Discover how Blockchain for Securities Trading is revolutionizing the financial landscape. Imagine faster trades, reduced errors, and no middlemen siphoning off your profits. This isn’t just a trend—it’s your chance to navigate high-stakes finance with enhanced security and transparency. Are you ready to join the revolution?

Understanding Blockchain in Finance and Securities Trading

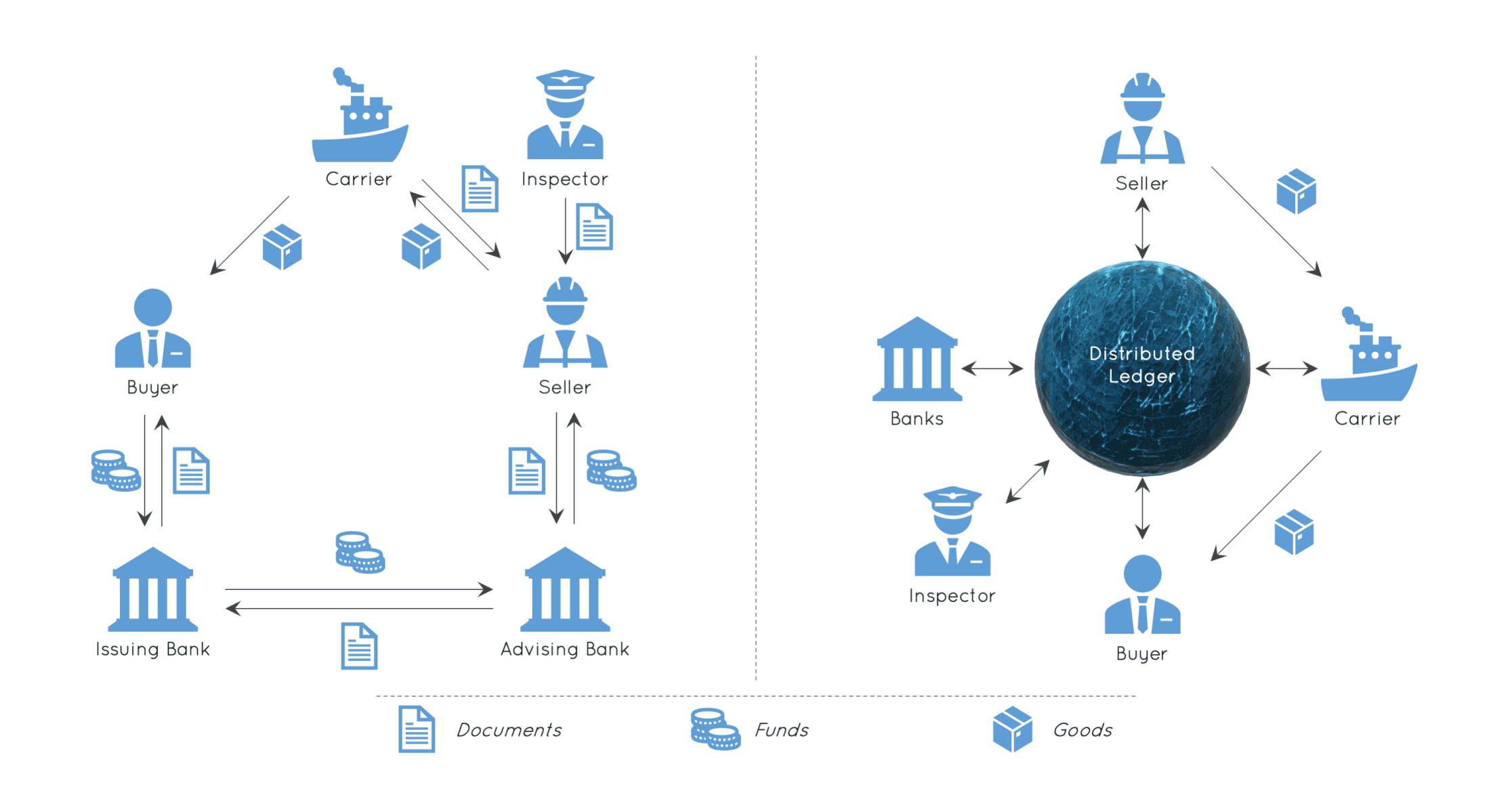

The Emergence of Distributed Ledger Technology in Capital Markets

Imagine a huge book where all trades are written down. Now, make it digital and secure. That’s a distributed ledger. This tech is shaking up finance big time. It’s like a shared record book everyone can trust, and no one owns it outright. Banks and stock markets are sitting up and taking notice. Here’s why.

Each trade, each buy, and sell, it’s all stored clear as day. In such a system, smart contracts do the heavy lifting. Picture small computer programs that seal deals on their own when certain rules are met. With these in play, stock trading enters a whole new era.

No more waiting days for a trade to close. Blockchain cuts wait times to near zero. Money moves fast, safe, and without hassle. This is a game-changer for traders. Suddenly, selling stocks can be as easy as sending an email.

Ensuring Regulatory Compliance and Market Integrity with Blockchain

Now, for the serious stuff. Keeping markets clean matters. And blockchain makes it easier. It’s about being sure everything’s above board, and the rules are followed to a T. Watchdogs love blockchain because it’s transparent. They can see trades in real time and know no one’s up to no good.

When you trade stocks, there are tons of rules. Too many to count! But with blockchain, smart contracts can be coded to follow these rules automatically. This means less room for mistakes and more trust in the market. Plus, with everything on the blockchain, it’s harder for bad actors to mess with the system.

Let’s wrap our heads around tokenization of assets. Sounds fancy, right? It’s just taking something like a piece of real estate and breaking it into digital shares. Blockchain is perfect for this. It makes these digital shares easy to trade and trace.

So, things are changing fast in finance, all thanks to blockchain tech. Stocks are easier to trade, the rules are followed better, and everything’s open for all to see. This isn’t just talk; it’s happening now, and it’s exciting stuff.

Advancing Securities Trading with Smart Contracts and Tokenization

Automating Transactions and Reducing Settlement Times

We know trading can be slow. But what if it wasn’t? Picture blockchain as a fast track. It uses smart contracts in stock trading. These smart contracts are like auto-pilots for deals. They follow set rules. Once those rules are met, the trade happens. No waiting. This cuts settlement times a lot. We’re talking minutes, not days.

Smart contracts make sure everyone plays fair. They keep track of all the steps. This way, money and shares swap hands right. No mix-ups. This trust comes from blockchain’s way of recording info. It’s like a group project where everyone writes down the same notes. All see it, all agree, no cheating. It’s clear and quick.

Blockchain beats old trading ways here. It’s simple. Old systems take time. They need lots of checks. But smart contracts don’t. They check themselves. This means faster trades, less waiting.

The Growth of Security Token Offerings and Digital Asset Exchanges

Now, let’s talk tokens. It’s not arcade games. It’s the future of investing. Security token offerings are like normal stocks going digital. Only better. Think of tokens as pieces of a company you can own. But unlike old stocks, you buy them online with a click.

Digital asset exchange is a new marketplace for these tokens. It’s online and open to all. No need for a big building with traders shouting. You can trade from your couch. And because it’s all digital, it’s super fast.

With these exchanges, companies can reach more people. Investors like you and me can find more chances to grow our money. Also, these tokens are often backed by real stuff, like buildings or art. That adds safety for your investment.

And companies love it because it’s new cash for them. They can grow more and make new things. All thanks to these tokens and the people who buy them.

So, blockchain shakes things up in trading. It makes trades faster and safer with smart contracts. It opens up new ways to invest with tokens. And all this is growing just like your favorite tree in the park. It starts small, but with care and smart choices, it can grow big and strong. This is the new world for investors — digital, direct, and dazzling. And it’s only just the start.

The Impact of Decentralized Platforms on Trading Costs and Liquidity

Comparing Blockchain with Traditional Trading Systems

Let’s talk shop about how blockchain is changing the game for trading. Have you ever swapped baseball cards with friends? You’d know right away who you swapped with, what you got, and what you gave. Now, imagine a super-powered version of that for trading stocks.

That’s what blockchain does. It’s like a digital ledger that everyone can see, but no one can mess with. Before, trades took a few days to settle because lots of folks were involved. It was complex. Blockchain does it way faster and safer. This means stocks and money move quicker. Cheaper too, without all the middle people.

Now, blockchain is pretty new compared to old ways of trading. It’s like comparing smartphones to landlines. The old systems are good, but they’re a bit slow and cost more.

So, to wrap it up, blockchain makes trades fast like a rocket and keeps fees low like a limbo stick!

Enhancing Liquidity and Reducing Costs through Decentralized Exchanges

Have you ever tried to sell something but couldn’t find a buyer? That’s a bummer, right? But what if there was a huge room, virtual, of course, where lots of buyers and sellers hang out? That’s what decentralized exchanges are – everyone’s invited, and you can trade directly with them.

And get this, because it’s peer-to-peer, which means person-to-person, you don’t have to give a cut to a middle person. More people trading means you can sell or buy easier, that’s called liquidity, and it’s a big deal. When you need to sell fast, a liquid market is your best friend.

That fee you save on each trade might not seem huge alone. Stack them all up over time, though, and we’re talking serious cash. Money better off in your pocket than someone else’s, right?

Most importantly, blockchain tech is honest. Everyone can see what’s going on, no tricky business. And smart contracts on blockchain make sure trades are fair and square.

So, lower costs, more folks trading, and trusty tech? That’s the power of blockchain for you. You get a safer and smoother ride on the trade train, all thanks to this digital marvel.

Cross-Border Trades and Market Transparency Powered by Blockchain

Exploiting Blockchain Transparency for Fraud Prevention and Investor Trust

Blockchain tech is a game changer in trading, keeping things open and honest. It brings a clear view of each trade, for everyone to see. This transparency means you can trust that no one is cheating you. Frauds can’t hide on a blockchain because each trade lives on a shared record. This makes our investment world safer and more reliable.

Think of blockchain like a big digital notepad that can’t be messed with. Everyone on the network sees the same notes. This builds trust when you trade across borders. In the past, sending trades far away could be risky and unclear. Now, blockchain lets us trade stocks like we exchange texts – fast and easy to check. It’s like having a light on in a dark room, so no one trips over.

Pioneering Real-Time Data Dissemination and Settlement Efficiency in Global Trading

Let’s talk about settling trades. Before blockchain, you had to wait, sometimes days, to finish a deal. Now, with smart contracts on blockchain, this happens almost at the snap of your fingers. Like magic, these smart “rules” do the trade steps for us, right when conditions are met. So, money moves and stocks change hands quickly, without any go-between.

But that’s not all. Blockchain also means anyone, anywhere, has the same facts about a trade at once. It’s like a group text where when one gets the news, everyone does. Real-time data keeps markets fair and lets us make smart choices fast. And if you’re trading across borders, there’s no waiting for some other market to wake up.

The beauty of blockchain in finance is that, while it’s complex in tech, it simplifies your trade life. It’s all about making things quicker, clearer, and cost-friendlier for you, the trader. So, whether you’re in New York or Tokyo, sending stocks or buying them, blockchain is your ace for quick, clear, and fair plays in this big global game.

In this post, we’ve explored how blockchain is reshaping finance and trading. From capital markets leaning on distributed ledger tech to uphold rules, to the exciting rise of smart contracts slashing the time it takes to move money around. We saw that security tokens are blooming and digital exchanges are setting the stage for a new era in trading.

Trading costs are taking a dive and cash flow is smoother thanks to decentralized platforms. We compared old-school trading systems with blockchain’s sleek, cost-effective ways. And let’s not forget the big win: more trust and clear-as-day deals in cross-border trade thanks to blockchain’s transparency.

Blockchain isn’t just a buzzword; it’s a game changer in trading, cutting down costs and making processes quicker, safer, and more transparent for everyone. As I wrap this up, think about the power of blockchain. It’s not just a distant dream; it’s happening now, making waves and rewriting the rules of finance. Let’s stay tuned, because this technology is going places, and it’s taking us along for the ride at Blockchain Global Network.

RELATED POSTS

AI Agents: Automation solutions for Web3 platforms

Artificial intelligence is ushering in...

Future of Education: How Decentralized Learning Platforms Are Revolutionizing Learning

Embracing the future of education...

Identity Management and Compliance Solutions: Navigating the Maze of Modern Security

Identity management and compliance solutions...

The Benefits of Conducting Blockchain Audits for Secure Transactions

Gain transparency and trust with...

Cryptocurrencies and Digital Payments: Revolutionizing Modern Transactions

Understanding cryptocurrency transactions and blockchain...

Blockchain Breakthrough: How can blockchain improve patient data security

How can blockchain improve patient...

BlackRock and Citadel New Stock Exchange – What Awaits in the Future?

The BlackRock and Citadel New...

What is Animoca Brands? Learn about the Blockchain empire

In the dynamic world of...

What is the purpose of blockchain technology?

What is the purpose of...

Blockchain Basics: Unlocking the Mysteries of Modern Cryptography

Understanding the Cornerstones of Blockchain...

Innovation in Blockchain Security: How Attacks Are Sparking Genius Breakthroughs

"Innovation in blockchain security due...

Blockchain Beyond Bitcoin: How will blockchain be used in everyday life

"How will blockchain revolutionize everyday...

Not Pixel Airdrop – Optimize Profits from Pixel

To optimize profits from Not...

Methods to Prevent Blockchain Attacks: Safeguard Your Digital Fort Knox

Prevent blockchain attacks with fortified...

Unlocking the Future: The Real Difference between Cryptocurrency and Blockchain

Explore the foundational differences between...

CoinList and U2U Network – Partnering to Build the Future of Decentralized Infrastructure

The cryptocurrency market is witnessing...