On April 23, 2025, the memecoin $TRUMP, associated with President Donald Trump, experienced a dramatic price surge of over 50% following the announcement of an exclusive dinner event for its top 220 token holders. This development, reported by Blog Tiền Ảo, has sparked significant interest in the crypto community, highlighting the volatile nature of meme coins and their sensitivity to high-profile endorsements. This article explores the details of the event, the token’s performance, and the broader implications for investors and the cryptocurrency market.

The Exclusive Dinner Announcement

According to the official $TRUMP project website, President Trump will host a private dinner at an exclusive members-only club in Washington, D.C., on May 22, 2025. The event is reserved for the top 220 holders of the $TRUMP token, offering them a unique opportunity to dine with the U.S. President, who has been dubbed the “Crypto President” for his pro-cryptocurrency policies. Additionally, the top 25 holders will receive a VIP tour and a private meeting with Trump, further incentivizing large-scale investment in the token.

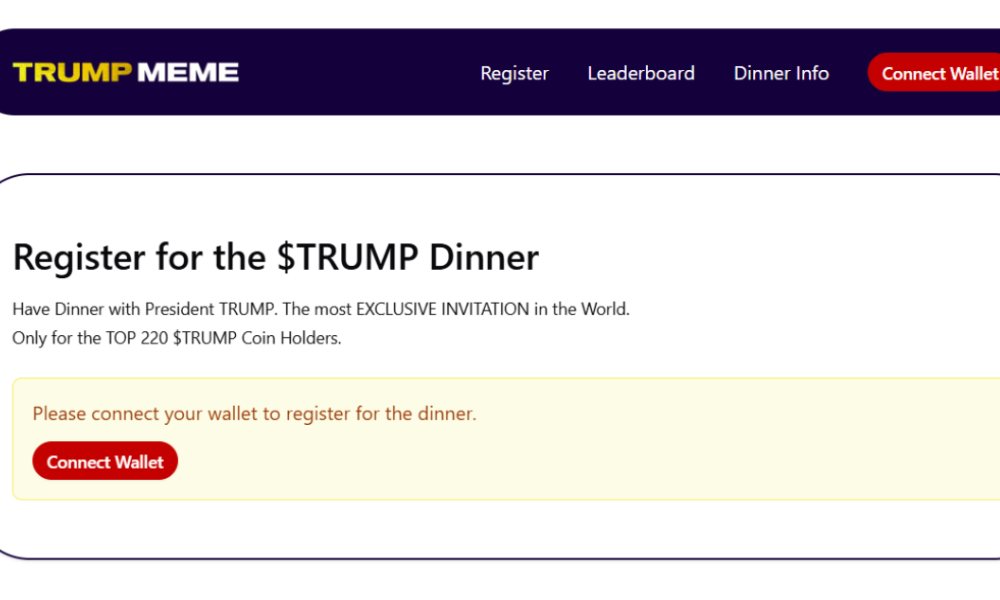

The announcement, prominently displayed on the project’s website, reads: “Join President Donald J. Trump for an exclusive dinner at a private, members-only club in Washington, D.C. Only the top 220 $TRUMP holders will have this privilege. Hear the President discuss the future of digital assets.” This event marks the first tangible utility for $TRUMP, a meme coin previously criticized for lacking practical use cases.

$TRUMP Token’s Market Performance

Following the dinner announcement, the $TRUMP token saw an immediate and significant price rally. Data from CoinMarketCap indicates that the token’s price surged from approximately $9 to a peak of $16 within hours, representing a 70% increase. By midday on April 24, 2025, the price stabilized at around $11.9, still reflecting a 50% gain over the previous 24 hours.

Despite this rally, $TRUMP remains highly volatile. The token, launched just before Trump’s inauguration on January 20, 2025, reached an all-time high of $73 shortly after its debut but has since declined by over 80% from that peak. The recent surge demonstrates the token’s susceptibility to news-driven pumps, a common trait among meme coins.

The $TRUMP token’s market capitalization currently stands at approximately $8.24 billion, making it one of the top 20 cryptocurrencies by market cap, according to CoinGecko. However, concerns remain about its concentrated ownership, with 80% of the token supply controlled by the Trump Organization and affiliated entities, such as CIC Digital and “Fight, Fight, Fight.” Additionally, 75% of the token supply remains locked, with a significant unlock of 40 million tokens (valued at $300 million) scheduled for July 2025, which could introduce further volatility.

Why This Event Matters

The announcement of the exclusive dinner underscores several key dynamics in the cryptocurrency market:

-

Influence of Celebrity Endorsements: Trump’s involvement with $TRUMP, even if indirect, has proven to be a powerful catalyst for price movements. His status as a polarizing political figure and his vocal support for cryptocurrencies amplify the token’s appeal to speculative investors.

-

Meme Coin Volatility: Meme coins like $TRUMP thrive on hype and community sentiment rather than fundamental utility. The 50%+ price surge following a single announcement highlights the high-risk, high-reward nature of these assets. Experts, including Anthony Scaramucci of SkyBridge Capital, have warned that such tokens are prone to rapid declines once hype subsides.

-

Regulatory and Ethical Concerns: The $TRUMP token has faced criticism for its opaque ownership structure and potential conflicts of interest, given Trump’s role as President. Critics argue that the token blurs the line between governance and personal profit, raising questions about transparency and regulatory oversight.

-

Market Sentiment Boost: The event aligns with Trump’s broader pro-crypto agenda, including the establishment of a Strategic Bitcoin Reserve and the inclusion of tokens like XRP, SOL, and ADA in a national digital asset reserve. This policy shift has bolstered optimism in the crypto market, with Bitcoin surpassing $93,000 and the total crypto market cap rising by over $300 billion since early March 2025.

Implications for Investors

For investors, the $TRUMP dinner announcement presents both opportunities and risks:

-

Short-Term Gains: Traders who capitalized on the news-driven rally likely profited significantly. Social media posts on X reflect excitement among $TRUMP holders, with some celebrating the token’s “short squeeze” and rapid price increase.

-

High Risk of Volatility: The token’s history of sharp declines—such as a 63% drop within 10 days in April 2025 due to competition from the $MELANIA token—suggests that investors should exercise caution. The upcoming token unlock in July could further depress prices if large holders sell.

-

Regulatory Uncertainty: While Trump’s administration has been favorable to cryptocurrencies, the SEC and other agencies may scrutinize $TRUMP for potential securities violations, especially given its concentrated ownership and lack of clear utility.

-

Strategic Positioning: For high-net-worth investors, holding enough $TRUMP to secure a dinner invitation (estimated at $400,000 worth of tokens) could offer networking opportunities with Trump and his administration, potentially influencing crypto policy discussions.

How to Approach $TRUMP as an Investor

-

Conduct Thorough Research: Understand the token’s ownership structure, unlock schedule, and lack of intrinsic utility. Resources like CoinMarketCap and CoinGecko provide reliable data on price and market cap.

-

Manage Risk: Given $TRUMP’s volatility, allocate only a small portion of your portfolio to meme coins and set strict stop-loss orders to limit losses.

-

Monitor News: Stay updated on Trump’s announcements and policy moves, as they directly impact $TRUMP’s price. Following credible crypto news outlets like Blog Tiền Ảo, CoinDesk, or BeInCrypto can help.

-

Diversify: Balance investments in speculative assets like $TRUMP with more established cryptocurrencies like Bitcoin and Ethereum, which benefit from broader adoption and Trump’s strategic reserve policies.

Broader Market Context

The $TRUMP dinner event coincides with a bullish period for cryptocurrencies, driven by Trump’s pro-crypto policies. Since his inauguration, the crypto industry has seen significant developments:

-

Strategic Bitcoin Reserve: Trump signed an executive order in March 2025 to establish a national Bitcoin reserve, prohibiting the sale of seized BTC and signaling long-term accumulation.

-

Crypto-Friendly Appointments: The resignation of SEC Chairman Gary Gensler and the appointment of Paul Atkins, a crypto advocate, have boosted industry confidence. David Sacks’ role as AI and Crypto Czar further aligns policy with innovation.

-

Industry Donations: Major crypto firms like Ripple ($5 million in XRP) and Coinbase have donated heavily to Trump’s inauguration, securing influence in policy discussions.

These factors have created a favorable environment for cryptocurrencies, but meme coins like $TRUMP remain speculative and prone to sharp corrections. Experts like Lee Reiners, a former Federal Reserve economist, warn that a potential “crypto bubble” could have broader economic implications if it bursts.

Conclusion

The announcement of an exclusive dinner for top $TRUMP holders has reignited interest in the meme coin, driving a 50%+ price surge and reinforcing Trump’s influence in the crypto market. While the event offers short-term opportunities for traders and networking potential for large holders, it also underscores the risks of investing in volatile, hype-driven assets. As the crypto market continues to evolve under Trump’s pro-crypto administration, investors must navigate this landscape with caution, balancing speculative bets with diversified strategies.

For the latest updates on $TRUMP and other cryptocurrencies, follow trusted sources like Blog Tiền Ảo, CoinGecko, and CoinMarketCap. Stay informed, manage risks, and approach meme coins with a clear understanding of their speculative nature.

RELATED POSTS

BoxBet Airdrop – Your Ultimate Guide to Earning BXBT Tokens

The BoxBet Airdrop is making...

U2U Network was Honored by Asia Business Outlook – Shaping the Future of Blockchain

U2U Network was honored by...

3 surprising effects on Pebonk when Pavel Durov was arrested

Pebonk has witnessed some unexpected...

Your essential guide to crypto conference events 2025

As the blockchain space matures,...

What is Hi PIN by PIN AI? Maximizing Your Airdrop Rewards with Hi PIN

Hi PIN by PIN AI...

Plenty Airdrop: Chance to get free PLY tokens

The Plenty Airdrop program distributes...

What is Consensus? Consensus Mechanisms in Blockchain

In the world of cryptocurrency,...

2024 US Election Results – Political Shock and the Future of Cryptocurrency

The 2024 US election results...

Your Ultimate Crypto Airdrop Eligibility Guide

The world of cryptocurrency offers...

A definitive guide to the best crypto airdrop platforms

Finding legitimate crypto airdrops can...

What is a honeypot in Crypto? Unveiling the Deceptive Traps!

What Is a Honeypot in...

What is dYdX? A deep dive into Decentralized trading

What is dYdX? It is...

What is blockchain technology and How does it work?

What is blockchain technology and...

Is Bitcoin Going to Crash? – 3 Current Market Dynamics

Wondering, “Is Bitcoin Going to...

Wewe Airdrop – Opportunities and Investment Potential in the Blockchain World

The Wewe airdrop is not...

Acki Nacki Airdrop: A detailed guide on how to participate

In the rapidly evolving world...