Impact of regulations on security standards can make or break the shield protecting our personal info. They either lift us to new heights of security or pile on so much weight that we struggle to keep up. Ever wonder if these rules truly help or just add more to your plate? Laws shape the way we guard our precious data in industries like healthcare and finance. Let’s cut through the noise and dig into the real story behind these shifts. Do they set us up for success or just create more hoops to jump through? Today, I’m unpacking the truth about how regulations influence the standards keeping our data away from prying eyes.

The Evolution of Security Standards Under Regulatory Influence

GDPR and HIPAA: Raising the Bar for Data Protection and Healthcare Security

Think of rules as the lines on a soccer field. They define the game. In cybersecurity, regulations are like those lines. They keep players—businesses and people—safe while they “play.” The General Data Protection Regulation (GDPR) did this for Europe. It said, “Here’s how you must guard people’s data.” Suddenly, companies had to be much more careful with personal info.

These rules changed security standards big time. Before GDPR, data protection was looser, like a game with fuzzy lines. Now, these lines are clear. If a business steps over them, they pay big fees. They’re forced to respect our privacy. Rules make sure no one’s data ends up in the wrong hands.

HIPAA does something similar in healthcare in the United States. Medical data is super private. You don’t want just anyone seeing your health history. HIPAA spells out what doctors, hospitals, and even your health app must do to keep your info safe. With HIPAA, patient data gets VIP treatment. It’s locked up tight, with only the right eyes seeing it.

Financial and Telecom Sectors: How PCI DSS and SOX Shape Security Protocols

Now, let’s peek at banks and phone companies. They’ve got their own set of rules. PCI DSS says, “Hey, protect credit card data like it’s treasure!” If stores take card payments, they’ve got to follow PCI DSS or face the heat. It’s all about keeping our card numbers under wraps. We swipe, and PCI DSS shields our numbers from hackers.

SOX, or Sarbanes-Oxley Act, adds more lines for businesses. It’s strict with companies that trade public stocks. They must show they’re honest with money and data. SOX said, “Prove you’re clean, no cheating or hiding stuff.” It helps us trust these companies more.

In telecom, our phone chats and texts need guarding too. The rules here say, “Keep those wires and waves secure!” Companies must ensure our conversations stay private. No eavesdropping allowed.

So, what’s the scoop with all these rules? They make companies step up their game. They must tighten their digital locks and watch more closely. It’s tough but good for us. We get to live, shop, and chat, knowing someone’s working to keep our secrets safe. And that’s the goal, right? A safe digital world where we can all play without fear.

The Interplay Between Government Mandates and Corporate Cybersecurity Strategies

Navigating NIST Guidelines and ISO 27001 in Organizational Policy Adjustments

Think of cybersecurity as a locked door. You wouldn’t leave your door unlocked, right? Bad guys would walk right in. Government rules are like strong locks on that door. They tell companies how to protect their digital houses. NIST and ISO are two big names in security. They set the rules for a safer internet world. Businesses follow these steps to keep info safe from hackers.

What’s NIST? It’s a group that says, “Here’s how you should guard your cyber home.” They give a list, something like a recipe, for strong security. It helps, a lot. NIST says your password shouldn’t be just “password”. It’s like a no-brainer, still, they’ve got to tell people. Then we have ISO 27001. Think of it as a VIP pass. It shows companies take top-notch care of your personal info.

The Role of FISMA and CCPA in Enforcing Stronger Security Measures

Now, what about FISMA and CCPA? More big deals! FISMA is Uncle Sam’s way to say, “Hey, government data needs strong locks!” CCPA is California’s shoutout saying, “Your secrets are safe.” They both make rules so your stuff – like your address or credit card number – stays yours.

FISMA has agencies do check-ups. These check-ups make sure the locks on data are not rusty. If they are, that’s a big no-no. FISMA fixes it. CCPA is more about you, the folks in California. It lets you ask, “Who’s got my info?” or say “Don’t sell my stuff!” It’s kind of like telling a nosy neighbor to back off.

So, when laws change, businesses need to stay sharp. They change their security to match. It’s like updating your locks when you know thieves learned some new tricks. Cybersecurity isn’t just tech stuff. It’s about obeying these laws to stop bad guys from snooping around your digital life. All of this helps us sleep tight at night, knowing our online world is safer.

The Consequences of Compliance: Balancing Security Needs and Business Operations

The Cost of Compliance for SMEs and Supply Chains

Picture a small business or a company that makes parts that go into other products. They have a lot to do every day. Now, add new rules they must follow to keep information safe. It can be a lot. Cybersecurity regulations are like a list of things they must do to protect against hackers and keep customer data safe.

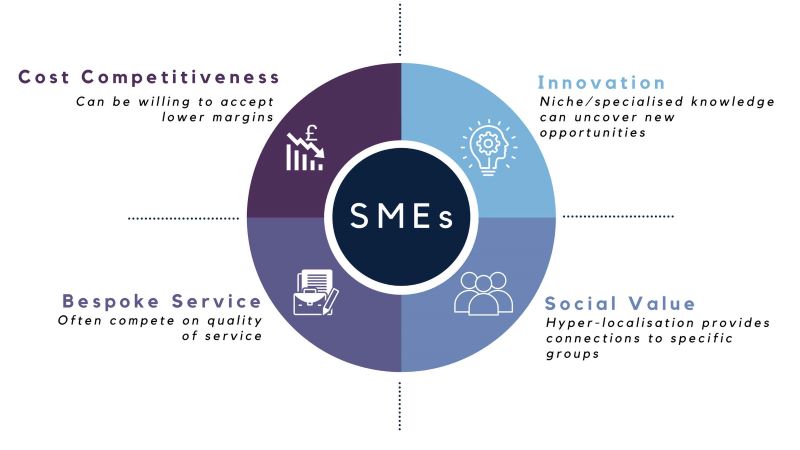

For small and mid-sized businesses (SMEs), following these rules can be hard. They might not have big teams or a lot of money like the huge companies do. GDPR and data protection standards can make them spend more money. They need new tech and people who know about these things. But it’s important because following the rules keeps the business and customers safe.

Supply chains feel this too. If one part of the chain has weak security, it can put everyone at risk. That’s why there’s a push for everyone to follow security standards like ISO 27001. It says what good security looks like. It helps the whole chain stay strong against cyber threats.

Evolving Threat Landscapes and Mandatory Security Control Updates

Hackers and bad guys who want to steal data are always coming up with new tricks. This means that what worked to stop them yesterday might not work today. So the rules must keep changing to stay ahead of the threats. It’s like playing a never-ending game of keep-away with your most prized possessions.

Take HIPAA compliance for healthcare security. It’s a big deal. If hospitals and clinics don’t keep patient info safe, they can get in big trouble. It’s not just about the money. Patient trust is on the line too. Healthcare places have to update their security all the time. This is to make sure they keep patient data safe from new dangers.

The same goes for payment systems. They use PCI DSS impact strategies to keep your credit card info safe. It means shops and banks have to check and update their security a lot. If they don’t, bad things can happen, like theft and loss of trust.

NIST guidelines help businesses know what to do to protect their systems. They give a list of smart ways to keep data safe. The government tells companies to use these guidelines to be sure they’re covering all bases.

Remember, these rules are here for good reasons. They’re like seat belts for your data, keeping everything in place when there’s trouble. But it’s also important that the rules are clear and doable. Otherwise, they could end up costing too much. This could make doing business harder for those who are just trying to keep up.

It’s a fine dance between staying safe and keeping the business running smooth. Changes in cybersecurity threat landscapes mean updates are part of the job. Even if it’s hard, keeping up with mandated security controls helps everyone in the end. Companies can work without fearing cyber monsters under the bed, and that’s a win for all of us!

Towards International Consensus: Harmonization of Cybersecurity Standards

Cybersecurity Insurance: Transferring Risk in a Regulatory Environment

Laws change, and so must we. We see this dance when it comes to cybersecurity. New rules pop up, making us shift our tactics. Think of cybersecurity insurance. It’s like an umbrella in a storm. When a data breach happens, it lessens the blow to a business’s wallet. It’s a smart move in a world full of online threats.

But here’s where it gets tricky. As we try to keep data safe, we’ve got a mix of rules to follow. There’s GDPR in Europe, making sure personal data gets treated right. Then there’s HIPAA in the U.S., keeping health info under lock and key. Every industry has a watchdog, and every country has its own twist on the rules.

So, how do we suit up for this? Cyber insurance must match these regulations. Let’s say a clinic messes up and patient data leaks. If they’ve got the right insurance, they can handle the fines and fix the mess. This is where knowing your HIPAA stuff comes in handy. You pick the insurance that understands the healthcare game.

For companies handling credit cards, PCI DSS is another player on the field. It makes sure each swipe or chip insert keeps our card details safe. If you slip, penalties can hit hard. But if you’re lined up with PCI DSS-savvy insurance, you’re covered.

The Future of Cybersecurity: Understanding Regulatory Frameworks and Their Global Impact

Looking ahead, let’s chat about where cybersecurity’s heading. The online world’s a web connecting us all. What happens in one place can send ripples all around. That’s why getting everyone on the same tune matters. We want a smooth ride, not bumps and crashes.

ISO 27001 steps up here. It’s a worldwide rulebook for keeping info safe. It talks about how to set up a solid security plan no matter where you are. Big or small, any business can sing from this song sheet. It’s all about staying ahead of the bad guys and shielding precious data.

NIST, on the other hand, is a set of tips and tricks from the U.S. It’s like a wise friend telling you how to steer clear of danger. When companies tap into NIST’s wisdom, they’re taking steps to stand tall against threats. It’s another piece in the puzzle of staying safe in cyberspace.

What all this boils down to is making friends, not walls, across borders. If rules align, guarding against cyber crooks gets easier. It saves time and keeps us working in harmony. As we knit tighter rules together, the fabric of internet safety gets stronger.

International chats about cybersecurity are buzzing. It’s about making sure no one’s left in the lurch. When one link in the chain gets stronger, we all do. That’s the power of linking arms in cyber defense. And it’s a future worth aiming for.

In this blog, we talked about how rules are changing the way we keep data safe. We saw how laws like GDPR and HIPAA make it necessary to protect personal and health information. In the financial and telecom worlds, PCI DSS and SOX guide how companies keep their systems secure.

We also looked at how firms use NIST and ISO 27001 to make their cybersecurity better. Laws like FISMA and CCPA make sure companies take security seriously. For small and medium businesses, following these rules can be costly, but it’s key to stay safe as online threats keep changing.

We can’t avoid the rules, and sometimes they can slow down how we do business. Yet, they’re there to protect everyone’s data. As cyber threats grow, these standards will change, so businesses must update their security plans.

Looking forward, I see a world where countries agree on how to manage cybersecurity risks. Products like cybersecurity insurance are becoming more popular as a way to handle these dangers.

As an expert, I tell you to keep learning about these rules. By understanding them, you can better protect your business and stay ahead in today’s digital world.

Q&A :

How do regulations influence security standards in various industries?

Regulations play a critical role in shaping security standards across different sectors. They act as a baseline that organizations must meet, ensuring a minimum level of security is maintained. Compliance with these regulations can also drive companies to adopt more advanced security measures to protect against data breaches and other security threats.

What are the common security regulations businesses must adhere to?

Businesses may need to comply with a variety of security regulations depending on their industry and location. Common regulations include the General Data Protection Regulation (GDPR) for businesses operating in the EU, the Health Insurance Portability and Accountability Act (HIPAA) for healthcare providers in the US, and the Payment Card Industry Data Security Standard (PCI DSS) for companies that handle credit card information.

How do changes in regulations impact existing security protocols?

When regulations are updated or new ones are introduced, organizations must review and often revise their existing security protocols to ensure compliance. This may entail investing in updated security technologies, modifying data handling practices, or implementing additional training for staff to understand the new requirements.

Can an organization exceed regulatory security standards?

Organizations are not only permitted to exceed regulatory security standards, but it is often encouraged. Going beyond compliance can lead to improved trust with customers, better protection against security incidents, and a competitive advantage in the marketplace. It demonstrates a commitment to security that can add significant value to the business.

What are the consequences of non-compliance with security regulations?

Failing to comply with security regulations can result in a range of consequences, including hefty fines, legal action, and damage to a company’s reputation. Furthermore, non-compliance can lead to security vulnerabilities that may be exploited by cybercriminals, potentially resulting in data breaches, loss of customer trust, and significant financial costs for recovery and remediation.

RELATED POSTS

What is a 51% attack? How a Blockchain Takeover Threatens Your Crypto

What is a 51% attack?...

What Is Decentralization: Navigating the Future of Distributed Power

What is decentralization? Understanding the...

Preventing All Types of Attacks on Blockchain: Your Ultimate Guide

Preventing all types of attacks...

Pricing Factors for Blockchain Code Audits: Unlocking Cost Secrets

Pricing factors for blockchain code...

Grindery Airdrop – Earn G1 and GX Tokens Easily!

Grindery airdrop, supported by Binance...

What is the Cryptocurrency Market? How Transactions Work on the Blockchain

Curious about what is the...

What is dYdX? A deep dive into Decentralized trading

What is dYdX? It is...

Exploring the Growth of the Blockchain Technology Market in 2024

The blockchain technology market is...

Emerging Consensus Mechanisms for Blockchain: The Future of Decentralized Validation

Emerging consensus mechanisms for blockchain....

What are the benefits of blockchain: How It Transforms Business and Daily Life

Discover the benefits of blockchain...

Vessel Finance: The DEX with near-zero gas fees

In the ever-evolving world of...

How Blockchain Boosts Educational Equity: A Tech Revolution in Learning

How can blockchain promote educational...

What is Tokenized Real Estate? – Unlocking Global Investment Opportunities

What Is Tokenized Real Estate?...

Blockchain Revolution: How Is Blockchain Used In Different Industries

How is blockchain revolutionizing finance,...

Blockchain Trends and Predictions: The Future of Tech Unveiled

"Blockchain trends and predictions: Embracing...

Who founded Bitcoin? Who is the owner of bitcoin?

Who founded Bitcoin is a...