The digital gold rush is on, but so are the bandits. Your virtual wallets, echoes of the Wild West, face threats. Government regulation after blockchain hacks is not just big talk; it’s your safe haven. As an expert, I’ll guide you through these uncharted waters, breaking down how new rules shape your digital future. We’ll look at the steps taken to protect you after major heists. Staying safe in a land of codes and keys means knowing the law’s role. Let’s unlock this together.

Understanding Blockchain Regulation in the Wake of Security Breaches

The Evolution of Government Regulation Post-Blockchain Hacks

After a major hack, the first thing authorities do is assess the damage. This helps them make new rules to stop future attacks. The shift in government regulation blockchain security after such events is like learning to build a stronger house after a storm. Before, rules were loose, now, they are much tighter. Kids, imagine if someone found a way to break into your clubhouse – you’d come up with new rules to keep out the bad guys, right? That’s what financial regulators are doing for our digital clubhouses – crypto platforms.

Key Blockchain Cybersecurity Laws Implemented After Major Incidents

When hackers hit, new laws pop up to protect our digital money. These laws focus on making sure companies follow strong security routines, just like how you must lock your doors at night. Blockchain cybersecurity laws also make companies tell the truth if a hack happens. This way, everyone knows what’s going on. Think of it like needing to tell your teacher if someone broke a rule in class. By making these things law, we trust our money is safe, just like we trust our teachers to keep us safe in school.

Governments now keep a closer eye on digital money movements. After a hack, they check more carefully who is sending money to whom. This is kind of like when your mom asks who gave you the cookie. It’s all about being safe. They also set up a fintech regulatory sandbox after hacks. This sandbox lets companies test their ideas safely before playing with real money. It’s very much like trying out your toy boat in a bucket before taking it to the lake.

When all the grown-ups – government folks, lawyers, and tech experts – talk, they create new rules, or what we call a cryptocurrency regulatory framework. These are the big rules everyone who deals with digital money must follow, kind of like the school rules we all follow for a safe and fun day. This framework is always changing and growing, just like you, so we can learn from the past and get better at stopping the bad guys.

In all, with each cybersecurity hiccup in the blockchain world, we’re building a digital future where our money, just like our personal information, can be kept a lot safer. Remember, every time we learn from a mistake, whether it’s a broken lamp or a hacked crypto wallet, we get one step closer to making sure it doesn’t happen again. Let’s keep those clubhouse rules tight and the bad guys out!

Analyzing the Aftermath of Crypto Hacking Incidents

Impact Assessment and Regulatory Response to Crypto Breaches

After a crypto hack, what comes next? It’s a tough spot for all. Victims lose funds. Trust takes a hit. I know this well; I work to fix it. We ask: “How much harm did the hack cause?” and “How will rules change?” First, we check the size and reach of the hack. I do this by looking at data loss, money stolen, and user impact. Then, it’s about learning and improving. We look at our rules. We find the gaps and fix them.

These fixes might mean new laws or updates to old ones. We watch all crypto platforms to keep your digital dollars safe. We also make sure these platforms tell you fast if a hack happens. This means you stay in the loop. More rules come into play here. Experts like me check these platforms often. We make sure they do what they should.

Expanding the Cryptocurrency Regulatory Framework for Enhanced Security

So, how do we make crypto safer for you? We grow and change the rules as needed. I help build a stronger cage to guard your digital coins. We call this the cryptocurrency regulatory framework. It’s a set of rules that decides how crypto moves and is kept safe. New rules are coming. You’ll notice more checks when you join a crypto service. They’ll ask for more info to know it’s really you. We call this KYC/AML. It stands for “Know Your Customer” and “Anti-Money Laundering.” It’s a big deal and a helpful step to stop bad guys.

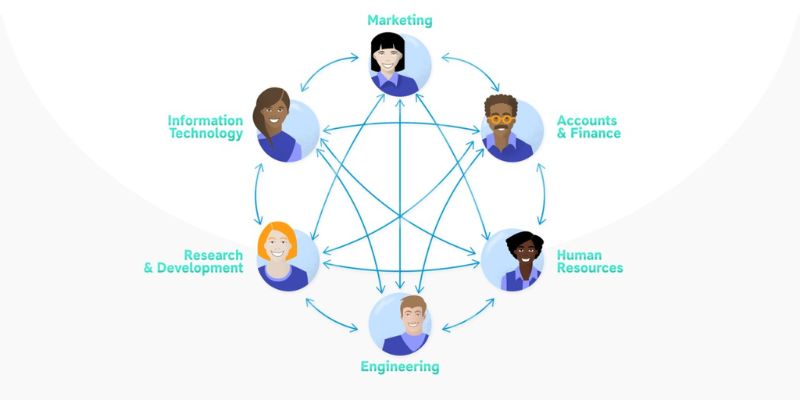

We also work with people who make laws, both in our country and around the world. It’s a team effort to protect your crypto wallet. These folks write new rules to cover future risks. They look at hacks and learn. We talk to each other a lot. We share ideas. We plan. Then we act together.

Folks like me meet with leaders of different lands too. We create a rulebook everyone can use. It saves time and stops hacks from crossing borders. It’s like building a big, strong net that catches more than one nation can alone. This teamwork makes all our crypto safer.

Believe me, keeping your digital future safe is a lot of work. But it’s work that matters. It’s work I love. We’re here to build trust, grow safety, and guide crypto into tomorrow. Together, we can protect and enjoy the promise of a digital world.

Formulating Post-Hack Regulatory Measures for Crypto Platforms

Government Oversight and Legislative Actions Following Digital Currency Hacks

Hacks shake trust in blockchain. How can we bounce back? Strong government rules help. We need clear steps to follow after crypto thefts. This keeps our digital money safe. New laws can make sure that crypto exchanges protect our cash. They must find and fix their weak spots. One key way? They must tell us when a hack happens. Fast. We also need a way to check that they are keeping our data safe. The Financial Crimes Enforcement Network and the SEC offer guides. They make sure that blockchain obeys the law. Bit by bit, hacks can teach us. We learn and then make better rules. This is how we keep your digital future secure.

When bad things happen, like a hack, we look to leaders. We need them to guide us and make new rules. These rules help stop more hacks. Lawmakers see the damage. They make new rules to keep our digital cash safe. The government looks at how exchanges handle our money. If something goes wrong, they step in. They can shut down bad sites or make them pay fines. This tells other exchanges to stay sharp. We all want to avoid trouble. This is how government keeps an eye on crypto.

Strengthening Decentralized Ledger Technology through Fintech Regulatory Sandboxes

New tech is great, but risky. We need safe places to test it. Fintech sandboxes are the answer. Here, companies can try new ideas. They do this under the watch of experts. This way, if something goes wrong, it’s not a disaster. These labs help us find what works and what’s safe. They guide us to use blockchain well.

Smart rules keep us safe. In these labs, we learn. How? We see how new tech hits the real world. We find the good and bad sides. We talk to smart folks in finance. They help us make our tech better. Then, we take these new ideas out of the lab. We use them in our everyday blockchain world. They become part of our system to protect your digital coins.

In sum, after hacks, we need strong steps from government. They watch and make new rules. This helps bring back trust in blockchain. Fintech labs test out new ideas safely. Then we use what works best to keep your wallet safe. We all win when we know our money is secure. This is how we put the pieces back together after hacks. We build a stronger, safer block by block future.

Enhancing Blockchain Security and Compliance via International Cooperation

Integrating International Standards for Blockchain Security into Legal Structures

Secure blockchains keep our money safe. But when hacks occur, people lose trust. It’s my job to help build that trust back. I work with laws from all over the world to make blockchains strong.

New rules must fit with how blockchains work today. We look at the best standards around the globe. Then we suggest how to use them here. This means talking to experts and getting ideas. Together, we create rules that protect everyone.

In these talks, we focus on key topics. We need to stop bad guys from using crypto for crime. We also work to keep your data safe. And we help to tell you fast if a hack happens. This way, you’re not left in the dark.

Rules from the Financial Action Task Force are important. They stop money-laundering and fund terror. We must stick to those rules, even in crypto. The SEC also has guidelines for what counts as a security in crypto. We have to follow these too.

For these reasons, we change laws as new tech comes out. This keeps blockchains ahead of hackers and keeps your money safe.

The Role of Financial Regulators and Intergovernmental Bodies in Reforming Blockchain Policies

States can’t fix crypto problems alone. They need help from other countries and big groups. These groups help make rules that work for everyone. They hold meetings and write reports on how to make blockchains safe.

Organizations like the G20 play a part. They make sure big countries agree on rules for crypto. This helps stop crimes like thieves stealing digital money.

Bodies like the Financial Crimes Enforcement Network (FinCEN) watch over these rules. They see that banks and others follow them. This makes crypto safer for us all. They also help find where stolen money goes.

The SEC plays a big role too. They figure out if a crypto asset is a security. This changes how it can be sold. It helps stop people from losing money in bad deals.

These bodies all work hard. They try to protect your money in the crypto world. The key is putting rules in place before more money gets stolen. They want to act fast but also be fair. They listen to what people need and make rules to help. This should make you feel safer about your money in crypto.

We’ve walked through the twists and turns of blockchain regulation after security fails. Starting with how rules have grown post-hacks, we saw key laws come into play for better cybersecurity. Then, we looked at the ripples crypto hacking made, pushing for rules that keep our digital coins safe. We also dove into fresh moves by the government to watch over and guide crypto after thefts, and how new tech helps make things safer.

Lastly, we joined hands across borders to bring top-notch security to blockchain. From setting up global standards to financial big shots shaping the future of blockchain rules – we covered it all. My final say? Staying sharp and joining forces means our digital money stays in the right hands. Always play it safe and stay informed, folks!

Q&A :

How has government regulation evolved in response to blockchain hacks?

As blockchain technology has expanded, so has the attention of government regulators, especially following significant hacks. In the wake of these security breaches, governments worldwide are examining and amending regulatory frameworks to include stricter controls on cryptocurrency exchanges, enhanced KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance requirements, and more rigorous standards for the security of digital assets. Some jurisdictions have also introduced reporting mandates for blockchain companies to ensure quick action is taken after a hack.

What are the common regulatory measures taken to prevent blockchain hacks?

To counter and prevent blockchain hacks, regulatory bodies have implemented a variety of measures. These typically include the enforcement of enhanced cybersecurity protocols for cryptocurrency exchanges and wallet providers, strict oversight of smart contract deployments, and regular audits of blockchain service providers. Authorities may also require blockchain platforms to maintain a certain level of operational resilience and to have contingency plans in place for responding to cyber incidents.

How do blockchain hacks impact government policy on digital currencies?

Blockchain hacks tend to serve as a wake-up call to governments regarding the risks associated with digital currencies. These incidents usually lead to more focused and accelerated policymaking. The aftermath of a blockchain hack often sees policymakers drafting proposals to tighten regulation, including measures like licensing for crypto businesses, requirements for improved security infrastructure, and guidelines for consumer protection in the digital currency space.

Are there any global standards or cooperation between governments regarding blockchain security?

Yes, there is an emerging trend towards international cooperation and the development of global standards for blockchain security. Organizations such as the Financial Action Task Force (FATF) and the G20 are actively working on harmonizing regulatory approaches to manage the risks associated with digital assets, including those related to cybersecurity. These international frameworks aim to establish a unified response to blockchain security threats, requiring collective action from member countries.

What can blockchain users expect from future government regulations following hacks?

Users should expect future government regulations to place a stronger emphasis on security, transparency, and consumer protection. More robust legal requirements for incident reporting and data protection are likely to be enacted, along with verification procedures to prevent unauthorized access to blockchain networks. Regulations could also mandate the use of best practices for code maintenance and vulnerability assessments to minimize the risk of future hacks. As the landscape evolves, users should stay informed about the changing regulatory requirements that could affect their transactions and holdings in the blockchain space.

RELATED POSTS

What is KYC in Crypto? The Key to safer and transparent trading

What is KYC in Crypto...

Discover the Benefits of Decentralized Learning Platforms with Blockchain

Transform your education with decentralized...

DuckChain Airdrop: Great opportunity to get free Tokens

In the context of rapid...

What is Notcoin? Explore 3 hidden secrets of Notcoin

“What is notcoin” is a...

Pencils Protocol: Optimizing DeFi yields on Scroll

In the vast landscape of...

Casper Crypto: Exploring and evaluating growth potential

As the cryptocurrency market continues...

Money Dogs Airdrop – Dog Racing for Profit, Real Earnings from Cryptocurrency

The Money Dogs Airdrop offers...

On-Chain Data Analysis Instructions: Unlock Crypto Market Secrets Now

Grasp the basics of on-chain...

Keith Grossman: The journey from media to finTech

Discover the life and career...

The Evolution of Cryptocurrency and Blockchain Technology – 7 Things to Look Forward To

Cryptocurrency and Blockchain Technology have...

Differences Between From vs Reply To in Email Ledger

Understanding the difference between From...

Do you know the value of 881 AVA tokens in USD?

“881 AVA Tokens in USD”...

Purple Bitcoin: A new currency in the digital world

Purple Bitcoin is a unique...

Blockchain Smart Contracts: Unveiling 7 Game-Changing Applications

Unlock Efficiency: Explore Smart Contracts'...

Explanation of Proof of Work: How PoW Secures Blockchain Innovation

Explanation of Proof of Work...

What are ledgers legit emails?

What are Ledgers legit emails?...