Custodial vs Non-Custodial Wallets: It’s the clash of the titans in the world of cryptocurrency storage, a crucial decision that can either secure your digital fortune or leave you at a hacker’s mercy. As you dive headfirst into this digital age dilemma, knowing the ropes can mean the difference between a sleep-easy night and a nail-biting nightmare. Are you the master of your crypto keys, or do you hand them off to a third party for safekeeping? Let’s rip apart the complexities and give it to you straight: your hard-earned assets deserve iron-clad security, and I’m here to guide you through the labyrinth of wallet options. Choose incorrectly and you risk losing more than just sleep. Strap in and let’s decode which wallet will keep your crypto safest.

Understanding Custodial and Non-Custodial Wallets: Defining the Basics

Custody of Crypto Assets: The Fundamental Difference

Do you know who holds your crypto keys? In custodial wallets, a third party does. They keep your crypto safe. This means they manage the keys to your digital cash. Think of banks, but for cryptocurrency. These providers help you buy, sell, or hold your coins.

Types of Digital Wallets: A Broad Overview

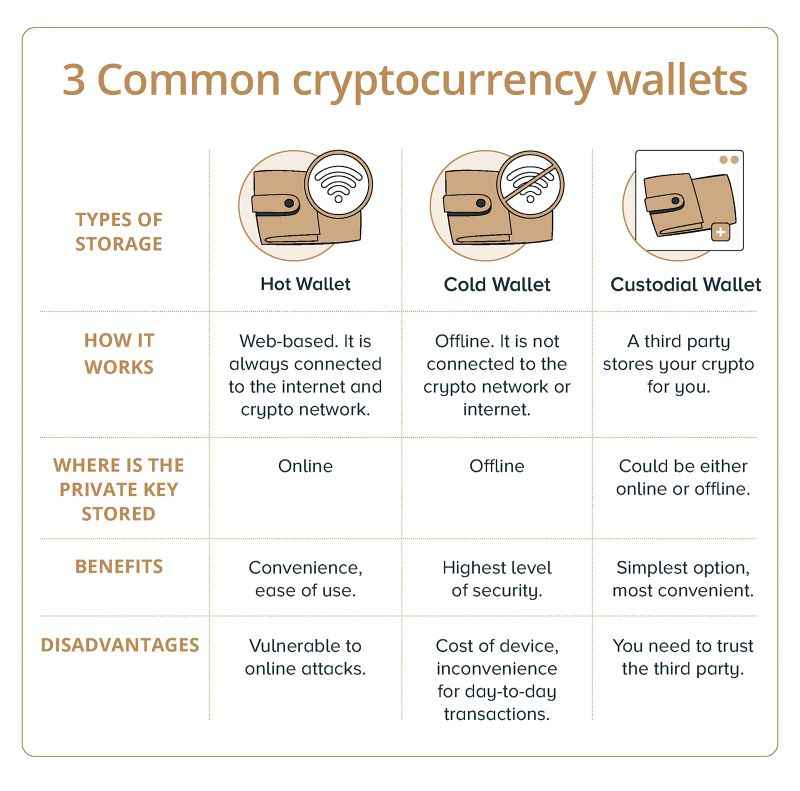

There are many wallet types out there. A big split is between online or offline storage. Hot wallets are online and easy to use. Cold wallets are offline and very safe. Control over private keys is another divide. In a non-custodial wallet, you hold your keys yourself. You have full charge of your crypto money. But with this control comes the duty to protect your assets.

Non-custodial wallets offer freedom. No one can touch your coins unless you let them. But, lose your key and your coins can’t come back. These wallets give you power over your own money. They don’t rely on others, like banks or crypto exchanges.

Using a non-custodial wallet, you create your own security. You keep track of your seed phrase. This phrase is a backup key. It’s a list of words that can help regain access to your money if you lose your main key. This is vital for keeping your crypto safe.

Encryption is another layer of safety for digital wallets. It changes info so only those with the right key can read it. Think of it like a secret code for your crypto. It helps keep out unwanted guests. Wallets also offer different features to help you get back into your account. It’s like having backup plans for your digital funds.

For those who like to trade through exchanges, custodial wallets come in handy. They make buying and selling simple. They also have their own security systems. But there is a risk. If the third-party service is attacked, your crypto might be at risk. That’s why the trust level in crypto storage varies.

You need to think about what fits your crypto needs. Do you trade a lot and need quick access? If yes, custodial wallets could be for you. They offer a user-friendly crypto storage option. Choosing the right crypto wallet should match your crypto habits. It’s a balance between comfort and security.

Look at the blockchain wallet comparison to choose. Consider wallet recovery options and the importance of the seed phrase too. Keep in mind that high convenience sometimes means lower security. It’s a trade-off you need to think about carefully.

In asset management in crypto, you are the boss. You decide where and how to keep your digital cash. Hot or cold, custodial or non-custodial, the choice shapes how you access digital currencies. It’s vital to think about these things to keep your crypto coins secure. It’s your money, your decision. Make sure the decision counts.

Examining Security Measures: How Wallets Protect Your Cryptocurrency

Wallet Security Cryptocurrency Features: Encryption and Recovery

Wallet security is like a safe for your digital money. It uses smart code to lock it away. The code turns your data into secret code battles. This stops thieves in their tracks. What if you lose access? The wallet must have a backup plan. This is where recovery steps come in. It uses special words, called a “seed phrase”. You must keep this safe. It’s the key to get back in.

Wallets take different paths to keep your crypto safe. It’s about finding the right balance for you. Let’s dive into your options, starting with the private keys.

Control Over Private Keys: The Security Implications

“Private keys” may sound fancy. They’re actually your pass to get in and move your crypto. When you have your keys, no one else should come near them. This is top-secret stuff.

Think of these keys as the key to your house. If someone else has them, they might get in. In the crypto world, this can mean big trouble.

Hosted wallets keep your keys for you. It’s like a hotel holding them. But remember, hotels have many keys. If someone tricks the hotel, they might get yours.

Self-hosted digital wallets let you keep the keys. No one else has a copy. You are the boss. This means work, though. You must keep them hidden and safe.

Blockchain wallet comparison gets tricky here. Each wallet has its own safety dance. Some do the tango with extra steps, like multi-signature wallets. These need more than one key to open.

Encryption in wallets scrambles your data. It’s a barricade against hackers. Wallet recovery options are your safety net. If you mess up, these can save the day.

Let’s boot up some real talk. Can other people make choices for you? Can they hold onto your savings? For some, this is okay in banks. But in crypto? This can be risky. It’s all about trust. How much do you give to someone else? With cryptocurrencies, you call the shots. You choose how tight to lock down your digital gold.

We’ve got two main paths. The main road – where someone else drives. This is the custodial route. Then there’s the wild path. You drive with no map, but total freedom. That’s the non-custodial way.

Our finish line here is understanding. Know how wallets work. Know what risks you face, and how to dodge them. Guarding your crypto starts with knowing what’s up. I’m here to light that path for you.

Navigating the Risks and Benefits of Wallet Types

Advantages and Risks of Non-Custodial Wallets: Autonomy vs. Responsibility

You want full control over your crypto? Non-custodial wallets make that happen. Total control over private keys? Yes, that’s on you. No middle man. Just you and your crypto, holding hands in the digital world. It feels great, but it’s not all fun and games.

Now, let’s talk shop. With great power comes… you guessed it, big responsibility. Lose your key? Wave goodbye to your assets. No bank or service can swoop in to save the day. Keep in mind, security is your job now. It’s not just about owning a safe. You need to know how to lock it tight.

Yet, non-custodial wallets reign in one area: they’re user-friendly and ideal for those who want to learn. They give you a front-row seat to blockchain’s world. Like driving stick, it’s intimidating at first, but with practice, you’re owning the road. These wallets also cut out the middle man. That means fewer fees and direct transactions.

Benefits and Potential Dangers of Custodial Wallets: Convenience vs. Trust

Prefer leaving the complex stuff to someone else? That’s where custodial wallets come in. Ever used an online wallet service? That’s custodial. Here, a third party holds onto your assets. Handy, right? Especially for quick trades on cryptocurrency exchanges.

Convenience in crypto transactions is key with custodial wallets. It’s like having a banker in your pocket. But here’s the kicker, they have your keys. You’re putting your trust in them to handle your digital coins safe and sound. The risk? If they get hacked, there’s a chance your crypto says bye-bye.

With custodial wallets, it’s also tougher to move your money where you want. You might bump into centralized services for crypto calling the shots. Need to jump through hoops for access to your funds? Yep, that can happen.

So, what’s the smart play? Know what you’re getting into. Do you value autonomy and are up for the task of private key responsibility? Then non-custodial could be your jam. Or is convenience more your speed, despite the risk of third-party mishaps? Then custodial might be your match.

Dig deep into what you need in crypto asset management. Consider how much trust you can invest in services where you bank your digital dollars. In the world of crypto, whether you prefer steering your ship or cruising with a captain, it boils down to how you want to sail the seas of digital currency. Choose wisely, and always stay informed.

Choosing the Right Crypto Wallet for You

Aligning Wallet Choice with Personal Needs: Access and Management

Picking a wallet for your crypto? It’s big! Think about how you’ll use it. For quick buys and sells, or being your own bank? I’ll break it down for you.

“Which type of digital wallet offers the most control over private keys?” Self-hosted digital wallets give you full control. You manage your private keys, like a safe deposit box only you open. Hosted wallets? Think of them as a bank. They keep the keys, you trust them to guard your crypto.

Having control sounds great but it’s not simple. If you lose your private key, no backup. You lose access to your money. So with power over your keys comes a big duty to keep them safe.

Trust Level in Crypto Storage: Balancing Control and Accessibility

How much do you trust yourself versus a service? That’s what it comes down to. Using a third-party wallet service means trust is a must. They’ve got your keys. But, hey, you get convenience. You can get to your money easily, online, anytime.

Self-hosted wallets? They’re about taking charge. If you forget your password or lose your seed phrase, that’s on you. Tough, right? But it also means nobody can touch your crypto unless you say so.

Remember, trust level matters. And with crypto, you’ve got to balance control and how easy it is to get to your cash. It’s a choice: convenience with a bit of risk, or full control with big responsibility.

Picking what works for you is about knowing the risks and perks. It’s not just picking a wallet; it’s choosing how you manage your digital dollars.

In this post, we’ve walked through the world of crypto wallets. We looked at custodial and non-custodial options. You learned that who controls your crypto assets is the main difference. We saw the many types of wallets available and how they keep your crypto safe through things like encryption and key management.

Security is vital. Your choice in wallet type decides how much control you have and the security risks you face. Do you want total control with non-custodial wallets? Or do you prefer the convenience of custodial ones, while trusting others with your assets?

Think about what matters to you. Want easy access or to be fully in charge? Your trust level in crypto storage will guide you. Choosing the right wallet balances control and easy use. Remember, in crypto, your wallet choice can shape your experience. Keep your needs and security in mind when picking one!

Q&A :

What is the difference between custodial and non-custodial wallets?

Custodial wallets are managed by a third party, such as a cryptocurrency exchange or a wallet service. This means that the private keys to your funds are held and controlled by the service provider, and they take care of the security and maintenance for you. On the other hand, non-custodial wallets are ones where you have complete control over your keys and therefore your assets. In non-custodial wallets, the responsibility for safeguarding the wallet’s private key lies solely with you.

Are non-custodial wallets safer than custodial wallets?

Both wallet types have their advantages and risks. Non-custodial wallets give you full control over your funds and reduce the risk of losing your assets due to the service provider’s failure. However, if you lose your private key or backup phrase, there is usually no way to recover your funds. Custodial wallets, while convenient, can be seen as less safe because the service provider can be a target for hackers and you rely on their security measures to keep your assets safe.

How do I access my funds in a non-custodial wallet?

To access funds in a non-custodial wallet, you will need the private key or a mnemonic phrase (commonly known as a seed phrase) that was generated when the wallet was first created. It’s imperative to keep this information secure and private, as anyone with access to it can control your assets. Typically, you’d use a wallet application or interface that will ask for this information or for a password you’ve set up to decrypt the private key.

What happens if the custodial wallet provider goes out of business?

If your custodial wallet provider goes out of business, there is a risk that you could lose access to your cryptocurrency. However, reputable providers generally have contingency plans in place for users to recover their funds in such events. It’s crucial to read the provider’s terms of service and ensure you understand their protocols for these scenarios.

Can I switch from a custodial to a non-custodial wallet?

Yes, you can switch from a custodial to a non-custodial wallet. To transfer your funds, you would send the cryptocurrency from your account with the custodial service to the public address of your non-custodial wallet. It’s important to perform such transfers carefully and double-check addresses, as transactions on blockchain networks are irreversible.

RELATED POSTS

Ethereum ETFs have been approved by the SEC

The recent announcement that ethereum...

What is the Swell Airdrop? Detailed guide to participation

The Swell Airdrop is an...

Different Types of Crypto Wallets: Secure Your Digital Fortunes

Delve into different types of...

What is the current market price of Bitcoin? Insights into today’s fluctuating values

What is the current market...

Nick Neuman Crypto: A pioneer in Cryptocurrency security

Join me as we explore...

The Benefits of Blockchain for Consumers: Transforming online shopping experiences

Revolutionize retail and e-commerce with...

Bitcoin Golden Cross – Strategic Investment Solution

The Bitcoin Golden Cross is not...

Peer-to-Peer Learning Unlocked: Harnessing Blockchain for Collaborative Education

Blockchain's role in peer-to-peer learning:...

Can you short on Coinbase Pro?

Can you short on Coinbase...

Future Trends in Blockchain Security: Staying Ahead of Threats

Future trends in blockchain security:...

What is a decentralized exchange?

What is a decentralized exchange?...

Comparison Of Consensus Mechanisms In Blockchain: Gatekeepers Unveiled

Discover the differences between PoW,...

Interledger Protocol Unveiled: The Future of Seamless Payments?

What is Interledger Protocol? Unraveling...

Top 3 Secrets behind Bitcoin Peak that you must know

The rise and fall of...

What makes the Hash Rate higher?

Hash rate is a critical...

Security Testing Providers for Blockchains: Who’s Guarding Your Digital Gold?

The Critical Role of Blockchain...