Imagine a future where money flows as effortlessly as emails do—welcome to the world of the Interledger Protocol. Curious about how this groundbreaking technology is transforming payment systems? Get ready to explore its potential to eliminate costly fees and delays, revolutionizing the way we handle transactions globally!

What is Interledger Protocol?

The Interledger Protocol, or ILP, lets you send money across different payment networks. Think of it like the internet, but for money. It’s not tied to one company or currency. This makes paying anyone, anywhere, super easy.

How Does Interledger Work?

ILP connects banks, payment services, and blockchains. It uses small chunks of money called “packets.” These packets move from one place to another until they reach the final spot. ILP ensures money is safe at each step.

Interledger Protocol or ILP is about connecting different banks and networks to move around money fast. It’s like a bridge that lets cars drive between different islands. The “cars” in this case are chunks of money, also known as packets. ILP is smart; it knows the best path for these money packets to take.

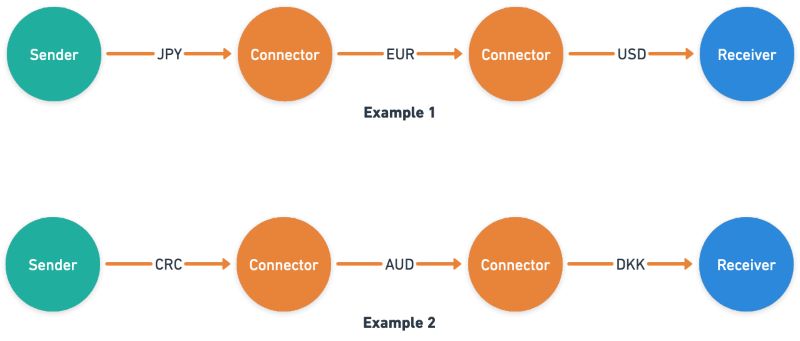

ILP uses things called connectors to help money hop across ledgers, like stepping stones across a river. These connectors know how to grab a packet from one place and pass it on to the next, until it gets where it needs to go.

When money moves in ILP, it breaks down into tiny parts. This breaking down is called “packetizing.” Each part is sort of wrapped up in a safe package, called a packet structure. It tells where the money’s coming from, where it’s going, and how much is moving.

Now, let’s talk about “routing.” That’s how ILP decides the way these packets will go. It’s like using a map to find the shortest path to your friend’s house. But for ILP, it’s finding the quickest and safest path for money packets.

ILP makes sure no one loses their money. If something goes wrong along the way, ILP’s design makes sure the money goes back to where it started. That keeps everyone’s money safe.

Why is all this great? The benefits of the Interledger Protocol are big. First, it’s super fast. It’s like sending a text — it happens in the blink of an eye. Second, ILP is really safe. It’s built to stop anyone from taking money that’s not theirs. And finally, ILP can talk to pretty much any payment system out there. That means you can send money to anyone, no matter what bank they use or where they are.

The real kicker? ILP can work with regular money just like it does with cryptocurrencies like Bitcoin. It doesn’t pick sides. It’s open to all types of money moving around the world.

In the end, ILP is changing how we think about sending money. Payment protocol interoperability is a big word for a simple idea: making different money systems work together as one. Interledger is making that happen today, and it’s doing it with style, safety, and speed. And guess what? This is just the start. The future of the Interledger Protocol is bright, and it’s going to make sending money as easy as sending an email.

Advancing Payment Systems with ILP

Money moves around the world every second. We use different banks, apps, and currencies. Here’s the problem: these systems often don’t talk to each other. This is where the interledger protocol (ILP) jumps in. It’s like a translator for money, making various systems understand each other.

What is an ILP connector?

An ILP connector is a hub that connects different money networks. Think of it as a train station where money trains from different tracks come and go. These connectors help money move between these tracks smoothly.

How do cross-ledger transactions work?

When you send money abroad, ILP connectors check the best route. They send the money through this route, using something called “packets.” These packets safely carry your money info across ledgers until it reaches its destination.

The Role of ILP in Payment Protocol Interoperability

Payment protocol interoperability might sound tricky, but it’s simple. It means making sure your money gets where it needs to go, no matter the system. Like being able to call someone on a different phone network, it should just work.

Without it, sending money can be slow and costly. With ILP, it’s like opening gates between different payment worlds, letting money flow freely.

ILP isn’t just a nice idea. It’s a tool that’s changing how we think about and use money. It lets us wave goodbye to waiting days for a bank transfer. It slashes the fees we pay just to send cash to another country. It’s the quiet power player making sure your Friday night pizza money arrives at your friend’s wallet—rapid and secure, no matter what app they use.

Imagine being able to pay for anything, anywhere, with no fuss about who uses what bank or currency. That’s the future ILP is building, and that future looks dazzlingly open and connected.

The Technical Underpinnings of ILP

Interledger Architecture and Packet Structure

Interledger changes the game in how we send money. Its design Lets different payment systems talk to each other. Think like translating French to Mandarin in a snap. It’s made to work with any type of money, from dollars to Bitcoin. So, how does Interledger work? It uses a special packet, like a digital envelope. This packet holds payment info and moves across different networks.

Imagine sending an email. You write it, someone gets it, no matter their email provider. ILP does this with money. Packets carry payment data through various networks to reach the end. They ensure safety and correct delivery. Now, what about getting money to the right place?

Security and Settlement Mechanisms in ILP

This is where ILP connectors come in. They’re like payment post offices. They pass packets along until they reach the final spot. Think of playing telephone, but with no mistakes. And security? ILP’s connectors check every packet. They lock in funds before sending money through. This means we don’t send funds until we’re sure they’ll arrive safe.

ILP also settles payments fast – really fast. It uses smart tech to check and finish payments. This happens in seconds. Plus, it’s built to scale. Whether it’s ten bucks or a million, ILP can handle it.

Here’s the neat part. ILP isn’t just a far-off idea. It works today. Teams across the globe use it now. They’re moving cash in new, better ways, lightning quick. It’s not just about speed. It’s about making sure that anyone, anywhere, can pay or get paid with ease.

Remember, ILP isn’t just smart, it’s tough. Its security and quick settles make it top-notch for banks and businesses. This means we can trust ILP to get our money where it needs to go. Safe, sound, and swift – that’s ILP for you. It’s not just a tool, it’s a move to a world where your money moves as easily as email. And that’s a world that benefits us all.

Interledger Impact and Future Prospects

Use Cases of Interledger Protocol

Imagine sending money as easily as sending an email. That’s what the interledger protocol (ILP) is here for. It’s a way for money to flow across different types of payment systems. Think of ILP like a translator for money, making sure that dollars, euros, bitcoin, or any other form of value can move smoothly from one place to another.

Businesses get a big win from ILP. They can accept payments from around the world without worrying about different currencies and the fees that come with them. People working far from home can send money back to their families without the hefty costs.

This tech is not just for now, it’s shaping the future. Soon, machines could use ILP to pay each other for services. Your fridge might order milk and pay for it without you lifting a finger. The possibilities are huge for making our lives easier and more connected.

The Evolution of ILP and Next-Gen Banking Systems

You might be thinking, “How can ILP make a real change in banking?” Well, it’s all about connection. ILP links up banks and payment networks that used to work alone. It’s like building bridges across all these financial islands.

This brings big advantages. Money moves faster, with real-time settlements now in reach. No more waiting for days for a payment to clear. And it’s safer — ILP’s design keeps your money secure every step of the way.

Banks are catching on and using ILP to offer better services. They’re ditching old, slow systems for this new, speedy method. ILP also takes on the tough job of scaling up. It handles a growing flood of transactions without breaking a sweat.

Now, let’s talk digital currency. ILP makes it simple for banks to move into the world of cryptocurrency. It lets them weave crypto into their services, giving you more options for how to spend and invest.

Stepping into tomorrow, ILP is becoming a universal payment standard. That means wherever you are, whatever you’re paying for, the process is the same. Easy, fast, and secure.

The growth of ILP is not slowing down. It’s changing the game in global finance, one transaction at a time. With each improvement and new use case, ILP is helping to paint a picture of a world where sending value is as effortless as sending a text message. Keep an eye on ILP — it’s on a path to revolutionize how we all do business and handle money.

We just explored ILP or Interledger Protocol, a tech that lets different payment systems talk to each other. First, we looked at what ILP is and how it works, making it clear it’s a big deal for sending money across various networks. Then we dived into how ILP’s connectors and its role in payment protocols help money move smoothly and safely from one place to another.

We also uncovered the inner workings of ILP, like its structure and how it keeps our money safe. Finally, we discussed how ILP is changing the game in global finance, and what’s ahead for banking.

ILP might sound complex, but it’s really about connecting dots so money can move without a hitch. As someone who knows a lot about this, I’m excited to see where this technology will take us. It’s not just about banks and bucks; it’s about building bridges in finance. And that’s something we can all look forward to.

Visit our website at Blockchain Global Network for more information!

RELATED POSTS

NebulaStride Airdrop – Tips to Maximize Income

To maximize your income from...

Is Ledger open source? 95% of Ledger’s software is open source

Wondering “Is Ledger open source?”...

Government Regulation Post-Blockchain Hacks: Safeguarding Your Digital Future

Government regulation after blockchain hacks:...

limitations of traditional systems in transparency: Unveiling the Gap

Limited transparency in old systems...

Do you know the value of 881 AVA tokens in USD?

“881 AVA Tokens in USD”...

Privacy Considerations: Navigating the Future of Student Data Management

Discover how to ensure privacy...

Security Testing Providers for Blockchains: Who’s Guarding Your Digital Gold?

The Critical Role of Blockchain...

AI Agents: Automation solutions for Web3 platforms

Artificial intelligence is ushering in...

ABLY Airdrop: A comprehensive guide on how to participate

In the rapidly growing cryptocurrency...

A Slice of History – The First Recorded Bitcoin Purchase and Its Impact Today

The First Recorded Bitcoin Purchase...

LazyOtter Airdrop – Increase Your Chances of Owning Tokens with DeFi Vaults

LazyOtter Airdrop brings a safe...

Crypto Crashing and 3 important investment implications

Crypto Crashing has shaken the...

Blockchain Breakthroughs: Latest academic papers on blockchain technology

Discover the Latest Academic Papers...

Plenty Airdrop: Chance to get free PLY tokens

The Plenty Airdrop program distributes...

Why is Solana Going Up – Unveiling 3 Potentials of Solana

Why is Solana Going Up?...

Polymarket airdrop – Smart investment for the Web3 generation

With the Polymarket airdrop, users...