Liquid Native Restaking is emerging as a key innovation in the EigenLayer ecosystem, attracting significant attention from both the community and major investment funds. But what exactly makes Liquid Native Restaking so intriguing, and why is it being hailed as a game-changer in decentralized finance (DeFi)? Let’s dive deeper into this new concept.

Understanding restaking and its evolution into Liquid Native Restaking

Restaking, introduced by EigenLayer, allows users to stake their Liquid Staking Tokens (LSTs) on the platform after their initial staking, effectively allowing them to “restake.” On the other hand, Native Restaking applies to the activities of Validators on the EigenLayer network. Traditionally, Ethereum Validators only earned rewards from staking on the Ethereum network. However, with Native Restaking, Validators can participate in EigenLayer, unlocking additional revenue streams.

While promising, Native Restaking comes with several inherent challenges. Running a Validator on the Ethereum network requires substantial hardware and financial investment, including the need to stake a minimum of 32 ETH (around $70,000 at the time of writing). Additionally, Validators face significant security risks, such as slashing penalties for misbehavior, making the process daunting for many.

What is Liquid Native Restaking?

Liquid Native Restaking addresses the limitations of Native Restaking, offering a more flexible and accessible alternative for Node Operators. This approach allows operators to run a node on Ethereum with as little as 2 ETH, significantly lowering the barrier to entry compared to the 32 ETH required by the Ethereum Beacon Chain.

Additionally, technologies like Distributed Validator Technology (DVT) enhance security and reduce the need for complex hardware setups. By leveraging these solutions, Liquid Native Restaking also helps improve decentralization and scalability across the Ethereum network.

How Liquid Native Restaking works

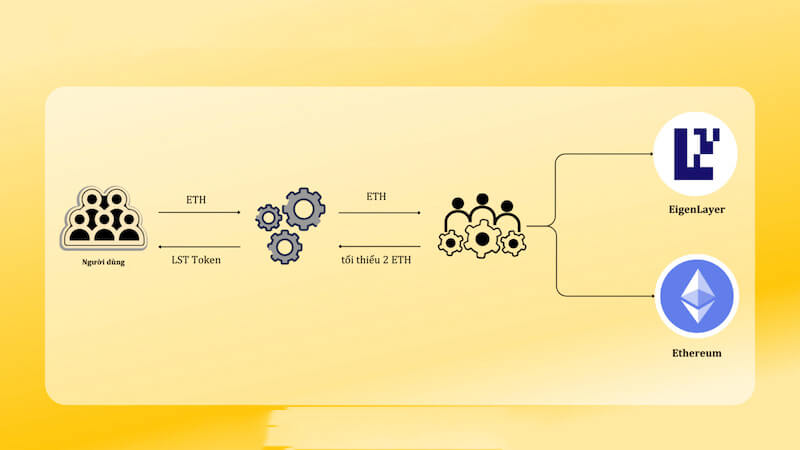

The mechanics behind Liquid Native Restaking can be broken down into a few key steps:

- Depositing ETH: Users deposit their ETH into Liquid Native Restaking protocols, receiving LST tokens in return. These tokens represent both the rewards from staking ETH on Ethereum and the income generated by Node Operators on EigenLayer.

- Becoming a Node Operator: To become a Node Operator, a user needs to deposit at least 2 ETH. The remaining ETH required to run the node is pooled from other users’ deposits.

- Node Operation and Security Integration: Node Operators then run their nodes on both EigenLayer and Ethereum to maximize returns. These platforms also integrate various security technologies from Liquid Native Restaking to ensure better protection and enhanced decentralization.

The risks associated with Liquid Native Restaking

Despite its advantages, Liquid Native Restaking comes with its own set of risks. One significant concern is the potential misuse of leverage by Node Operators, which could lead to losses if they lack sufficient experience. Inexperienced operators may face penalties or even slashing, risking the ETH staked by both themselves and users. Additionally, since the technologies supporting Liquid Native Restaking are still under development, there are inherent risks involved in their practical implementation.

Promising projects in Liquid Native Restaking

Puffer finance

Puffer Finance is one of the pioneering projects in Liquid Native Restaking, backed by the Ethereum Foundation. The project introduces cutting-edge solutions, such as the Secure-Signer technology, to prevent significant losses due to slashing. Puffer Finance also offers Fractal DVT, allowing users to run nodes without complex hardware, thus enhancing security and decentralization.

Puffer Finance has successfully raised funds from high-profile investors, including Jump Crypto, Animoca Brands, and Lemniscap. The project’s Secure-Signer and RAVe technologies have even received grants from the Ethereum Foundation, further solidifying its place as a leader in this emerging field.

Ether.fi

Another standout project in the Liquid Native Restaking space is Ether.fi. This platform focuses on maximizing staking returns for ETH holders while simplifying the process. Ether.fi relies on DVT from Obol Network, enabling Node Operators to operate without sophisticated hardware while maintaining high levels of security.

Ether.fi has also garnered investment from several prominent venture capital firms, including North Island Ventures, Arrington Capital, and VersionOne.

Liquid Native Restaking represents a significant leap forward for staking and DeFi, offering greater accessibility, scalability, and security for Ethereum Validators and users. As new projects and technologies continue to emerge, Liquid Native Restaking is poised to revolutionize the way staking operates in the Ethereum ecosystem, paving the way for exciting developments in the near future.

Join the Blockchain Global Network today! Discover innovative solutions, connect with industry leaders, and be part of a community that’s shaping the blockchain landscape.

RELATED POSTS

Comparison Of Consensus Mechanisms In Blockchain: Gatekeepers Unveiled

Discover the differences between PoW,...

Memefi Coin Airdrop: Airdrop Timeline and Launch of Memefi Token

The Memefi Coin Airdrop presents...

Cow DAO base L2 chain launch: Faster, cheaper and more scalable blockchain

The Cow DAO Base L2...

Top 3 Secrets behind Bitcoin Peak that you must know

The rise and fall of...

Explanation of Proof of Stake (PoS): Revolutionizing Cryptocurrency Security

Discover the Advantages of Proof...

Stuart Alderoty: His role at Ripple

Discover Stuart Alderoty, Chief Legal...

On-Chain Analysis Unveiled: Unlocking the Advantages for Savvy Investors

Gain comprehensive market insights with...

Pebonk Kombat – The next frontier in gaming and crypto

Pebonk Kombat is revolutionizing gaming...

Examples of Secure Blockchain Implementations: Unveiling Industry Innovations

Examples of secure blockchain implementations...

Differences Between From vs Reply To in Email Ledger

Understanding the difference between From...

What happened to MOVE Coin? Market Trends, Challenges, and Future Outlook

What happened to MOVE Coin?...

Blockchain Backlash: Navigating the Turbulent Waters of Application Security

Understanding the Ripple Effect of...

Blast Airdrop – Tips for Earning KRO Tokens Easily

Earning KRO tokens from the...

Ongoing Research Projects in Blockchain: Decoding Tomorrow’s Tech Revolution

Explore ongoing research projects in...

Peer-to-Peer Learning Unlocked: Harnessing Blockchain for Collaborative Education

Blockchain's role in peer-to-peer learning:...

Can my Phantom Wallet be hacked?

Wondering, “Can my Phantom Wallet...