Dull banking methods are out, and blockchain use cases in financial services are in! I’ve seen firsthand how this tech changes the game. It’s not all buzz; real change is happening. From the way we make payments to new possibilities in trade and investments, blockchain is where finance meets the future. Take a seat, as I show you inside this revolution – no jargon, no fluff, just the exciting stuff. Today, you’ll get why blockchain tech is not only cool, but how it really makes a difference in banking, compliance, and beyond. Let’s dive in and explore together how this is all unfolding right before our eyes.

The Impact of Blockchain on Modern Banking Practices

Revolutionizing Payment Systems with Blockchain

Blockchain isn’t just a tech buzzword; it’s changing how we handle money. I’m here to show you how. Banks are now moving cash using this smart tech. Picture sending money as easy as a text message, even across countries. This is real, thanks to blockchain.

“Can blockchain make payments faster?” Yes, and it’s already happening! It’s like having a superhighway for money, cutting down time on transfers. This speed is a game-changer for businesses and folks working far from home. Money zips across the globe, without waiting days.

It’s not only speedy, it’s sturdy too. Each transaction is safe, locked down with complex math. No one can mess with it. That’s why banks trust blockchain to move bucks safely.

Blockchain gives everyone a crystal-clear view of transactions. No secrets or hidden steps. So, we see where our cash moves, second by second.

Implementing Smart Contracts for Efficient Banking Operations

“Can a bank cut its busy work?” You bet! Smart contracts do just that. They are like tiny robot lawyers inside the blockchain. They follow strict rules set in code to deal with money matters without human help.

When you meet their conditions, they act right away. Say you borrow money. Pay back on time, and the smart contract steps in to say “All good!” Miss a payment, and it’ll ring alarm bells without a person checking.

Smart contracts make banks run smoother. They cut out mistakes and speed things up. That’s key for loans and mortgages, where timing is everything. Banks get to be more reliable, and we don’t have to sweat the small stuff.

This is no small change. It’s a leap for banking, making things easier and safer for everyone. From handling cash to sealing deals, blockchain earns its place as a banking star. It’s smart, swift, and secures our money like a digital vault. And that’s just the start!

So, the next time you hear about blockchain, know it’s not just for techies. It’s working for you, keeping your money moving without a hiccup. Watch this space – banking’s only getting better with blockchain on board.

Decentralized Finance (DeFi) and Its Role in Financial Services

Expanding Access to Financial Services through DeFi

DeFi changes how we use money. It lets more people get financial services. No banks needed. Picture using your phone to lend, save, and pay people anywhere. That’s what DeFi makes possible. It relies on blockchain. This means, no single point of control. It’s open to all. Internet access is all you need.

We see DeFi altering financial reach. Many folks don’t use banks. DeFi gives them a chance. They can now save money, get loans, and insure assets. All without setting foot in a bank. These services run on smart contracts. They’re like digital promises. They auto-execute deals without goof-ups.

Enhancing Transaction Security and Transparency with Decentralized Ledger Technology

Blockchain brings trust to deals. It’s a digital ledger that everyone can check. Imagine a book of records that’s out in the open. This ledger doesn’t let people cheat or hide their steps. Each deal, each move is there clear as day.

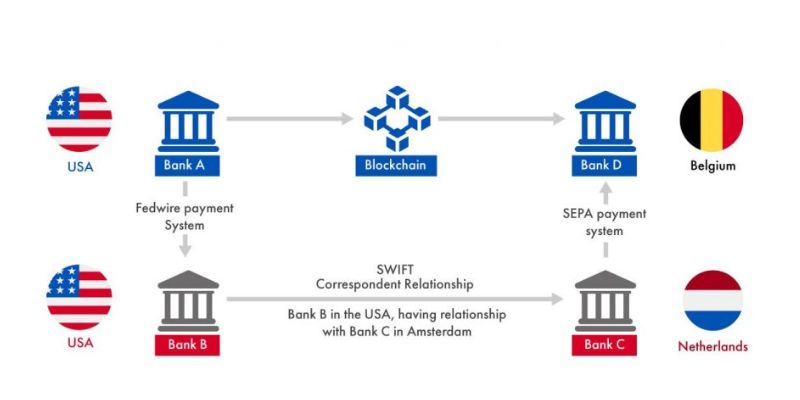

Take sending money across borders. It used to be slow and costly. Now, blockchain quickens things up. It cuts the middleman. This makes it cheaper. You can now send and get money fast. It’s a big win for business and families far apart.

Also, fraud is a big pain in the neck for banks. Here comes blockchain. It’s a trusty tool to fight fraud. Think of it as a lock and key. It locks up data so tight that tricking systems gets way tough. When you combine blockchain with finance, you keep money safe.

In short, DeFi builds a new world of money use. It’s fair, fast, and everyone fits in. It makes our cash matters run smooth and safe. On this blockchain road, we’re heading towards smart money. This is money that can think and act without us poking at it. How cool is that?

Streamlining Trade and Investment through Blockchain Applications

Transforming Trade Finance with Digital Ledger Innovations

Trade finance is all about trust. People must trust that they’ll get their money or goods. But trust can be slow and costly. Enter blockchain in banking. It’s a tech fix for trust.

Banks and companies now use ledger technology finance tools. These help track products from factory to shipping to sale. It’s smart and fast. The records are safe and can’t be changed.

This tech lets us do deals overseas with fewer risks. It calls for less paperwork too. Payment settlement blockchain methods mean you pay or get paid quicker.

Ever wonder how you can keep money safe when you trade? Distributed ledger technology (DLT) has your back. It guards the data like a digital fortress. This means fewer chances for theft or mistakes.

For those working in trade, this means less waiting and less worrying. Big stuff, right?

And KYC? That’s “know your customer”. For banks, it’s tough work. A KYC blockchain solution might be a game-changer. It takes the guessing out of who you’re dealing with.

So that’s the story with trade finance modernization. It’s high-tech, quick, safe, and saves money. Blockchain isn’t just about crypto. It’s about making old banking better.

Democratizing Investments with Blockchain Asset Tokenization

Ever dreamed of owning a piece of a big skyscraper or an artwork? Too expensive? Not anymore! Asset tokenization on blockchain lets everyone invest in big-ticket items.

Here’s how it works. A big asset gets split into digital pieces, or ‘tokens’. You buy as many as you want. It’s like owning a tiny part of that skyscraper. And you can sell your part whenever you want.

This is a huge step for financial inclusion blockchain efforts. People who had no luck getting into investing can start easily. With just a bit of cash, you’re in the game.

Think about it. You’re not just stuck with stocks or bonds. Now, your investment world is huge. Paintings, buildings, even fine wines can be part of your portfolio.

So, what’s the big win here? It’s about making fair chances for everyone. It doesn’t matter if your pockets are deep or not. Blockchain lets you join the investment party.

And when you want to cash out? Real-time transactions blockchain style are quick and simple. No lines, no waiting, no hassle. It’s smart money, really.

In short, blockchain is doing wonders for us all in finance. From trading across the world to owning a share of something grand. It’s clear why people get excited about ledger technology finance. It’s not just talk. It’s real money moves. And that’s something to pay attention to.

Advancements in Compliance and Fraud Prevention Using Blockchain

Embedding KYC Procedures in Blockchain for Robust Due Diligence

Imagine a world where your identity is safe, always. This is what blockchain in banking does. It makes sure who you are stays secret but also known to the right people. This is key for KYC, which stands for “know your customer.” KYC is a big deal in finance. Banks need to know their customers to stop bad things like money laundering.

How does blockchain help here? It helps by making a secure online ID for everyone. This ID is like a lock that only the right key can open. With smart contracts banking gets smarter. Think of them as rules that run on their own when conditions are met. They make sure everything checks out without needing a human to look over.

Why is this good? If your ID is on a blockchain, banks can check it fast and know it’s real. It’s like a stamp of truth on your ID that nobody can mess up. This saves time and money for everyone. Banks can trust who they deal with, and you don’t have to keep proving who you are.

Using Blockchain Audit Trails for Enhanced Financial Security and Compliance

Now let’s talk about keeping track of money. In banking, it’s vital to know where money has been. We call this an audit trail. With blockchain, this trail can’t be changed, which is perfect for security. Every step a dollar takes is written down on the ledger technology finance needs to be bulletproof.

Think of blockchain like a chain of blocks. Each block is a step that money takes. Once a step is in the block, no one can change it. Not even a tiny bit. This helps a lot with being sure that things are right and fair. It helps with rules, like automated compliance blockchain sets.

For example, when stocks are bought or sold, things have to be just right. Securities settlements blockchain makes this happen without mistakes. This means safer deals for all. This trust is what the financial world is all about.

In a nutshell, blockchain’s ledger keeps track of everything in a way that’s clear and true. For banking and finance, this is game-changing. It means less risk of fraud and more faith in the system. It doesn’t just help big banks; it helps you too. It means the money you work hard for is safe and sound. Blockchain is the trusty guard of your hard-earned cash.

In both of these ways, KYC and audit trails, blockchain is like a superhero. It fights fraud and keeps everything in check. All this while getting rid of heaps of paperwork. It’s pretty clear: blockchain is here to make finance better for all of us.

We dove deep into how blockchain is a game-changer for banks. It upgrades how we pay and firms up the banking jobs with smart deals. The tech gives more folks a way to bank and makes moving money safe and see-through with DeFi. Trade gets a speed boost, and anyone can invest with new digital ways. Banks get stronger at checking who you are and stopping tricks with tight security steps. It all means safe, fast, and fair money tasks for you and me. Remember, as banks and tech blend, our pockets feel safer and fuller. Keep an eye out; this blend is just starting to heat up the finance world!

Q&A :

What are the most common blockchain use cases in financial services?

Blockchain technology has revolutionized financial services by providing a decentralized and secure ledger for transactions. Some of the most common use cases include digital payments, through cryptocurrencies, which bypass traditional banking systems for faster and cost-effective transactions. Smart contracts, which execute automatically when conditions are met, provide a secure and transparent way to handle agreements without the need for intermediaries. Blockchain also enables more efficient settlement systems for trades, reducing the time from days to mere minutes and improving the liquidity and efficiency of the financial markets.

How does blockchain enhance security in financial transactions?

Blockchain elevates security in financial transactions by employing cryptographic hashing, which turns any form of data into a unique string of text that is nearly impossible to reverse-engineer. Every block on the chain contains a hash of the previous block, creating an immutable chain of blocks that secures the entire system. Moreover, being a distributed ledger, blockchain ensures that the records are not kept in a single location that can be easily tampered with or hacked. This redundancy across multiple nodes in the network makes it exceptionally resistant to fraudulent activities and cyberattacks.

Can blockchain reduce costs in financial services?

Yes, blockchain can significantly reduce costs in various areas of financial services. By removing the need for middlemen or intermediaries in transactions such as payments or securities trading, blockchain cuts down on fees and commissions. It also simplifies and streamlines back-office operations, like clearing and settlement, by reducing the number of staff and systems needed to reconcile and verify transactions. Blockchain’s ability to automate processes, like compliance using smart contracts, further lowers expenses associated with manual labor, auditing, and reporting.

What impact could blockchain have on cross-border payments?

Blockchain could dramatically transform cross-border payments by making them quicker, more cost-effective, and transparent. Traditional international payments involve multiple intermediaries, currency exchanges, and can take several days to process. With blockchain, the transaction can be verified in real-time without the need for intermediaries, reducing processing time to seconds or minutes. It also reduces the costs associated with exchange rate fees and processing charges, while providing a clear, auditable trail of the transaction, thus enhancing transparency and trust between parties.

How is blockchain being used to prevent financial fraud?

Blockchain’s natural design inherently discourages fraud. Each transaction on the blockchain is recorded on a block with a unique cryptographic signature, making it immutable once formed. This means that altering any information on the blockchain would require an enormous amount of computing power to override the entire network, which is virtually impossible to coordinate. Additionally, the transparency of the distributed ledger means all transactions are visible to network participants, making illicit activities easier to spot and harder to hide. Regulators and participants can trace actions back to their source, enabling a more secure and trustworthy financial system.

RELATED POSTS

What are ledgers legit emails?

What are Ledgers legit emails?...

Blackwing Airdrop – HOT Opportunity to Receive Tokens from BXP

In the fast-moving cryptocurrency space,...

Toggle Airdrop and Tips for Earning Passive Income

Toggle Airdrop is a great...

Optimistic Airdrop – Detailed Guide on How to Acquire OP Tokens

This guide provides detailed steps...

Toby Airdrop: A complete guide to participation from A to Z

Participate in the Toby Airdrop...

Future Applications of Blockchain Technology: Beyond Bitcoin to Bold Innovations

Future applications of blockchain technology:...

MiCA: A new regulation or a restraint on Crypto?

Starting from December 30, the...

Bitlayer Airdrop and the opportunity to earn token exchange points

The Bitlayer Airdrop is not...

Purple Bitcoin: A new currency in the digital world

Purple Bitcoin is a unique...

Blockchain Decoded: How Does Blockchain Work For Beginners

How does blockchain work for...

Zotto Airdrop – Accelerating Meme Coin Trading

The Zotto Airdrop is attracting...

Recent Advances in Blockchain Research in Financial Services

Recent advances in blockchain research...

Blockchain Technology News Update – HOT Trends for 2025

Blockchain technology news is abuzz...

BulbaSwap Airdrop: A unique investment opportunity in DeFi

BulbaSwap, a decentralized exchange (DEX)...

Exploring the Bitcoin Halving Cycle – Future and Price Predictions

Exploring the Bitcoin Halving Cycle...

Physical Bitcoin: The truth about the top digital currency

Have you ever heard of...