are there Risks to Liquid Staking in Crypto?

Yes, there are risks associated with liquid staking, as with any financial activity within cryptocurrency. These can include smart contract vulnerabilities, liquidity risks, and the potential for price discrepancies between the staked assets and their representative tokens. It is essential for users to research and understand these risks before engaging in liquid staking.

Which Cryptocurrencies Support Liquid Staking?

Several cryptocurrencies have implemented or are exploring liquid staking solutions. Projects like Ethereum 2.0, Polkadot, and Cosmos are among the front-runners in adopting liquid staking. The availability of liquid staking options depends on the underlying network and whether it has enabled this feature or if a third-party service provides it. Always double-check which platforms and assets support liquid staking before participating.

RELATED POSTS

How Companies Using Blockchain Technology Are Revolutionizing Operations

Curious about how “Companies Using...

Mining Cryptocurrency how to? How to read trading charts cryptocurrency?

When venturing into the world...

Yala Airdrop – A Great Opportunity to Earn Free Tokens Today

Discover Yala Airdrop now –...

How Will Blockchain Technology Evolve?

"How will blockchain technology evolve?...

Challenges of Blockchain Technology: Navigating the Digital Minefield

Struggling with blockchain scalability and...

How to Make a Safe Crypto Wallet: Fortify Your Digital Gold

How to make a safe...

When was Blockchain Technology invented? A journey through its origins

Ever wondered, “When was blockchain...

What is ETH Analysis? Trends, Predictions, and What’s Next for Ethereum

Ever wondered what makes Ethereum...

Bitcoin surges to $72,000 ahead of the U.S. elections

Bitcoin has experienced an impressive...

Unveiling the secrets of blockchain technology meaning

What if the key to...

Replay Attacks on Blockchain: Protecting Your Digital Assets

Protect your digital assets from...

Bitcoin Charlotte and 3 Expected Growth Signals

Bitcoin Charlotte is not just...

What Makes the Connection Between Blockchain Technology and Cryptocurrencies Special?

Blockchain technology and cryptocurrencies form...

Blockchain Basics: Unlocking the Mysteries of Modern Cryptography

Understanding the Cornerstones of Blockchain...

Different Types of Crypto Wallets: Secure Your Digital Fortunes

Delve into different types of...

Steps Involved in Blockchain Technology: Unraveling the Digital Ledger’s Mysteries

Discover the steps involved in...