Fundamental vs technical analysis plays a crucial role in cryptocurrency investment strategies. While fundamental analysis focuses on evaluating the underlying value of a cryptocurrency by examining factors such as technology, team, and market demand, technical analysis delves into price charts and trading volume to identify patterns and trends. Understanding the strengths and weaknesses of both approaches can empower investors to make more informed decisions in the ever-evolving crypto landscape.

What is Fundamental Analysis?

Fundamental analysis in cryptocurrency investment is the method of assessing the true value of a cryptocurrency by examining the fundamental factors related to it. The goal of fundamental analysis is to determine the long-term growth potential and intrinsic value of the coin. Below are some key aspects of fundamental analysis in cryptocurrency investment:

Technology

- Platform and Protocol: Consider the technology that the cryptocurrency uses, such as blockchain, smart contracts, scalability, and transaction speed.

- Innovation and Features: Evaluate the unique features and innovations that the coin offers compared to other cryptocurrencies.

Development Team

- Experience and Expertise: Examine the founding and development team, including their experience in IT, blockchain, and finance.

- Motivation and Goals: Assess the goals and motivations of the team, as well as their ability to execute the project.

Market and Competition

- Demand and Supply: Analyze the demand for the cryptocurrency in the market, along with the circulating supply.

- Competitors: Research competitors within the same field and how this coin positions itself against them.

Economic and Political Situation

- Regulations: Monitor government policies and regulations regarding cryptocurrencies, as these can impact its development and value.

- Economic Conditions: Analyze global economic conditions and how they may affect the cryptocurrency market.

Community and Support

- User Community: Evaluate the support and engagement from the user community, including forums, social media, and research groups.

- Partnerships and Collaborations: Track strategic partnerships that the project has with large organizations or companies, as this can enhance its value.

Understanding fundamental vs technical analysis is crucial for investors in making informed decisions about cryptocurrencies. By focusing on these fundamental aspects, investors can better assess a cryptocurrency’s potential for long-term growth and intrinsic value.

What is Technical Analysis?

Technical analysis in cryptocurrency investment is the method of evaluating and predicting the value of a cryptocurrency based on historical data regarding prices and trading volumes. The goal of technical analysis is to identify market trends and make informed trading decisions using various tools and indicators.

Price Charts

- Chart Types: Utilize different types of charts, such as line charts, bar charts, or candlestick charts, to track price movements over time.

- Chart Patterns: Identify chart patterns such as head and shoulders, flags, and triangles to predict future trends.

Technical Indicators

- Trend Indicators: Use indicators like Moving Averages (MA) to determine the current price trend.

- Momentum Indicators: Employ indicators such as the Relative Strength Index (RSI) and MACD (Moving Average Convergence Divergence) to assess the momentum of price movements.

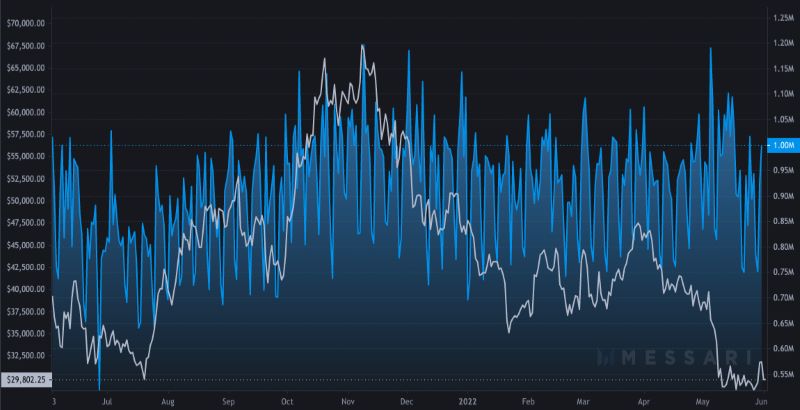

Trading Volume

- Volume Analysis: Monitor trading volume to gauge the strength or weakness of price trends. A strong upward trend typically accompanies high trading volume.

- Price Correlation: Compare changes in volume with changes in price to identify potential entry and exit points.

Support and Resistance

- Support Levels: Identify price levels where buying demand tends to increase, helping to prevent the price from falling further.

- Resistance Levels: Determine price levels where selling demand tends to increase, putting downward pressure on prices.

Market Trends

- Identifying Trends: Analyze short-term, medium-term, and long-term trends to make appropriate trading decisions.

- Timing Trades: Use technical analysis to identify the best times to enter or exit the market.

In summary, understanding fundamental vs technical analysis is essential for cryptocurrency investors. While fundamental analysis focuses on intrinsic value, technical analysis provides tools for predicting market behavior and making informed trading decisions based on historical data. By integrating both approaches, investors can enhance their overall strategy in the cryptocurrency market.

Comparison Table Between Fundamental vs Technical Analysis in Cryptocurrency Investment

| Criteria | Fundamental Analysis | Technical Analysis |

| Purpose | Assess the intrinsic value of an asset based on fundamental factors. | Predict future prices based on historical data of prices and volumes. |

| Data Used | Financial information, news, projects, development team, and industry trends. | Price charts, trading volumes, technical indicators, and price patterns. |

| Time Impact | Typically focuses on long-term and significant changes in the market or project. | Suitable for short-term or medium-term decisions that can change quickly. |

| Analysis Method | Focuses on factors such as revenue growth, profits, technology, and competitive position. | Uses tools like moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) to analyze charts. |

| Nature of Data | Data quality is often prioritized and may include external factors such as laws and regulations. | Focuses on numerical data and charts, potentially overlooking external factors. |

| Application | Helps investors understand the true value of an asset for long-term investment decisions. | Useful for identifying entry and exit points, suitable for short-term trading. |

| Required Skills | Skills in financial analysis, market research, and industry knowledge. | Skills in reading charts, understanding technical indicators, and price patterns. |

| Market Sentiment Changes | May react slower to rapid changes in market sentiment. | Changes quickly according to market psychology and news, potentially creating trading opportunities. |

Both methods of analysis play crucial roles in cryptocurrency investment. Fundamental vs technical analysis allows investors to understand the intrinsic value of an asset while helping them identify trading opportunities and market trends. Depending on investment goals, investors may choose to use one method or combine both to make more accurate decisions.

The comparison of Fundamental vs technical analysis reveals that both approaches offer unique insights into cryptocurrency investment. While fundamental analysis focuses on intrinsic value and market trends, technical analysis emphasizes price movements and patterns. Investors can benefit from understanding both methods to make informed decisions in the dynamic crypto market. As highlighted by Blockchain Global Network, leveraging these analytical strategies can enhance investment outcomes and mitigate risks.

RELATED POSTS

HOT!!! Notcoin Accuses Bidget of Lying!

Notcoin Accuses Bidget of Lying!!!...

What is a decentralized exchange?

What is a decentralized exchange?...

Your essential guide to the blockchain expo schedule 2025

Planning your professional calendar for...

Trump Token and Justin Sun’s Role: Unraveling the Controversy

The Trump Token, tied to...

Purple Bitcoin: A new currency in the digital world

Purple Bitcoin is a unique...

GRVT Airdrop – The 2 Most Important Expectations

The GRVT Airdrop offers a...

BoxBet Airdrop – Your Ultimate Guide to Earning BXBT Tokens

The BoxBet Airdrop is making...

Acki Nacki Airdrop: A detailed guide on how to participate

In the rapidly evolving world...

What is Notcoin? Explore 3 hidden secrets of Notcoin

“What is notcoin” is a...

U2U BingX Listing: Significance and potential in the Blockchain market

On December 10, 2024, the...

Starknet: A Layer-2 scaling solution for Ethereum

Starknet is rapidly gaining traction...

Dawn Airdrop – Unique Reward Mechanism and How to Participate

Dawn Airdrop stands out with...

Passive Earnings with UPhone by U2U Network

UPhone by U2U Network is...

Distributed Ledger Technology vs Blockchain – A Comparative Analysis

Have you ever wondered about...

When was Blockchain Technology invented? A journey through its origins

Ever wondered, “When was blockchain...

Arch Network Airdrop: Detailed guide on how to participate

Arch Network is an innovative...