Welcome to the Blockchain Revolution: Reshaping Finance’s Future Today. If you’re curious about how blockchain tech is making waves in money matters, you’re in the right spot. The applications of blockchain in finance are changing how we think about secure transactions, honest ledgers, and smooth payments across borders. Sit tight as we dive into the world where finance gets faster, safer, and way more clever thanks to this digital wizardry. Time to see finance’s future, and it’s right here, glowing bright with blockchain!

The Backbone of Finance: Distributed Ledger Technology

Streamlining Cross-Border Payments

Have you ever sent money overseas? If you have, you know it often feels like a marathon. Now, imagine a world where sending funds abroad happens fast – like a sprint! That’s all thanks to something called distributed ledger technology or DLT for short.

But what exactly is DLT? In the simplest terms, think of it as a digital system where everyone keeps an eye on all transactions. No one person or bank is in charge. It’s a team effort. Now, let’s use our Stanford Question Answering Dataset (SQuAD) approach to break this down.

What helps cross-border payments go faster?

DLT does. It connects parties directly, cutting out the middleman, so transactions are quick. Afterward, I can tell you more details, and wow, it gets interesting!

Banks use systems that often take days for overseas payments. It can also cost a pretty penny. That’s where DLT shines! It’s like having a fast pass at an amusement park. You get to zoom past the long line of traditional banking hurdles, and it’s cheaper too!

With this tech, everyone involved can check transactions. This means fewer mistakes and top-notch security. It’s brilliant for people needing quicker access to their money and businesses that rely on swift payments to keep things moving.

Enhancing Ledger Transparency

We’ve all played hide and seek. In the financial world, though, staying hidden isn’t fun. It can even be risky. When money gets lost in the shuffle, that’s bad news for anyone. So, let’s bring in the big guns – blockchain.

What makes blockchain a big deal for ledger transparency?

With blockchain, transparency rules. It’s a kind of DLT where all details are out in the open for those who need to see them. Now, strap in, as we dive deeper.

It’s like letting everyone see where the money is going, from start to finish. No sneaky business. Can you think of something you wanted to know more about but just couldn’t see it clearly? Blockchain fixes that. In finance, it’s a game-changer.

For example, peer-to-peer lending platforms use blockchain to make sure everyone’s on the same page. No secrets, no surprises. Plus, it sticks to the rules, bowing to all kinds of rules set by the money bigwigs of the world.

Companies that need to explain their money moves love this. It’s perfect for tracking the dough in a way that’s upfront and honest. This helps stop the sneaky stuff, like financial fraud, and makes sure everything’s above board.

Blockchain and DLT aren’t just future talk – they’re here right now, making banking better. They make sure everyone plays fair and fast. With these tools, finance is getting a shiny new look, becoming something we can all trust and rely on.

Innovating with Smart Contracts and Decentralized Finance (DeFi)

Automating Compliance in Banking with Smart Contracts

Smart contracts are like computer programs. They stick to the rules, and once conditions are met, they act. For example, if I owe you money and we set a date, the smart contract pays you when the date comes. No delay, no mistake. This is a game-changer in banking. It makes sticking to rules automatic. Banks use a lot of time and money to make sure they follow the law. Smart contracts can save that time and money. They check themselves. Banks can trust them to do what they should.

Banks often face big fines for breaking laws. Smart contracts can help avoid this. They act by fixed rules that follow legal guidelines. If banks use them, they can worry less about mistakes that cause fines. This helps banks and their customers. It keeps money safe and makes everyone’s life easier.

Broadening Investment Horizons through DeFi Systems

DeFi stands for Decentralized Finance. It means financial systems that don’t rely on traditional banks. Instead, it uses blockchain to let people deal directly with each other. This new way of dealing with money is shaking things up. It lets people invest in new ways. Through DeFi, you can lend money to others and earn interest, or you can borrow from people you don’t even know, without banks in the middle.

DeFi opens doors for regular people to join in on investments they couldn’t before. We’re talking things like real estate or big company projects. It’s not just for the rich. It works like an open club—anyone with internet can join.

Because there’s no middleman, things move faster and cost less. Savings on fees mean you keep more of what you earn. It also means I can send money across the world, quick and without extra high fees. This is huge for people who have family in different countries.

As a blockchain strategy advisor, I see clients curious about these new options. They want to know how to use them for growth. The smart ones see DeFi as a way to grow their cash. They ask about risks too. And yes, there are risks, like with any investment. But knowing how to manage risks means you can still move forward bravely.

Smart contracts and DeFi change how we think about money. Banks once seemed to be the only way. Not anymore. This tech leads to faster, cheaper, and more open finance. It cuts out the middle, puts you in control, and blows the door wide open for new chances to grow your money. Use it smartly, and the future of your finance could be brighter and wider.

Modernizing Transactions: Digital Currency and Tokenization

Facilitating Digital Currency Transactions Securely

Think of digital currency like a new kind of money. It works online and fast. Now, picture blockchain as a super-safe lockbox, where everyone can see the box, but only you have the key to your money in it. This is blockchain tech at work in digital currency transactions.

Need to send money across the ocean? No sweat. Blockchain makes this quick and cuts costs. It’s a win-win. Blockchain also helps you trust where your money is going. Every move it makes is right there, on a shared ledger. This ledger is a list that everyone can see but no one can mess with.

Some folks worry, “Is blockchain safe for banking?” You bet. Blockchains use smart tech to keep money safe. They make sure everything follows the rules, too. Even those big, scary words like “regulatory compliance” seem less spooky. Blockchain is like a guard who’s always on duty.

Unlocking Liquidity with Asset Tokenization

Now let’s talk about “tokenization of assets.” Sounds fancy, huh? But it’s quite simple. Imagine you own a part of something, like a piece of a building. Blockchain can turn your piece into a digital token. It’s like a single Lego block out of a whole set.

Why do this? With tokens, you can sell your piece fast to anyone, anywhere. This makes the item more liquid. That means it’s easier to turn into cash. More cash on hand is good, right?

And it’s not just for buildings! Art, music, even a bottle of fancy wine can become tokens. This opens the door for many people to invest in things they couldn’t before. It’s like getting a VIP ticket to an exclusive club.

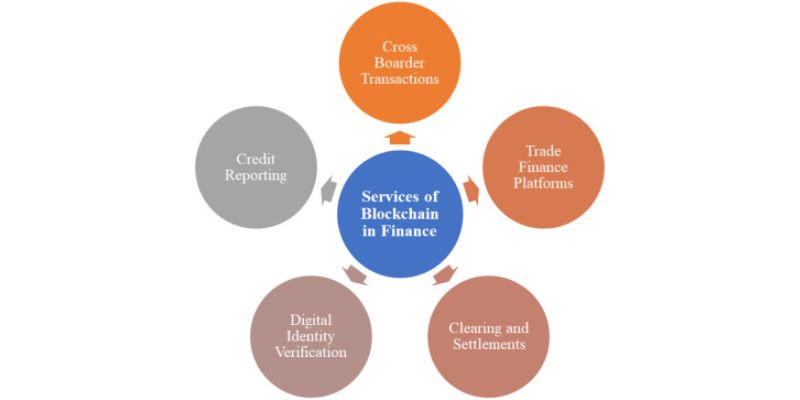

Blockchain doesn’t stop there. It helps in other big-money areas like trade finance and clearing and settling stuff. Think of it like a big game, where everyone knows the score, and all the players play fair.

In short, blockchain is shaking up finance in the best ways. It’s like having the safest, fastest money-moving tools, and a key to a new world of investments. Cool, right?

Advancing Security and Compliance in Finance

Strengthening Anti-Money Laundering Protocols with Blockchain

Imagine money that leaves no room for bad guys to hide. With blockchain, it’s possible. Blockchains store money moves in ways that are tough to hack. This is handy for stopping money laundering. What is money laundering? It is where dirty money from crimes looks clean. Blockchain shines here. How does blockchain help? It makes every step in money’s journey clear. This way, banks can spot foul play fast.

Ensuring Robust Financial Security with Blockchain Integration

Money needs to stay safe. We all want that, don’t we? Blockchain helps keep it secure. This tech acts like a strongbox that is very hard to crack. How does blockchain boost security in finance? It locks in data across many places at once. Crooks can’t change it without a huge effort. This means our cash and details are safer when banks use blockchain. It’s like giving money a shield against trouble.

We’ve explored how Distributed Ledger Technology (DLT) is reshaping finance. From making global payments swift to boosting transparency in ledgers, DLT’s influence is clear. Smart contracts pave the way for stricter compliance in banks and DeFi opens doors to new investment chances. Digital currencies transform how we transact, while tokenization breathes life into assets by freeing up cash.

Let’s wrap it up. Today’s financial scene is changing fast thanks to tech like blockchain. It promises safer, faster, and more open deals for everyone. Using blockchain, we can fight money laundering better and offer solid financial safety nets. So, the future of finance? It looks secure, well-oiled, and ready to handle the digital age full steam ahead. Let’s embrace these changes and watch finance get even better.

Q&A :

1. What are the primary uses of blockchain in the financial sector?

Blockchain technology has revolutionized the finance industry by introducing a secure, transparent, and efficient method for conducting transactions and storing data. Some of the key applications include:

- Decentralized Finance (DeFi): Leveraging blockchain to create financial systems that are accessible to anyone with an internet connection, without the need for traditional banking institutions.

- Cross-Border Payments: Facilitating faster and cheaper international money transfers by bypassing traditional banking systems and currency exchanges.

- Fraud Reduction: Significantly lowering the chances of fraud in financial transactions due to the immutable nature of blockchain.

- Smart Contracts: Automating the execution of contracts when certain conditions are met, without the need for intermediaries.

- Tokenization of Assets: Dividing real-world assets into digital tokens, which can be easily and securely bought, sold, or traded.

2. How does blockchain improve security in financial services?

Blockchain’s innovative approach to security lies in its structure:

- Decentralization: With no central point of failure, the system is more resistant to hacks and fraudulent activities.

- Encryption and Cryptography: Advanced encryption techniques protect sensitive financial data, ensuring that only authorized parties can access it.

- Immutability: Once data is entered into the blockchain, it cannot be altered or deleted, which helps prevent tampering and maintains a permanent and transparent ledger of all transactions.

- Consensus Mechanisms: Transactions are validated by multiple parties (nodes), which helps to prevent unauthorized transactions and ensures data integrity.

3. Can blockchain technology reduce costs in financial transactions?

Absolutely, blockchain can cut down the costs in financial transactions by:

- Eliminating Middlemen: Reducing or removing the need for third-party intermediaries, such as banks and clearinghouses, which traditionally charge fees for their services.

- Streamlining Processes: Automated processes, like smart contracts, can reduce the manual effort needed for compliance, settlement, and dispute resolution.

- Lowering Transaction Fees: Blockchain can minimize transaction fees, especially in international transfers, by simplifying the cross-border payment process.

- Reducing Fraud and Cybersecurity Costs: By securing transactions against fraudulent activities, blockchain can decrease the expenses associated with fraud prevention and cybersecurity measures.

4. What role does blockchain play in asset tokenization?

Blockchain is pivotal in asset tokenization by providing:

- Liquidity: Converting physical assets into digital tokens can enhance their liquidity, making it easier to buy, sell, or trade them at any time.

- Divisibility: It allows assets to be split into smaller units, enabling investment in fractions of an asset, which was not possible or practical before.

- Provenance Tracking: Blockchain stores the entire history of an asset, ensuring its authenticity and ownership trail is transparent and tamper-proof.

- Efficiency: Tokenizing assets streamlines the transfer process, eliminating the need for multiple intermediaries and reducing associated costs and delays.

5. What advancements might we see in the future with blockchain in finance?

The future of blockchain in finance is promising, with ongoing developments that might include:

- Central Bank Digital Currencies (CBDCs): Many countries are exploring or developing their own digital currencies, which could change the face of national and international monetary systems.

- Expanded DeFi Services: Broader and more comprehensive decentralized financial services may emerge, providing greater access to financial instruments without traditional banking constraints.

- Interoperability: Different blockchain systems may become more interoperable, allowing for seamless transactions and interactions across various platforms and cryptocurrencies.

- Regulation and Standardization: As the industry matures, we can expect more regulatory clarity and standardization, which could provide a more stable foundation for blockchain finance applications.

RELATED POSTS

What is the current market price of Bitcoin? Insights into today’s fluctuating values

What is the current market...

Green Crypto Coins: Investing in a Sustainable Digital Future

Understanding the Future of Sustainable...

Kuroro Beasts: An engaging NFT Game on Ronin

Kuroro Beasts – An NFT...

Blockchain Research Unveiled: Navigating the Future of Tech Innovation

Uncover the Evolution of Blockchain...

Guide to participate in TENEO Airdrop for beginners

Ready to explore the world...

Blockchain Technology Explained In Simple Terms For Beginner

Discover the basics of blockchain...

Future of On-Chain Code Audits: Revolutionizing Collaborative Cybersecurity

Enhance blockchain security with on-chain...

Custodial vs Non-Custodial Wallets: Which Secures Your Crypto Best?

Custodial vs Non-Custodial Wallets: Understanding...

The Future Of Blockchain Technology: What’s Next for Digital Ledger Tech?

The future of blockchain technology...

Blockchain Breakthrough: Sources of funding for blockchain research

Sources of funding for blockchain...

PAWS Airdrop – Earn tokens easily through Telegram

PAWS Airdrop opens up an...

What is blockchain: Unlocking the Future of Secure Transactions Technology

What is blockchain? Explore the...

Disadvantages of Blockchain: Beyond the Hype, What Are the Real Costs?

Navigate the limitations of blockchain...

Hashgraph Consensus Demystified: Unlocking Blockchain’s Future Potential

Discover the technical mechanics of...

Blockchain Unveiled: How Does Blockchain Technology Work

How does blockchain technology work?...

Solutions for Scaling Blockchain Networks: Unlocking Next-Level Potential

Discover solutions for scaling blockchain...