Step into the world of Crypto Prediction Markets, where your insights can translate into profits! Bet on global events and leverage collective intelligence, all secured by blockchain technology. Join a vibrant community of traders and turn your predictions into potential fortune. Are you ready to make your mark?

What Are Prediction Markets?

Crypto prediction markets are innovative platforms where users can bet on the outcome of future events using cryptocurrencies. These markets leverage collective intelligence to forecast events, making them a unique blend of finance and information exchange. Here’s a closer look at the fundamentals:

Prediction markets allow participants to buy and sell shares in the outcome of specific events, such as elections, sports, or economic indicators. The price of these shares reflects the probability of a particular outcome occurring, providing insights into public sentiment and expectations.

How do crypto prediction markets work?

Users can place bets on various outcomes, and the market operates similarly to a stock exchange. If an event concludes in favor of a user’s bet, they earn profits based on the share price. Conversely, if the outcome doesn’t align with their prediction, they incur losses. The market adjusts prices based on new information, continuously refining the probabilities.

Use of Blockchain Technology

Many crypto prediction markets utilize blockchain technology to ensure transparency and security. Smart contracts automate transactions and enforce rules, reducing the need for intermediaries. This decentralization enhances trust among participants and minimizes the risk of manipulation.

The Dynamics of Market Participation and Liquidity Management

Analyzing Participant Behavior in Forecast Markets

In forecast markets, people bet on what they think will happen. They use money or crypto to show their guess. They pick things like sports, elections, or prices of coins. Smart people study how these bettors act. They learn about who wins more and why. This helps them bet better themselves.

Some bet on sure things. Others take big risks for big rewards. We see patterns. Many follow news or big world events. They use this info to make choices. When lots of people bet the same way, it changes the odds. This can make betting more exciting but also harder.

In crypto prediction platforms, they use blockchain to keep track. This is like a notebook that can’t be erased. They write down every bet. Then no one can cheat. And when you win, you get paid quick. No waiting around.

Strategies for Ensuring Robust Liquidity in Crypto Predictions

For a prediction market to work well, it needs money. This is liquidity. Imagine it like a machine that needs oil. Without it, things get stuck. Prediction markets need people betting to keep them going. More bets mean more money. And more money means better betting for everyone.

Good markets make it easy to bet and pay out fast. Simple rules and smart contracts help. Smart contracts are like robot deals. They follow rules with no one telling them what to do. This makes things fair.

People who run these markets mix big and small bets. They do this so there’s always money to win. No one likes a market where you can’t get your winnings. It’s like a store without stuff to buy. Not good.

Some markets let you use your coins as part of the betting pool. You can earn money just because people are betting. But remember, betting can be risky. You could lose what you bet.

Now, think about a big market event. Lots of people come in. They all have ideas and bets. This pushes the market up or down. Smart folks watch and learn from this. They might even make money by guessing correctly.

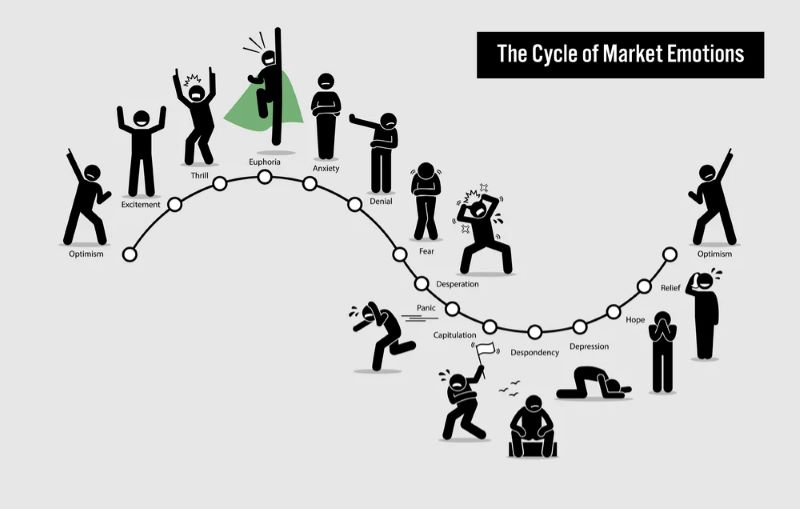

For experts, there’s more math. They use market sentiment analysis. This is a fancy way of guessing how people feel. If people are scared, they might bet one way. If they’re hopeful, they bet another. Understanding this can help you make smarter bets.

To end, remember: good markets need good people who understand. They bet wisely and follow the rules. This makes everything work better. And when things work better, we all have a chance to win.

Enhancing Prediction Accuracy and Regulatory Compliance

Designing Algorithms for Better Digital Asset Forecasting

In digital asset forecasting, algorithms play a huge role. We build them to “guess” outcomes in crypto prediction platforms. They look at past price movements and other data. This helps guess where prices might go. It’s like weather forecasting but with digital coins. To improve guess quality, we constantly tweak these algorithms.

Making them better involves a lot of tests and learning. It’s like teaching a kid to ride a bike. At first, they fall lots. But with practice, they get it right. Our goal is to have algorithms that “ride” the market well. They must handle crypto’s wild ups and downs. Smart and quick, they help users make choices in betting on crypto outcomes.

For example, Ethereum prediction contracts use these smart tools. They lock in bets on future events on the blockchain. Say you think a coin’s price will go up. You can put money on it with a smart contract. If you’re right, you win more coins!

Accurate crypto prediction accuracy means users trust us more. They know we work hard to guess right and win them coins. It’s thrilling and fun, and that’s what brings them back.

Navigating Legal Challenges in Blockchain-Based Betting

Now, let’s chat about laws because they’re huge in crypto. Betting with crypto is new and laws can be unclear. It’s like playing a board game without rules. Taking part in forecast markets cryptocurrency betting means knowing these rules well. We study lots and keep up with new laws.

It’s key to play safe and fair. We don’t want users getting in trouble. Understanding crypto betting is important for this. We help them know what’s cool and what’s not. We explain the rules in simple words. Like “don’t bet what you can’t lose” and “know your local laws.”

Decentralized prediction markets let people bet on all sorts of things. Not just coin prices but also stuff like sports or election results. This mix makes it even more important to know the rules.

In spots where it’s A-OK to bet, we work to keep it that way. We check all bets and make sure they’re fair. We use clever ways to prove that no one’s cheating. This helps us stay in the clear with the law folks.

To sum it up, my job’s to help folks bet smart and stay safe. We make tools to guess prices better and teach users the game’s rules. It’s a blast to see them win and come back for more.

Decentralized Governance and Advanced Market Insights

Integrating DAOs for Improved Prediction Market Oversight

Did you know DAOs can make crypto betting more fair? They make rules and vote on key decisions, which works well for managing decentralized prediction markets. Imagine a group of people, all over the world, working together without a boss. They use smart contracts on Ethereum to put power in everyone’s hands. This not only keeps the prediction markets honest but also follows the community’s ideas.

DAOs, or Decentralized Autonomous Organizations, are like teams that run without a single leader. They use smart contracts, which are bits of code that run on blockchains like Ethereum. DAOs let every member vote and help make choices for the platform, like Augur or Gnosis. This way, everyone who bets on crypto outcomes has a say in the rules.

It’s exciting because it’s not just about betting on if a coin will go up or down. You can bet on anything from sports to politics! And when you stake in crypto predictions, you become part of the action. Plus, you help decide how these markets work. That’s powerful, right? With DAOs, the aim is to keep everyone honest and the market fair.

Utilizing Market Sentiment Analysis to Inform Crypto Wagering

Ever think you can guess what people feel about crypto? That’s what market sentiment analysis does. It tries to figure out if folks are happy or worried about the crypto world. And this helps a lot with crypto prediction accuracy. Platforms like Polymarket use this tool to give bettors a hint of where things are heading.

Market sentiment analysis looks at what people say online. It checks news, blogs, social media, and more to find the mood. This isn’t just guessing; it’s smart analysis using algorithms. These algorithms spot trends and help predict where the crypto prices might go. Have you heard of the fear and greed index? It’s one example of trying to measure how folks feel about the market.

Why does this scene matter? When you get it right, you can win big with smart contract gambling. Betting on crypto outcomes isn’t just about luck. If you know the mood, you can make smarter bets. And you can earn more if you’re good at reading the signs. This method is not perfect, but it is another tool to help you in crypto event wagering.

In crypto prediction platforms, your aim is to outsmart the market. And with the help of DAOs and sentiment analysis, it’s like having a map and a compass for this wild crypto ride. This technology gives you more than just a chance to bet; it gives you a way to join a group of like-minded people. Together, you bring each other’s insights to the table and make better, informed decisions, all while being part of the thrilling and unpredictable world of crypto betting. This is not just about making a quick buck; it’s about being part of the future.

In this post, we dove into the world of crypto prediction markets. We started by explaining how they work and the smart tech behind them. Then, we looked at how people act in these markets and ways to keep money flow strong. Next up, we tackled getting predictions right and playing by the rules. And finally, we explored how shared control can make things better and how people’s feelings can guide crypto bets.

I believe these markets are not just a game of chance but a blend of tech, smarts, and knowing the rules. They’re changing how we see the future of money and betting. Play it smart, stay informed, and always think ahead!

Connect with us at Blockchain Global Network for the latest insights, innovative strategies, and updates. Join our community and empower your trading journey today!

RELATED POSTS

Blockchain Revolution: How will blockchain disrupt different industries?

How will blockchain disrupt different...

PAWS Airdrop – Earn tokens easily through Telegram

PAWS Airdrop opens up an...

Infrared Finance: Leading PoL Staking on Berachain

Infrared Finance has emerged as...

Real-world Applications Of Blockchain Technology: Beyond Bitcoin’s Buzz

Revolutionizing finance, trade, and security....

Blockchain Simplified: Unlocking the Secrets Behind Digital Ledgers

"Demystifying Blockchain: An Introductory Guide...

History of Blockchain: The Revolutionary Timeline That Changed Tech Forever

"Explore the Genesis of Blockchain,...

Exploring DLT in Blockchain: Navigating the Tech of Tomorrow

Understanding the Fundamentals of DLT...

Crypto Crashing and 3 important investment implications

Crypto Crashing has shaken the...

What is Distributed Ledger Technology in Blockchain?

Discover the fundamentals of distributed...

What are distributed systems? Bridging the Gap Between Efficiency and Complexity

In today’s digital age, the...

Cryptocurrency Unveiled: Unlocking the Mysteries Beyond Blockchain

How is cryptocurrency different from...

Blockchain Crypto Technology – Transforming Traditional Finance with Decentralization

Curious about how Blockchain Crypto...

Explanation of Proof of Work: How PoW Secures Blockchain Innovation

Explanation of Proof of Work...

The Unique Characteristics of Blockchain Technology – A Guide to Its Power and Potential

The unique characteristics of blockchain...

How Companies Using Blockchain Technology Are Revolutionizing Operations

Curious about how “Companies Using...

Casper Crypto: Exploring and evaluating growth potential

As the cryptocurrency market continues...