If you’re keen to dig into the crypto world, what is a layer 1 blockchain should be your starting question. It’s the rock-solid base that keeps all those coins and digital dealings secure. Think of it as the hidden hero, a power player making sure every transaction bumps along without a hitch. Here, I’m slicing through the tech speak to show you the meat of how these foundations shape the whole crypto scene. We’ll explore the nuts and bolts that keep your digital dollars dancing safely. Buckle up, it’s time to unravel the backbone of online currencies, one block at a time.

Understanding the Bedrock of Cryptocurrencies: Layer 1 Blockchains

Deciphering Base Layer Blockchain Technology

What do we mean by layer 1 blockchains? They are the groundwork of all crypto networks. Picture a layer 1 blockchain as the first and main street in a sprawling city. All other streets and pathways connect back to it. It’s where the whole story starts. Foundational, reliable, and key to the whole map – this is a layer 1 blockchain.

The technology that layer 1 blockchains use is a ‘decentralized ledger protocol’. It’s a fancy term, I know. But think of it like a book that everyone can write in, yet no single person owns. What gets written stays there forever, and everyone agrees on what’s written. These “books” are safe because the data can’t be changed once it’s written. The data here are all the deals we make on the blockchain.

This system is run by nodes, which are like the gatekeepers. They make sure every deal is fair and follows the rules. Nodes connect to the network to help keep track. When more nodes join the fight, the network becomes even safer.

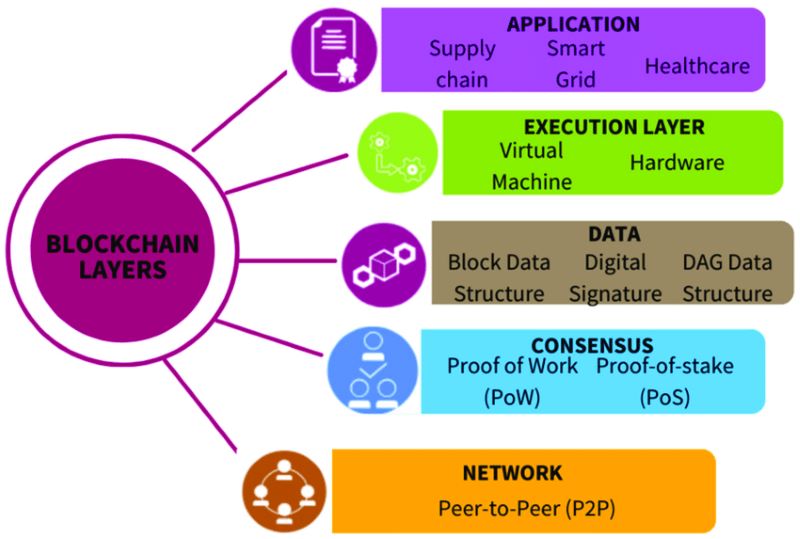

Now, let’s talk shop – specifically, “consensus mechanisms”. These are the rules of the game, telling everyone how deals are made. The most well-known are ‘proof of work’ and ‘proof of stake’. Proof of work is like a massive math puzzle. Computers compete to solve it. The winner gets to add new data to the ledger and earns some coins for their work. It uses lots of power, though. Proof of stake, on the other hand, picks the node with the most coins to validate new data. It’s like having skin in the game. You care more when your own coins are at stake.

The Role and Properties of Mainnet Blockchains

Mainnet blockchains are the real deal. When you hear mainnet, think of an official launch. It’s where real transactions happen with real coins. Each mainnet has its properties, like rules for the road that guide how transactions drive through the network. Speed is one such property. In blockchain language, we call this “transaction throughput”.

A mainnet’s throughput matters a lot. It tells us how quickly a network can process deals. People often look at well-known networks like Ethereum for how they handle all the traffic. Smart contracts are part of the flow here. They are like an autopilot for transactions. Set the rules, and they make sure things run without any hand-holding.

We’re always seeking ways to make these networks better. “Scalability solutions” is the term we use. It means finding ways to help the network deal with more action without causing any jams or raising prices too much.

In the world of crypto, we gotta keep evolving. Layer 1 blockchains might be just the beginning, but their sturdy foundation sets the scene for an exciting future. As we build new floors on this crypto skyscraper, we always look back at layer 1 with a nod of respect. It’s our rock, our reliable main street, the steadfast guardian of crypto security and trust.

Achieving Consensus: The Heartbeat of Layer 1 Networks

Proof of Work Versus Proof of Stake Mechanisms

Let’s dive right into the muscle that powers layer 1 blockchains: consensus mechanisms. These mechanisms are rules for how all the network nodes agree on ledger updates. Two well-known types are Proof of Work (PoW) and Proof of Stake (PoS).

With PoW, miners solve complex puzzles using computer power. This secures the network and processes transactions. But it uses a lot of energy. PoS is different. It lets holders of the native cryptocurrency tokens lock up their coins as a stake. They then get picked at random to validate transactions. It’s like playing the lottery. The more you stake, the better your odds are at getting to validate — and earn rewards. This uses less power than mining puzzles with PoW.

Assessing Transaction Throughput and Scalability Solutions

Now, let’s talk speed and growth. Imagine a checkout line. The speed you go through it is like transaction throughput. For layer 1 blockchains, this is how fast they process transactions. It’s key for a good user experience.

Some blockchains can get slow and pricey when too many folks use them. That’s called low scalability. To fix this, folks make changes to how blockchains work or add new layers on top. For example, think of adding more checkout lines or even self-checkout machines.

Bitcoin and Ethereum, two top dogs of layer 1, are working on scalability too. Bitcoin has things like the Lightning Network that make it quick for small payments. Ethereum is moving from PoW to PoS through upgrades. This could help it scale up and cut down on gas fees — the fees you pay to do stuff on the net.

In this wild world of base layer blockchain technology, finding the balance between speed, growth, and safety is vital. We’re part of a time where clever minds work on making these digital lands we roam more open, more fair, and ready for more people. And as we get it right, these networks will not just be the heart but the strong beating pulse of our future economy.

The Economic and Functional Pillars of Layer 1 Chains

Native Cryptocurrency Tokens and Their Tokenomics

Think of layer 1 blockchains as the main streets of a city. Just like main streets allow cars and buses to move around, these blockchains let data and money zip across the internet. They are the foundation of crypto networks.

Within these busy digital streets, native cryptocurrency tokens serve as the fuel. Money, in all forms, must have rules for how it works. We call these rules tokenomics. Tokenomics are the plans that make sure there’s not too much money that it becomes worthless or so little that no one can use it.

Each token is unique to its own blockchain. These tokens have jobs like paying for transactions or rewarding people using the network. Bitcoin, for example, is the original token for the Bitcoin network. It uses crypto mining for adding new coins out into the world. This is where tough math problems keep the system secure and make new Bitcoin for miners to earn.

Ethereum’s famous token, Ether, works in a new way. It supports smart contracts. Smart contracts are like vending machines. You pick what you want, put in your money, and the machine gives you your snack. No shopkeeper needed!

The Interplay between Smart Contract Platforms and Decentralized Finance (DeFi)

Now let’s dive into the smart city’s shopkeepers: smart contract platforms. They use blockchain tech to lock and unlock doors all by themselves. Sounds neat, right? Ethereum led the way here. This is where DeFi comes in, which is like an open market for financial fun. No banks in the way!

This bustling market is built on trustless agreements. That means you don’t need to know or trust the person you’re trading with. The deal is in the code and so, it must happen as stated.

But a busy city can traffic jam. That’s where scalability matters. It’s the number of cars our crypto streets can handle. Bitcoin keeps it easy. It doesn’t rush, which means it’s safer but slower. Ethereum, on the other hand, is trying new ways to handle more traffic, fast and without breaking down.

From crypto staking to paying to send data, these networks have rules. Think of gas fees like tolls on a bridge. They keep everything moving. All this is planned by folks called validators. They are like city planners for these digital streets.

Putting it all together, layer 1 blockchains are the base of our crypto world. They hold our digital economy up and keep our transactions secure and sound. Next time you hear about Bitcoin or Ethereum, think of the bustling city streets that they represent. Each car, or token, has a part in this active town we call layer 1.

Governance, Security, and Future Outlook of Layer 1 Protocols

Enhancing Blockchain Security Through Effective Governance

Think of layer 1 blockchains as the very ground we stand on in the crypto world. They’re the base layer of everything we do with digital currencies. Now, you might ask: What makes them so strong? Well, a big part is governance—how rules are made and followed by everyone on the network. Strong governance helps keep our crypto ground solid and safe.

For layer 1 blockchains, security is a top priority. And it makes sense, right? We’re talking about the foundation of crypto networks. They hold all our transactions and personal info. Effective governance means that the people in charge of making decisions work hard to put up good defenses against attacks.

Anticipating Layer One Upgrades and the Role of Validators

But, like anything in tech, upgrades are always around the corner. These networks need to grow and get better. So, what’s the buzz about? Validators. These are the folks who play a key part in making choices about changes to the network.

Let’s dive into validators a bit more. They’re like the guardians of our blockchain universe. Validators use their computers to check out each block — all the transactions bundled together. They make sure there’s nothing fishy going on. In return, they get rewards. It’s a big job, and it helps our base layer stay true and strong.

Let’s not forget about consensus mechanisms. These are the rules everyone follows to agree on updates. Some blockchains use what’s called Proof of Work. That’s when validators, or miners, solve complex problems to add a new block. But this can take a lot of power. Others use Proof of Stake, where validators must own and lock up some of the network’s coin to get a chance to add a new block. Both have their own ways to keep the network in check and running smooth.

Knowing all this helps us see how vital these players are in keeping layer 1 blockchains secure. We count on them to keep our digital ground solid. They look out for any cracks that might appear and work to patch them up. As we look to the future, these validators will have a big say in how these foundational networks shape up. So, we keep an eye on their moves. They’re the hands steering the ship, ensuring we sail into a future where our digital assets stay safe.

There you have it. Layer 1 protocols are the sturdy ground of our crypto land. Effective governance and vigilant validators help keep it a safe place to stroll. And as upgrades roll in, these protocols only get better. It’s exciting times for us in the world of blockchain. It’s a changing landscape, sure, but one thing stays the same: a secure and well-governed foundation keeps us all steady.

We’ve explored the key aspects of layer 1 blockchains. Starting from the core tech that powers them to the mainnet’s role, we’ve covered the basics. We then moved into how these networks agree on transactions, looking at proof of work and proof of stake methods. After that, we talked about how layer 1 blockchains handle lots of transactions and what they are doing to serve more people better.

We also dove into the money side of things, seeing how native coins work and how they fit with smart contracts and DeFi. Lastly, we looked at how these networks stay safe and what changes we might see in the future, with a focus on the people called validators who help make this happen.

In closing, layer 1 blockchains are more than just tech – they’re the backbone of a growing crypto world. With strong governance and new updates, they’re set to get even better. As an expert, I believe staying informed about these changes is key. Knowing layer 1’s strength helps you see where crypto is headed next. Keep learning, and you’ll keep ahead of the game.

Q&A :

What is a Layer 1 Blockchain?

Layer 1 blockchain is a term used to describe the fundamental network or infrastructure of a blockchain system. It is the base level for the creation, issuance, and management of digital currencies and various types of decentralized applications. As the main framework, it is responsible for maintaining the overall decentralization, consensus, security, and speed of transactions on the network. Examples include Bitcoin, Ethereum, and other main blockchains that operate their native cryptocurrencies.

How Does a Layer 1 Blockchain Differ From Layer 2 Solutions?

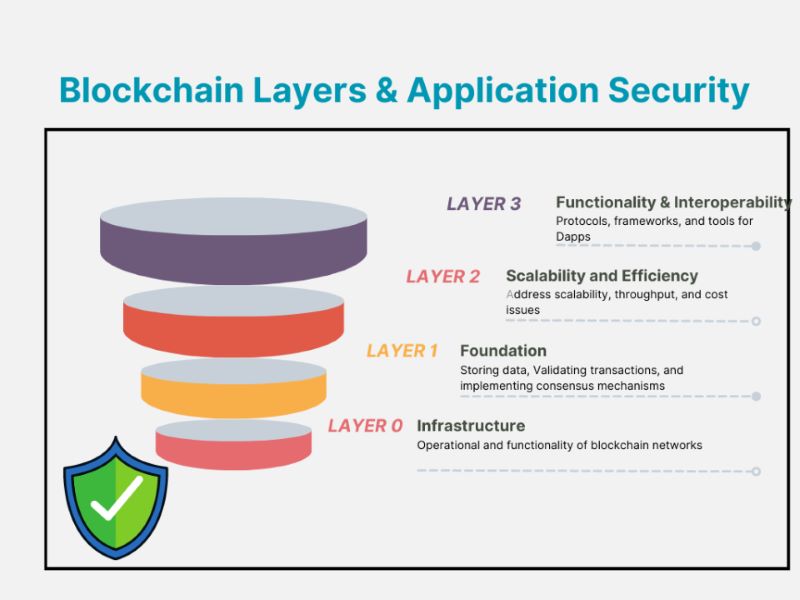

While Layer 1 blockchain refers to the underlying main blockchain, Layer 2 solutions are built on top of these base chains. Layer 2 aims to address limitations such as scalability and transaction speed without changing the original Layer 1 protocol. They do this through techniques like State Channels, Sidechains, or Rollups, which process transactions off the main chain but still retain the security and decentralization offered by the underlying Layer 1 blockchain.

What Are the Main Benefits of Layer 1 Blockchains?

The primary benefits of Layer 1 blockchains are their high level of security and decentralization. They operate on a trustless system, which means they do not require third-party intermediaries to validate transactions. This helps to maintain user trust and integrity within the system. Additionally, Layer 1 blockchains provide transparency, immutability of data, and are generally resistant to censorship, making them foundational to the blockchain ecosystem.

Can Layer 1 Blockchains Scale to Meet Growing Demand?

Scalability remains one of the significant challenges for Layer 1 blockchains as they often encounter issues with handling large volumes of transactions simultaneously. To address this, many Layer 1 solutions are exploring and implementing various strategies like sharding, consensus algorithm improvements (such as Proof of Stake), and network upgrades (like Ethereum’s move to Ethereum 2.0) to increase their transaction throughput and meet the growing demand.

Why is Decentralization Important in Layer 1 Blockchains?

Decentralization is one of the cornerstones of Layer 1 blockchains. It ensures that no single entity has control over the entire network, which helps to prevent points of failure and attacks that could compromise the system. Decentralization promotes a more egalitarian distribution of power, where all participants have a say in the governance and operation of the blockchain, thereby enhancing security, trust, and openness within the ecosystem.

RELATED POSTS

Tomarket Airdrop – Explosion of the Super Countdown Event

The Tomarket Airdrop event is...

Casper Crypto: Exploring and evaluating growth potential

As the cryptocurrency market continues...

MiCA: A new regulation or a restraint on Crypto?

Starting from December 30, the...

Future Trends in Blockchain Security: Staying Ahead of Threats

Future trends in blockchain security:...

Blockchain Security Breakdown: Why Trust is the Ultimate Currency

Discover the importance of trust...

Is Bitcoin Going to Crash? – 3 Current Market Dynamics

Wondering, “Is Bitcoin Going to...

Pebonk Kombat – The next frontier in gaming and crypto

Pebonk Kombat is revolutionizing gaming...

Kishu Inu Coin: A guide to investing in this Meme Token

Discover Kishu Inu Coin, a...

Security Risks in DeFi: Is Your Crypto Safe from Attack?

Understanding DeFi's security risks &...

BrainGames Airdrop: How to earn LEARN Tokens

BrainGames Airdrop is a unique...

Exploring the Bitcoin Halving Cycle – Future and Price Predictions

Exploring the Bitcoin Halving Cycle...

Can you short Bitcoin? – Exploring the Secret

Can you short Bitcoin? This...

Ethereum ETFs have been approved by the SEC

The recent announcement that ethereum...

PeckS Airdrop – Strategy to Receive $PeckS Airdrop

Participating in the PeckS Airdrop...

Proof of Elapsed Time in Crypto: Unveiling the Mystery Behind Secure Consensus

Discover the advantages of PoET...

Blockchain Breakthrough: Expanding Education in Developing Nations

Unlocking Education in Developing Countries:...