Imagine a place where trading tokens is secure and you hold the reins. Welcome to the world of decentralized exchanges and tokenization, where the power shifts back to you. No middlemen, no hidden fees, just pure trading bliss. But what does this shift mean for the future of digital ownership? Dive with me into the essence of this tech wonder, peel back the layers of its mechanism, and embrace the new era of non-custodial trades where your assets are safer than ever. Uncover how this fresh wave will not just rock your boat, but transform the entire ocean of blockchain tech.

Exploring the Essence of Decentralized Exchanges

The Mechanism of DEX Platforms

Think of a bustling market. But no one runs it, and it’s open day and night. That’s a DEX platform for you. It lets people swap tokens any time they want. And it all happens without someone in the middle to hold their money. On a DEX, trades are direct, with smart contracts doing the heavy lifting. This way, people keep control of their digital coins.

Smart contracts are the rules of this game. They’re like vending machines. You put your token in, choose what you want, and out pops your new token. Cool, right? Though you can’t grab a soda, you get a different kind of refreshment: new tokens in your wallet!

Embracing Non-Custodial Trading and Asset Security

Non-custodial trading means you’re the boss of your tokens. No one else can touch them. Not even the DEX. This keeps them safe from bad guys and even the exchange’s own troubles. You just need your crypto wallet to trade. No trust needed, because blockchain technology backs you up.

Think of blockchain like a group project where everyone writes down what happens. If someone tries to cheat, the others will spot it fast. This way, token trading stays honest and secure.

DEXs using Ethereum let us trade all sorts of tokens. It’s like having an entire mall in your wallet! Plus, you don’t have to worry about the mall security. Your tokens are safe with you, thanks to blockchain.

So, what are liquidity pools? They’re giant token buckets that make sure traders can always buy or sell. People put their tokens in and earn fees as a thank you. It’s a win-win. You help the DEX’s water flow and get rewarded for it.

Trading pairs on DEX? They’re the token duos you can trade. You can swap your Ethereum for another token or vice versa. The pairs depend on what’s in those liquidity pools. The more, the merrier, for smoother trades.

Fee structure in DEX is the small cut it takes to keep things running. Luckily, it’s often less than what you pay in traditional exchanges. That means more tokens stay in your pocket.

And that swap function in DEX? It’s the magic button. It lets you change one token for another quickly. Just like swapping a skateboard for a bike with your friend.

While there’s much to love about DEXs, they are not perfect. The regulatory world is watching. They want to ensure that no bad things happen. That’s where KYC might step in, especially as DEXs grow.

Lastly, why choose a DEX over a regular exchange? It’s all about freedom and security. You’re in control, and your assets are protected by blockchain might. It looks like the future of token trading is here, shining bright on DEX platforms.

Token Trading and its Impact on DeFi Ecosystems

The Role and Growth of Automated Market Makers

Automated market makers (AMMs) are like magic beans for DeFi. They let people trade tokens anytime they want, without waiting for someone else who wants to trade at the same time. How? They use math and some rules to figure out prices. It’s all about supply and demand. So, even if you’re up late at night and get the urge to swap some tokens, AMMs have your back. They’re always there, ready to trade. This open-all-hours shop has helped DeFi grow super fast.

Smart Contracts and the Formation of Liquidity Pools

Smart contracts are like the brains in DeFi. They handle everything on their own without needing a middleman. Think of them as trusty robots that live on the blockchain. They make sure trading, lending, and borrowing follow the rules. It’s like having an honest accountant that never sleeps.

Liquidity pools, on the other hand, are big pots of tokens. People put their tokens in, and by doing this, they help others trade more easily. It’s like adding water to a slide, so everyone goes down without getting stuck. In return, they can earn fees, kinda like getting a ticket to ride, for adding to the fun. This is all thanks to smart contracts.

With these tools, DeFi ecosystems are buzzing with new ways to use money. It’s more open and flexible than ever. Now we can all be our own bank, trade, lend, and save with just a few clicks. Welcome to the future – it’s now, and it’s decentralized!

Tokenization and Its Revolution in Blockchain Technology

Digital Token Issuance and the Spectrum of Crypto-Assets

In blockchain, tokens are a big deal. They are like unique digital coins. You can tie them to real things, like art or houses, or ideas, like membership in a club. These tokens live on blockchains made by smart contracts. This means no one person controls them.

Once created, these tokens can be traded. Think of them like trading cards but way cooler because they’re on the blockchain. Tokens come in different types: some give you part ownership in something (security tokens), some let you use a service (utility tokens), and some give you a say in how things run (governance tokens).

The Transformational Power of Tokenized Assets on Ethereum-based DEX

Tokenized assets on Ethereum bring new power to trading. Ethereum is a place where many tokens start life. It’s known for its massive community and tools like smart contracts that help create and manage tokens.

DEX platforms use Ethereum to let people trade tokens in a way that’s fair and open. They do this without holding onto your tokens; a term we call non-custodial trading. This way, you stay in control of your tokens at all times.

On these platforms, there are things like liquidity pools. Picture a big digital pot of tokens that makes trading smooth. People who add tokens to these pots are rewarded, often through methods like yield farming strategies, which is like planting a seed and watching it grow into more tokens.

All of this is part of the DeFi (Decentralized Finance) world. It’s a new way to deal with money, without the need for banks or other middle-men. It’s rapid, it’s global, and it’s open to anyone with a crypto wallet and internet access.

DEX platforms are not just about trading but also about using your tokens to do stuff like lending, borrowing, or swapping different types of assets using a swap function in DEX. That’s where automated market makers come in. They make sure there’s always a way to trade, even if it’s 3 AM and no other person is online to trade with you.

And the best part? DEX user experience keeps getting better. This means even if you’re new to all this, you can hop in fairly easy and start trading or tokenizing your own assets.

But remember, with great power comes great responsibility. DEXs are decentralized, which means it’s up to everyone in the network to play fair and stay informed. Always do your homework before diving into this exciting new world of tokenized assets.

Achieving Interoperability and Compliance in DEX Operations

Cross-Chain Solutions and Peer-to-Peer Transactions

In the world of DEX platforms, “Can I trade tokens from different blockchains?” is a common question. Yes, you can, thanks to cross-chain interoperability. This fancy term just means you can swap different types of digital money, even if they’re from separate places.

Let’s dig deeper. Suppose you have Bitcoin but want some Ethereum-based token. Normally, they don’t talk well with each other. However, special tools called bridges let you trade between them. This is like having a friend who speaks both English and French, making it easy for you to talk to someone from France.

Another cool thing about DEXs is peer-to-peer transactions. Think of it like swapping baseball cards with friends. You give what you have; you get what you want. It’s that easy, and there’s no middleman. You just need a computer or phone to do it. With these systems, you can trade with anyone in the world, at any time.

Cross-chain tech lets us trade tokens across different blockchains. Blockchains are like different countries’ rules for money. Sometimes, it’s hard for them to work together. But with the right tools, they can! This helps everyone use DEXs for trading without worrying about which blockchain they’re on.

One last thing: this all sounds great, but it’s only easy if you know how. Learning about DEXs can be hard, but don’t worry. There’s lots of help out there, and with time, you’ll get it!

The Road to Regulatory Compliance: KYC and DAOs in DEX Frameworks

Now, let’s talk about something a bit serious: rules. In DEX land, we also have to play by the rules, just like in real life. “Do DEXs need to know who their users are?” You may wonder. Well, it’s a bit tricky. Some say yes, we need ‘Know Your Customer’ or KYC. It’s like when a bank asks for your ID. It’s to keep things safe and clean.

But, here’s the twist. Many DEXs are proud of not asking for your details. They say it’s part of being free and in control. Yet, they still care about following the law. It’s a balance, like holding onto a bike. Lean too much one way, and you might fall over.

What’s a DAO, and how does it fit in here? DAO stands for Decentralized Autonomous Organization. It’s a group where everyone’s votes count, kind of like choosing where to go on a family trip. In DEXs, DAOs help decide big things, like changes or new rules.

For DEXs to be pals with the law, they might need to ask who you are. But still, you get to have a say through DAOs. It’s like being part of a club that makes its own rules, together. Everyone gets a voice, and everyone helps to steer the ship.

DEXs are not just tech; they’re like little worlds with their own ways. We’re all working to make them safe and fair for everyone. And as they grow, we’ll see even more ways they can amaze us with what they can do.

In this blog post, we dove deep into decentralized exchanges (DEX). We saw how DEX platforms work, offering secure, non-custodial trading that keeps your assets safe. Automated market makers are changing DeFi, making it easy for everyone to trade tokens. These tokens, especially on Ethereum-based DEX, are at the forefront of a blockchain revolution.

We also explored how tokenization is remaking the blockchain world. With the issuance of digital tokens, the range of crypto-assets has grown. Smart contracts and liquidity pools form the backbone of this new era. Moreover, we tackled the tricky subjects of interoperability and compliance in DEX operations, discussing cross-chain solutions and how KYC and DAO frameworks are evolving.

My final thought? Decentralized exchanges are more than a trend; they’re a key part of how we trade and engage with crypto-assets, providing security, growth, and innovation. It’s clear that as we solve cross-chain and compliance challenges, DEX will transform the financial landscape even further. Keep your eyes on this space—it’s where the future of finance is unfolding.

Q&A :

What are decentralized exchanges, and how do they differ from traditional exchanges?

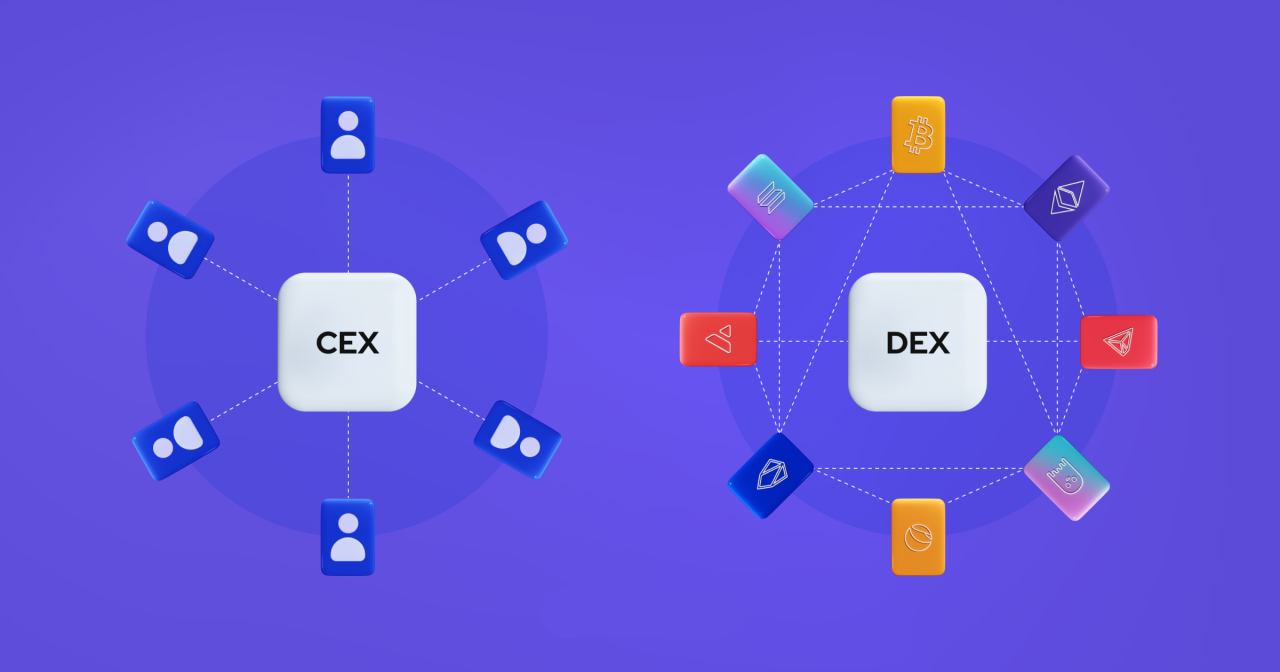

Decentralized exchanges (DEXs) are platforms that facilitate peer-to-peer trading of cryptocurrencies without the need for an intermediary or central authority to oversee the transactions. Unlike traditional centralized exchanges (CEXs) that act as third parties to hold and manage the funds, DEXs allow users to retain control of their private keys and funds, conducting trades directly from their own wallets. This enhances security, reduces the risk of hacking and fraudulent activities, and often results in lower fees.

How do tokenization and decentralized exchanges work together?

Tokenization refers to the process of converting rights to an asset into a digital token on a blockchain. These tokens can then be traded on decentralized exchanges, providing a seamless and efficient way to buy and sell assets that were previously illiquid or hard to exchange. The integration of tokenization with DEXs enables a wider variety of assets to be accessed by investors around the world without the need for traditional financial intermediaries.

Can anyone create a token on a decentralized exchange? What are the steps involved?

Yes, most decentralized exchanges offer the ability for users to create and list their own tokens. Here’s a simplified version of the steps involved:

- Develop your token by creating a smart contract on a blockchain platform that supports such functionality, such as Ethereum.

- Ensure the token complies with the standard protocols (e.g., ERC-20) for it to be supported by the exchange.

- Pay the necessary listing fees or fulfill any other requirements set forth by the DEX.

- Once approved, your token will be available for trading on the DEX platform.

What are the potential risks involved with using decentralized exchanges?

Although decentralized exchanges offer various benefits, there are risks associated with their use:

- Smart contract vulnerabilities: Since trades are facilitated by smart contracts, any bugs or flaws in the contract code could be exploited.

- Lack of regulation: DEXs are often not regulated to the same extent as traditional exchanges, potentially leading to issues with compliance.

- Liquidity issues: Some DEXs may suffer from lower trading volumes compared to CEXs, resulting in less liquidity and potentially higher slippage.

- User error: The onus is on the user to secure their private keys, and any mistake can lead to a loss of funds with no recourse.

Are decentralized exchanges legal, and is their use regulated?

The legality of decentralized exchanges varies by country and jurisdiction. In many regions, DEXs operate in a legal gray area due to the lack of specific regulations governing them. Some countries may impose regulations that affect the operation of DEXs, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance. It’s important for users to stay informed about the regulatory environment in their country when using a DEX. Remember to conduct your own research and consider consulting with a legal expert if you’re unsure about the legal standing of DEXs in your jurisdiction.