On December 3, 2024, South Korean President Yoon Suk Yeol declared martial law for the first time in 44 years to protect the country’s constitutional order and democracy. This decision came amid growing threats from domestic forces believed to have ties with North Korea. The martial law order has had a significant impact on domestic values and caused substantial volatility in the financial markets, especially in the cryptocurrency market and the South Korean Won.

Martial law in South Korea

In his speech on December 3, President Yoon explained that the declaration of martial law was necessary to safeguard national stability and protect the constitutional order in the face of rising threats from anti-national forces. He stated that certain political groups, particularly the Democratic Party, had acted in ways that aligned with North Korea and failed to respect government policies. In this context, military action was considered the only way to preserve social order and protect South Korea’s democracy.

The decision to impose martial law was not made lightly and has sparked strong reactions from both political and social communities. The announcement of martial law amid ongoing political tensions has raised fears about personal freedoms and democratic rights. One of the main reasons President Yoon cited was the actions of North Korea-supporting groups, which were seen as threatening national security, necessitating a firm response to prevent hostile forces from infiltrating South Korea’s politics and society.

Following the declaration of martial law, the National Assembly of South Korea responded strongly. The Democratic Party, which currently holds a majority in the National Assembly, rejected the President’s decision and called for the withdrawal of the martial law order. The National Assembly held an emergency session and passed a resolution demanding President Yoon rescind the martial law order. This has led to a legal issue, as under the South Korean Constitution, the President must act on the National Assembly’s decision within a short period.

The conflict between the government and the National Assembly has intensified political instability in the country. Both sides have their own reasons: the government views martial law as essential for national security, while the National Assembly sees it as an overreach and a violation of citizens’ personal freedoms. This tension is not only disrupting politics but also raising concerns about the long-term stability of South Korea’s political and economic environment.

Impact of martial law on South Korea’s financial market

Cryptocurrency market situation

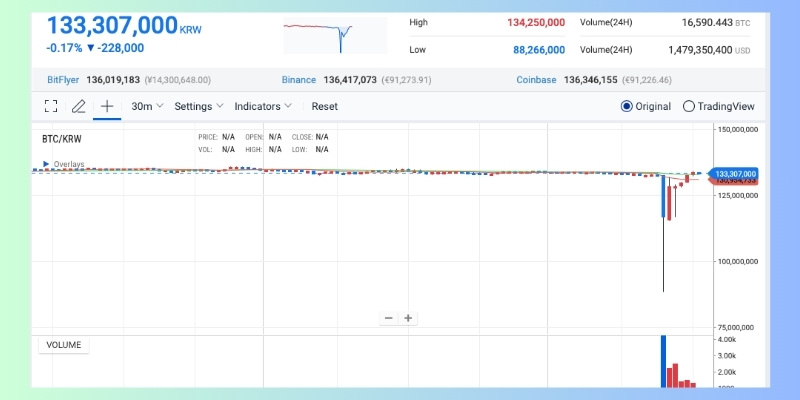

The declaration of martial law immediately caused significant turmoil in South Korea’s cryptocurrency exchanges, which represent one of the country’s largest and most developed cryptocurrency markets. One of the most notable effects was the sharp decline in the price of Bitcoin, the world’s most popular cryptocurrency, on South Korean trading platforms.

Bitcoin price volatility

Following the martial law announcement, Bitcoin prices on major South Korean exchanges, such as Upbit, plummeted from 132 million KRW (approximately 92,000 USD) to 88 million KRW (62,000 USD), a drop of 27%. This was a shock to investors who had been expecting market stability. However, after the initial drop, Bitcoin’s price rebounded strongly and began trading at higher levels, indicating that the market was gradually recovering from the sudden turbulence.

This reflected the instability of the cryptocurrency market amid political volatility. Investors are concerned that political instability may lead to government intervention in the cryptocurrency market, raising investment risks.

Impact on international trading

The decline in Bitcoin’s price was not limited to South Korean exchanges but also spread to global platforms. On international trading platforms such as Binance, ByBit, and OKX, Bitcoin’s price dropped below the support level of 94,000 USD. However, Bitcoin’s price then rebounded and traded between 95,000 and 96,000 USD. This demonstrates the global financial instability triggered by political events in a key country like South Korea.

Impact on other cryptocurrencies

It wasn’t just Bitcoin that was affected. The price of other cryptocurrencies, such as XRP, also experienced significant declines. On South Korean exchanges, the price of XRP dropped from 4,000 KRW (around 3 USD) to 1,623 KRW (1.23 USD), a 60% decrease in a short period. This price drop reflects the negative “Kimchi Premium” phenomenon, where domestic exchanges are unable to maintain synchronized prices with international platforms. High trading volumes in an unstable market further complicated the situation.

Impact of martial law on other financial sectors

South Korean stock market

South Korea’s stock market, particularly the shares of major companies like Samsung Electronics, has been significantly impacted by the martial law order. Investors are concerned that political instability will reduce foreign investment in the South Korean stock market.

Immediately after the martial law announcement, Samsung Electronics’ shares saw a sharp decline, falling by 5.5% on the London Stock Exchange. These fluctuations reflect the growing concern among analysts about the long-term effects of the political instability on South Korea’s economy.

Withdrawal of foreign investors

As political instability grows, foreign investors tend to pull back from markets with high risks. This has been the case for South Korea’s stock market, where related ETFs also saw substantial declines. The MSCI Korea ETF dropped by 4.5%, while the Franklin FTSE Korea ETF fell by 3.2%. This indicates a clear loss of confidence in South Korea’s market stability in the near future.

Weakening of the South Korean Won

The South Korean Won has been heavily impacted by the martial law declaration. Immediately after the announcement, the Won dropped 2.5% against the US Dollar, reaching its lowest point in eight years at 1,442 KRW/USD. This not only reflects political instability but also signals concerns about economic growth prospects.

Economic analysts predict that if instability continues, the Won could further depreciate, negatively affecting South Korea’s export sector. At the same time, the weakening Won could increase import costs, putting pressure on domestic production costs.

President Yoon Suk Yeol’s martial law declaration has led to widespread economic consequences, particularly in the cryptocurrency market and the South Korean Won. The strong market fluctuations, the depreciation of the Won, and ongoing political tensions have created a highly unstable environment.

According to Blockchain Global Network, financial advisors need to remain cautious and stay informed to adjust investment strategies during this period. While martial law may bring significant changes to the political system, its impact on the financial sector remains a key issue that must be closely monitored in the coming period.

RELATED POSTS

U2U Super App: A Central Hub for Asset Management, Privacy, and Blockchain Interactions

The U2U Super App is...

How the U2U Contract Address Powers Decentralized Transactions

The U2U Contract Address is...

What is Consensus? Consensus Mechanisms in Blockchain

In the world of cryptocurrency,...

The Rise of Meme Coins – Top Projects to Watch in 2025

Meme coins are making waves...

Don’t miss out on the DogX, Airdrop to X users

“DogX, Airdrop to X users”...

Helios consensus: The engine powering U2U Chain’s blockchain revolution

Ever wondered how U2U Chain...

What is Karak? Guide to joining Restaking

In the dynamic cryptocurrency market...

Preparing Blockchains: Quantum Computing’s Inevitable Impact

Protecting blockchain from quantum attacks:...

W-coin Airdrop offers a unique tap-to-earn experience

Combined with the powerful TON...

Why is Solana Going Up – Unveiling 3 Potentials of Solana

Why is Solana Going Up?...

Arch Network Airdrop: Detailed guide on how to participate

Arch Network is an innovative...

Nous Research Secures $50M for Decentralized AI on Solana

Nous Research, a trailblazing startup...

Dunes Airdrop – Optimizing liquidity from resting assets

Dunes Airdrop brings a solution...

How does Robinhood work? The Gateway to Blockchain

In today’s rapidly evolving financial...

Naoris Protocol Airdrop: Get free NAORIS Tokens

Naoris Protocol is an advanced...

Comedian Airdrop – Token BAN Leads the Memecoin Trend

In the world of memecoins,...