As a crypto enthusiast, you already know that securing your digital assets is non-negotiable. But when it comes time to choose between a hot wallet vs cold wallet, how do you decide which one best shields your crypto? Let’s break it down, comparing their risks and perks. We’ll explore how each wallet works, and which one gives your digital coins the fortress they need against the lurking threats of the digital world. Get ready to secure your crypto with confidence!

Understanding Hot wallets and Cold Wallets

The Basics of Cryptocurrency Storage Security

When we talk about cryptocurrency storage security, we are really talking about how to keep your digital coins safe. Imagine a wallet in your pocket. You can carry it around and use it to pay for things, but if you lose it, your money is gone. With digital currency, we call these “wallets” too, but they are apps or devices that keep your digital money.

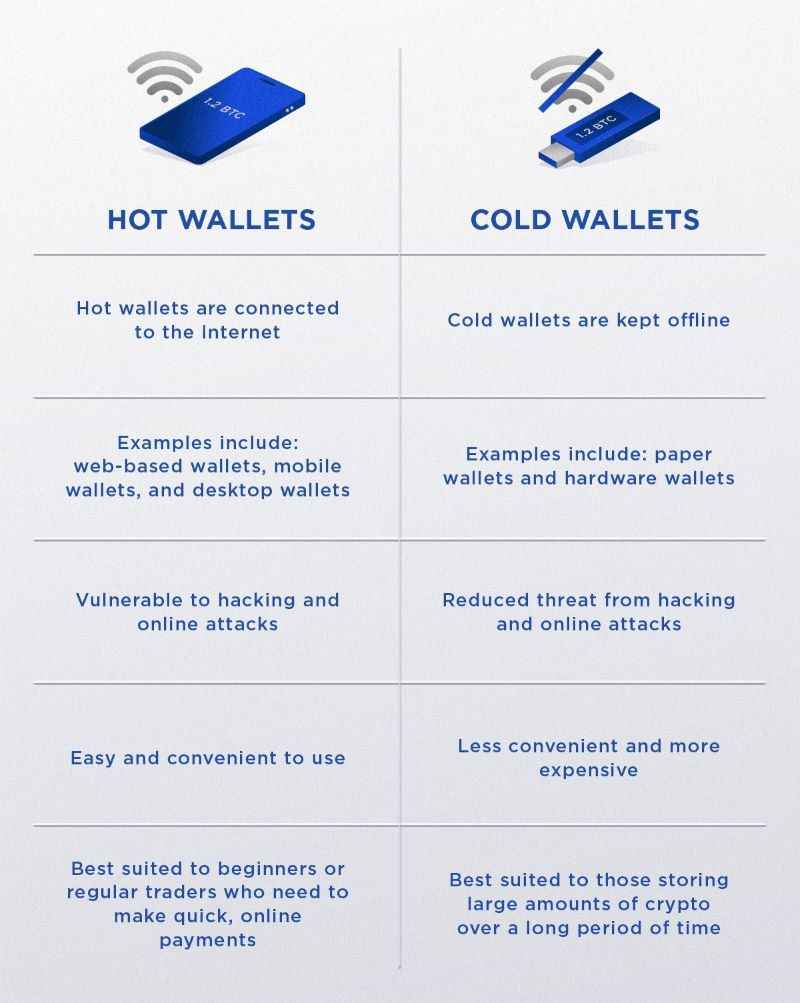

There are two main types of wallets: hot and cold. Hot wallets are connected to the internet, like a phone app. They let you get to your crypto fast but can be risky because online bad guys might try to steal from you. Cold wallets are like safes for your digital coins. They are not connected to the internet, which makes them super safe.

Comparing Digital Wallet Types: Hot vs. Cold

Choosing between a hot wallet and a cold wallet depends on what you need. If you use your crypto often, like for daily buying, you might prefer a hot wallet. It’s online, easy to reach, and you can trade quickly. However, the risk of hot wallets is higher. Thieves can try to break in through the internet. A hot wallet hack can happen if you’re not careful.

Cold wallets are the best for keeping your crypto safe for a long time. People like them because they offer offline wallet benefits. This means bad guys can’t break in over the internet. Cold wallets come in different styles, like USB sticks or special hardware devices, and they don’t need to be online to keep your money safe.

When picking the best wallets for cryptocurrency, consider a few things. How often do you plan to use your crypto? Do you worry about online wallet security? Would you rather have the super safe cold storage for digital currency, or do you need speedy access? For example, a mobile wallet versus hardware wallet choice might come down to if you want to pay while on the go or if you plan to stash your crypto away.

In a nutshell, hot wallets are like your everyday purse, ready for action but not as strong, while cold wallets are the vault in a bank, tough to crack but not meant for quick access. When you choose, think about safety first. Remember, digital wallet safety measures like two-factor authentication can help, but nothing beats the power of cold wallet theft prevention. With no internet connection, a cold wallet is a fortress for your digital treasure.

Remember, keeping your private keys safe is key. They are like your wallet’s password. Make sure only you can get to them, and always have a backup plan in case something goes wrong. If you learn one thing, let it be this: cold wallet or hot, protecting your keys is the most important step in securing your digital cash.

Navigating Risks and Benefits: Hot Wallet vs Cold Wallet

Examining the Risks of Hot Wallets

When it comes to keeping your digital coins safe, understanding hot wallets is crucial. These online wallets allow for quick access and trading of your cryptocurrency. However, that convenience comes with risks. Since hot wallets are connected to the internet, they can be vulnerable to hackers. If your security isn’t strong enough, you could face stolen coins and the heartache that follows.

- Common Risks with Hot Wallets

Hot wallet hacks are unfortunately common, as hackers constantly devise new ways to infiltrate these systems. To enhance your security, always use strong passwords and enable two-factor authentication (2FA). Think of 2FA as a double lock on your digital door. However, even the best locks can’t guarantee complete safety.

Software wallets can also have vulnerabilities. These flaws may be exploited by hackers, so it’s essential to keep your wallet software updated. Staying ahead of potential threats is vital for your security.

- Mobile Wallet Security

Are mobile wallets safer than desktop wallets? They might be, but they still carry risks similar to other hot wallets. To protect your mobile wallet, ensure your phone is secured with a strong password and use 2FA as an added layer of protection.

Exploring the Advantages of Cold Wallets

Now let’s shift our focus to cold wallets. These wallets are offline, making them much less susceptible to online attacks—a significant advantage for security.

- Why Choose a Cold Wallet?

Think of a cold wallet as a safe for your digital assets. Since it’s not connected to the internet, it minimizes the risks associated with online threats. This makes it ideal for long-term crypto storage.

- How Hardware Wallets Enhance Security

A hardware wallet stores your private keys on a physical device that isn’t connected to the internet, making it much harder for hackers to access. It’s like having a personal vault for your digital currency.

- Understanding Air-Gapped Wallets

When we say a wallet is “air-gapped,” it means it’s designed to never connect to the internet, eliminating any online threats. This offers complete peace of mind.

- Multi-Signature Wallets for Added Safety

There are also wallets that require more than one key to access. Known as multi-signature wallets, these require multiple approvals to unlock, much like a bank vault that needs two managers to open. More keys mean greater security.

Implementing Robust Security Measures for Your Crypto

Key Features and Safeguards in Hardware Wallets

Hardware wallets keep your crypto safe. They are physical devices, like USB sticks. You plug them into a computer to access your coins. They are safe because your private key stays offline. This means hackers can’t get to it through the internet. They’re often called cold wallets.

When you unplug a hardware wallet, it’s like locking your coins in a safe. Even if your computer is hacked, your crypto stays safe. Important features in hardware wallets include pin codes and recovery phrases. If you forget your pin or lose the device, you can still get your coins back with the recovery phrase.

Some hardware wallets let you check and approve each transaction on the device. This stops thieves who trick you into sending money to them. Always make sure you know who you’re sending crypto to.

Choosing a hardware wallet can be tough. Look for ones with good reviews and support for your coins. Companies like Ledger and Trezor are well-known and trusted.

Air-Gapped and Multi-Signature Solutions for Secure Crypto Storage

Air-gapped wallets are not connected to any network. This means they do not touch the internet at all. They’re one of the safest ways to store your coins.

These wallets need you to do things offline. For example, you sign a transaction offline and then move it online to send it. It’s like writing a check at home and then mailing it.

Multi-signature wallets need more than one key to approve a transaction. Think of it like a bank safe that needs two keys to open. This way, even if someone gets one key, they can’t take your coins without the other key(s).

Multi-signature and air-gapped wallets are great for businesses or groups. They make sure no one person can run off with all the money. It’s a team effort to move the crypto.

For extra safety, use two-factor authentication. This is where you use a password and something else, like a text message code, to get into your wallet. It’s like having two locks on your door.

When storing crypto, think about how much convenience you want and how much risk you can handle. Hot wallets, or wallets connected to the internet, are handy for day-to-day use. But they are more at risk for hacks. Cold storage, like hardware wallets, is better for large amounts or long-term holding. They are less convenient but much safer.

Decide based on what fits your life. If you trade a lot, a hot wallet might be better. But if you’re saving for the future, go with a cold wallet. Secure your private keys, use safe devices, and keep learning. When you know how crypto security works, you can make smarter choices. Remember, the goal is to protect your investment from thieves and hackers. Be smart and stay safe!

Selecting the Optimal Wallet for Your Cryptocurrency Needs

Factors to Consider in Choosing the Best Wallets for Cryptocurrency

When picking a wallet for your digital coins, think safety first. No one wants to lose their cash! Each wallet type has its own good points. I’ll walk you through what to look for.

First, ask how often you trade. If it’s daily, you might want an online wallet. They’re faster for quick trades. But remember, they can be risky. Your cash is online, where hackers lurk. We call this ‘hot storage.’

But maybe you’re in it for the long game. If so, think offline wallets – we say ‘cold storage.’ Here, your money sits safe and snug, away from prying internet eyes. Sure, trading might take more steps, but your coins stay secure.

What about the wallet’s make? Well, hardware wallets, like a USB, are tough to crack. Mobile wallets are handy but watch out – your phone could get lost or hacked. Write down your recovery keys, just in case. That’s a must. Don’t lose them!

Next, check if the wallet digs multi-signature access. This means more than one key to get in. Think of it as a safety deposit box for your crypto. More keys, more peace of mind.

Also, don’t forget two-factor authentication. It’s a double check for who you are. Like using a password and a text message code. This blocks strangers from sneaking in.

Last, how does it handle your keys? You should hold your private keys. If not, you’re not in full control. That’s risky business. So, make sure to encrypt your wallet. This scrambles your data into code. Only the right key can unlock it. Encryption matters!

Setting Up and Maintaining Secure Digital Wallets

Got your wallet picked out? Great! Now, let’s set it up right and keep it tight.

Firstly, update your software. Keep it fresh. Outdated software is like a broken lock. Easy to bust open.

Then, get that wallet backup rolling. Store it well, but keep it hush-hush. No sharing. And scan for viruses. You don’t want those buggers snooping through your stash.

Think about where to store your backup, too. A safe or a safety deposit box is smart. Just in case your computer goes kaput.

Remember, this stuff is complex. It’s okay to feel a bit lost. But once you get the hang of it, you’ll cruise through. Just like learning to bike.

And hey, even when you’re set up, keep checking in. Don’t get lazy. A forgotten wallet is a sitting duck. That’s not what we’re aiming for.

Set up your wallet, lock it down, and stay sharp. That’s the way to keep your crypto snug as a bug in a rug. Now you’re ready to make your pick and take on the crypto world. Go get ’em, tiger!

We just looked at keeping your digital coins safe. Hot wallets are good for quick access, while cold wallets are best for long-term security. Think of hot wallets like your pocket cash, and cold wallets as your bank safe.

Hot wallets may face risks, but they’re handy. Cold wallets, on the other hand, are tougher to break into. Each has its place. Also, remember that tools like hardware wallets and multi-sign features can strengthen your crypto safety. They help you guard against hackers and keep your investments safe.

When choosing a wallet, weigh the features against your own needs. Want quick trades? Go for hot wallets. Keeping a big stash? Cold wallets are better.

In the end, find the right balance that fits your crypto use. Stay sharp on the setup and updating your wallet security. This way, you protect your digital cash just like you would your real money. Keep these tips in mind, and you’ll do just fine.

Follow us for more infomation!

Q&A :

- What are the main differences between a hot wallet and a cold wallet?

Hot wallets are digital wallets that are connected to the internet, providing easy and quick access to cryptocurrencies for everyday transactions. They are convenient, but this constant connection to the internet also makes them more vulnerable to hacking and theft. On the other hand, cold wallets are cryptocurrency storage methods that are not connected to the internet, such as hardware wallets or paper wallets. They are considered more secure because they are less susceptible to online hacking attempts, making them ideal for storing large amounts of cryptocurrencies long-term.

- Why might someone choose a cold wallet over a hot wallet?

Someone might opt for a cold wallet over a hot wallet for enhanced security reasons. Cold wallets keep private keys offline, thereby significantly reducing the risk of cyber theft. For investors or users who want to store large amounts of cryptocurrency for extended periods, cold wallets offer peace of mind that their assets are safe from internet-based attacks. However, it’s important to note that while cold wallets are more secure against online threats, they can still be at risk of physical damage or loss, and accessing funds can be less convenient compared to hot wallets.

- How do I set up a hot wallet or cold wallet?

Setting up a hot wallet typically involves choosing a reputable software wallet provider, downloading the application, and creating an account with a strong password and all necessary security measures, such as two-factor authentication. The next steps would include backing up the wallet with a recovery phrase and then transferring cryptocurrency into the new wallet.

For a cold wallet, you’ll need to purchase a hardware wallet from a trusted manufacturer or create a paper wallet using an online generator. For hardware wallets, after purchasing, you would follow the manufacturer’s instructions to set up the device, recording the recovery phrase, and then transferring your cryptocurrency to the new wallet address. For paper wallets, steps include generating and printing the public and private keys, securing the paper, and transferring funds to the paper wallet’s public address.

- Are my cryptocurrencies still easily accessible if I use a cold wallet?

While cold wallets provide added security due to their offline nature, they can make it slightly less convenient to access funds compared to hot wallets. Cold wallets, such as hardware wallets, often require physical interaction (e.g., connecting the device to a computer) and may require more steps to move funds. However, many hardware wallets nowadays are designed with user-friendly interfaces that still allow relatively easy access to your funds when needed, although the process is not as instant as it is with hot wallets.

- Can I use both a hot wallet and a cold wallet at the same time?

Yes, it is common for cryptocurrency users to employ both hot and cold wallets simultaneously, a practice referred to as using a “hybrid” approach. This method allows for a balance between convenience and security. A hot wallet can be used for day-to-day transactions and holding smaller balances, offering ease of use. At the same time, a cold wallet can be used to store the bulk of one’s assets securely offline. This combination minimizes risk while maintaining the practicality needed for regular transactions.

RELATED POSTS

Hashgraph Consensus Demystified: Unlocking Blockchain’s Future Potential

Discover the technical mechanics of...

Define Blockchain Technology – A Beginner’s Introduction

Have you ever wondered what...

Government Regulations on Blockchain: Navigating the Crypto Maze

Understanding the Impact of Government...

Unveiling the Achilles’ Heel: Top Common Vulnerabilities in Blockchains

Protecting Blockchains from Vulnerabilities: Uncovering...

Unveiling the Future: How DAOs Revolutionize Learning and Teaching

Discover how DAOs are transforming...

What is KYC in Crypto? The Key to safer and transparent trading

What is KYC in Crypto...

How Security Bolsters Blockchain Adoption: Navigating the Tech Maze

How does security impact blockchain...

A Slice of History – The First Recorded Bitcoin Purchase and Its Impact Today

The First Recorded Bitcoin Purchase...

Crypto Prediction Markets: Can You Outsmart the Future?

Explore the mechanics of decentralized...

Interoperable Blockchains: Unpacking Hidden Security Risks

Understanding the security risks in...

Blockchain Trends and Predictions: The Future of Tech Unveiled

"Blockchain trends and predictions: Embracing...

Unveiling The Future: Benefits Of Using Blockchain In Different Industries

Benefits of using blockchain: transform...

Decentralized Systems Unveiled: Harnessing the Power of Collective Innovation

Unlocking the Benefits of Decentralized...

2024 US Election Results – Political Shock and the Future of Cryptocurrency

The 2024 US election results...

Reya Network Airdrop – Guide to Participate and Profit Before Launch

Do you want to profit...

Green Crypto Coins: Investing in a Sustainable Digital Future

Understanding the Future of Sustainable...