Delegated Proof of Stake in Crypto: Unlocking Speed and Efficiency

Imagine a crypto world where speed joins forces with democracy. That’s what is delegated proof of stake in crypto. It’s not just hype; it’s the smart bet for those craving quick, efficient blockchain action. Forget old-school systems that move like molasses. Whether you’re new to the game or a seasoned pro, understanding DPoS is key to mastering the fast-paced crypto realm. Let’s cut to the chase and unlock the secrets behind this high-octane engine of the cryptocurrency world.

Understanding Delegated Proof of Stake (DPoS) and Its Role in Crypto

Delegated Proof of Stake Explained

Let’s dive right in and crack the code of Delegated Proof of Stake, or DPoS. Imagine it as a small, tight-knit town where folks pick a few trusted leaders to make big decisions. In crypto land, DPoS works a bit like that – it’s a way for people to vote on who gets to keep the digital money safe and flowing. Each person with some coin in the game gets a say, depending on how much they hold. Those chosen few are called delegates, and they work hard to record and check every swap, sale, or spend in this digital town’s ledger. So, we get a system that’s slick and quick, where each coin vote counts towards who calls the shots.

Delegated Proof of Stake makes things zip along faster than waiting in line at your favorite burger joint. And, it keeps everything fair and square. Safety is top-notch too. Delegates watch each other like hawks to make sure no funny business goes down. This means people can trade and trust, without worrying about their digital dollars.

Evolution and Comparison of Consensus Mechanisms: DPoS vs PoW vs PoS

In the old days, we had Proof of Work (PoW). It’s like a massive math contest. Computers rush to solve tough problems. The first to finish gets to add to the ledger and wins some coin. But this race chows down more power than a whole bunch of TVs left on. Not so great for our planet, right?

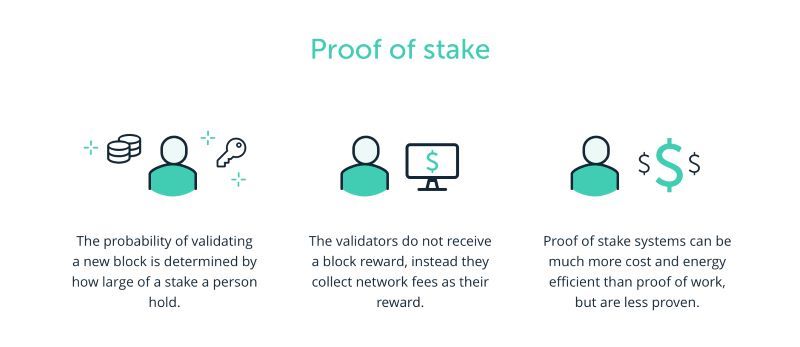

Then, Proof of Stake (PoS) came along. This one says, the more coin you lock up as a bet, the more chance to add to the ledger and snag some rewards. Better on the power bill, but it turns out, the rich get richer in this game.

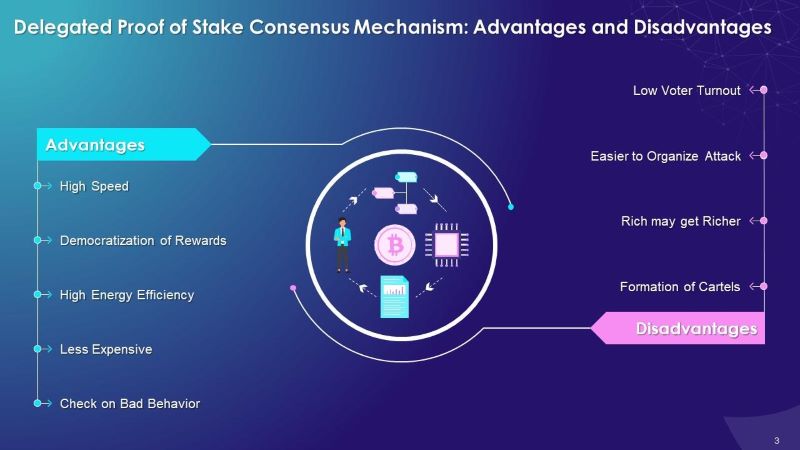

Now, picture DPoS. It’s like turning the whole system into a smooth-running council, where coin holders pick their champions. No monster math problems or power-hungry races. And no just sitting pretty on a pile of coin, either. DPoS spreads the love, so even little coin holders have a voice. Everyone gets together to pick the block producers, the nifty name for the delegates. These producers work in shifts, sort of like a tag team to keep things ticking. One guy can’t mess up because the others are always watching.

In this dance, security’s a big deal. With DPoS, the whole crew makes sure no one’s trying to double-dip with their coins. And thanks to everybody pitching in, the system can handle loads more transactions, quick as a wink. It’s like having a supercharged checkout line that never slows down.

When it comes to energy, DPoS sips instead of gulps. It’s easier on the wallet and kinder to Earth. It’s like swapping out old, chunky light bulbs for those fancy LED ones – a whole lot brighter for a lot less.

So, what have we got? A fresh, fair, fast way to run the show. It’s not just about having a stake, it’s about having a say. With DPoS, every coin holder’s voice can echo through the halls of crypto’s digital democracy.

The Mechanisms of DPoS: Validators, Delegates, and Stakeholders

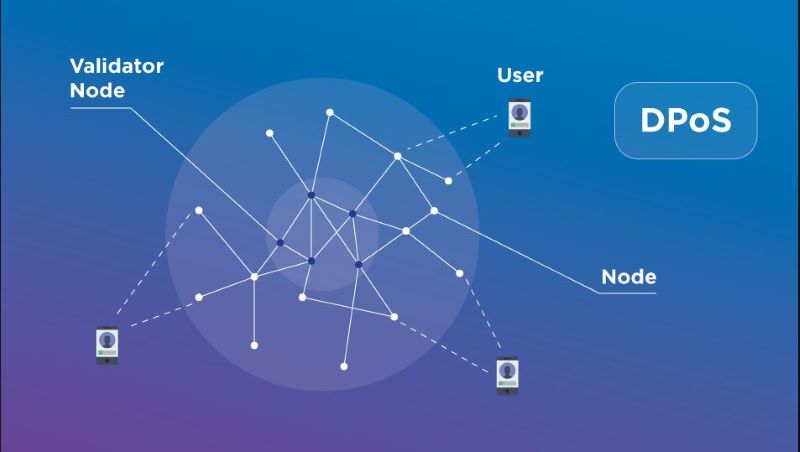

Validator Roles in DPoS and Witness Selection

In DPoS, validators have a big job. They process transactions and keep the network safe. They are also known as witnesses. Validators are picked by a vote from token holders in the system. The more coins you stake, the more your vote counts. It’s like being in a club where your ticket numbers decide your power to choose a leader.

Each validator stakes coins as trust collateral. This ensures they stay honest in their role. If they act wrongly, they risk losing their stake. This system keeps the network running smooth and quick. Validators are crucial for keeping the blockchain reliable and secure.

The Influence of Token Holders and Stake-Based Voting in Network Governance

Token holders in DPoS hold power through their votes. They can vote on who becomes a validator and on key network decisions. Your coins have power in these votes. The system encourages everyone to take part and have a say. This voting system is called stake-based voting.

Through stake-based voting, users shape the blockchain’s future. You can think of it like a digital democracy. It lets people who hold the currency influence how the blockchain grows. This influence is not just about being heard. It comes with rewards for active participation, too. Network governance, thus, is not only more inclusive but also rewarding.

In DPoS, your coins do more than just sit in your wallet. They earn you a say in how things run. This set-up helps with keeping the blockchain system fair and running. It also speeds things up compared to other models like PoW (Proof of Work). The blockchain can handle more transactions in less time. This makes it great for apps that need to work fast.

In short, DPoS relies on community trust and responsibility. Validators do the heavy lifting, while token holders guide the direction of the blockchain. Together, they help make the network more secure, fair, and efficient. This is a fresh take on how we make sure our digital world stays on track.

The Advantages of DPoS in Blockchain Technology

DPoS Benefits in Cryptocurrency: Transaction Speed and Scalability

Delegated Proof of Stake, or DPoS, is a real game-changer in crypto. It helps blockchains do more. It’s like choosing the best players for a team. In DPoS, crypto owners vote for a few to manage the blockchain. These few are called “delegates.” They handle transactions and keep things smooth. When users pick good delegates, transactions happen fast. New blocks are made quickly without any hiccups.

This process helps a lot with scalability. That’s a fancy word for saying a blockchain can handle lots of users or transactions without slowing down. DPoS lets blockchains grow big without trouble. It’s like a road that gets more lanes as more cars come in. The cool thing about DPoS is that it does this much better than older methods like Proof of Work (PoW).

DPoS Energy Efficiency and its Impact on Eco-Friendly Blockchain Operations

Now let’s talk about saving the planet while doing crypto. DPoS is super energy efficient. It’s like turning off lights in rooms you’re not using. Instead of every computer trying to validate transactions, like in PoW, only a few do the job in DPoS. This means less electricity is used. So DPoS is great for blockchain fans who want to protect nature.

Less energy use also means it’s cheaper to run a DPoS blockchain. That’s good for keeping costs low and making crypto more accessible to everyone. And for those who worry about being green, DPoS is a breath of fresh air. It shows that high-tech stuff like blockchains can be friends with our environment.

So, remember, DPoS makes transactions zoom by without using much power. It lets blockchains handle more users and activity without breaking a sweat. Plus, it’s kinder to Earth. Isn’t it amazing what some smart voting and teamwork can do?

Navigating the DPoS Ecosystem: From Governance to Investment

Delegated Voting Power and On-Chain Governance Models like Tezos and EOS

In a Delegated Proof of Stake (DPoS) system, your vote picks who makes blocks. Blockchains like Tezos and EOS use DPoS. Users stake coins to vote for delegates. These delegates are like the blockchain’s board, keeping everything in check.

Think of Tezos as a digital democracy. Here, your coins buy votes. Coin holders vote on updates and changes. EOS has a similar setup. Coin holders elect 21 main block producers. They handle the network’s heavy lifting. Both systems allow for smooth and quick changes.

Delegated voting power in DPoS tackles a big issue: how to let everyone have a say without slowing things down. By selecting delegates, token holders influence the blockchain. Their power shapes the network. It’s a delicate balance of giving a voice yet keeping things fast.

Now, let’s take this a step further. What do these on-chain governance models mean for you? They mean direct involvement. Your stake in Tezos or EOS isn’t just an investment. It’s your ticket to a voice in the network’s future. Buying into these DPoS coins is saying, “I want a say in how things run.”

DPoS Coins to Invest In and How to Become a Delegate in DPoS Networks

Thinking about DPoS coins to invest in? Research is key. Look at the coin’s history. See how it’s managed. Find out what value it might offer you.

To name a few, there’s EOS, Lisk, and Tezos. Each one operates a little differently. EOS focuses on user experience and speed, while Lisk promotes developer-friendly features. Tezos puts weight on formal verification, which adds security.

Investing in DPoS coins isn’t just about potential profits. It’s also about picking a system you believe in. Because with DPoS, you’re part of that system.

Now, what if you wanted to step up your game? To become a delegate in these DPoS networks, you’ve got to do more than just own coins. You need to convince other token holders to trust you with their votes. It means proving you’ve got the tech and the integrity to forge new blocks reliably.

Being a delegate is a big deal. You need a strong tech setup and a commitment to network security. Plus, you got to be ready to act in the best interest of the network.

Getting elected can be tough. You’ll need to network, maybe campaign, and definitely build a strong case for why you should be the one to trust. If you’ve got enough stake and support, you could be one of those making the big decisions. That’s how democracy plays out on the blockchain.

In conclusion, understanding DPoS means knowing it’s not just a tech thing. It’s about governance and investment too. It’s people-powered finance. Entering this space means you’re ready to play a part in the future of crypto – whether as a voter, an investor, or even as a delegate.

We’ve unpacked much about Delegated Proof of Stake or DPoS today. From its basics to how it makes crypto move fast and scale well, DPoS stands out. We saw how it grew from other methods like Proof of Work and Proof of Stake. Validators, delegates, and stakeholders keep the system fair and running smooth. Your stake matters in DPoS. You have a say in network rules and who keeps things in check.

We also noted that DPoS is not just quick; it’s green too. It uses less power and that’s key for our planet. For those keen on crypto, knowing DPoS can guide your choices. Whether you plan to invest in DPoS coins or become part of running a DPoS network, what you learned here can help.

Stick with me, and I’ll keep sharing insights that can aid your crypto journey. Trust in the knowledge we shared today to make smart moves in the world of DPoS and beyond.

Q&A :

What is Delegated Proof of Stake in Cryptocurrency?

Delegated Proof of Stake (DPoS) is an alternative consensus mechanism to Proof of Work (PoW) and Proof of Stake (PoS), designed to be more efficient and scalable. In a DPoS system, cryptocurrency holders vote for a select group of delegates, who are then responsible for validating transactions and maintaining the blockchain. This system is intended to improve speed and efficiency by reducing the number of nodes required to reach a consensus.

How does Delegated Proof of Stake differ from traditional Proof of Stake?

The main difference between Delegated Proof of Stake and the traditional Proof of Stake is the voting and delegation system. While PoS allows every stakeholder to participate in the validation process, DPoS limits the number of validating nodes to a chosen few, voted in by the currency’s community. This streamlined structure can result in quicker transaction times and less energy consumption.

What are the advantages of Delegated Proof of Stake?

DPoS offers several advantages, including increased transaction speeds due to fewer nodes being involved in the consensus process, reduced energy consumption compared to Proof of Work systems, and potentially stronger governance, as all stakeholders can exercise their right to vote for delegates. Additionally, DPoS can also reduce the risk of centralization, as it prevents the richest stakeholders from having complete control over the blockchain.

Are there any downsides to using a Delegated Proof of Stake system?

Although DPoS provides many benefits, there are some downsides. One potential issue is centralization of power, as the network relies on a smaller number of validators, which could lead to collusion among delegates. Another concern is the possibility of decreased security compared to PoW, since the system depends on the integrity of the elected delegates to validate transactions correctly.

What cryptocurrencies use Delegated Proof of Stake?

Several cryptocurrencies use Delegated Proof of Stake as their consensus mechanism. Some of the more notable ones include EOS, Tron, and BitShares. Each of these platforms has implemented DPoS with their unique tweaks and governance structures, showcasing the versatility and adaptability of the Delegated Proof of Stake system in addressing the needs of different digital asset communities.