Navigating the New Legal Landscape

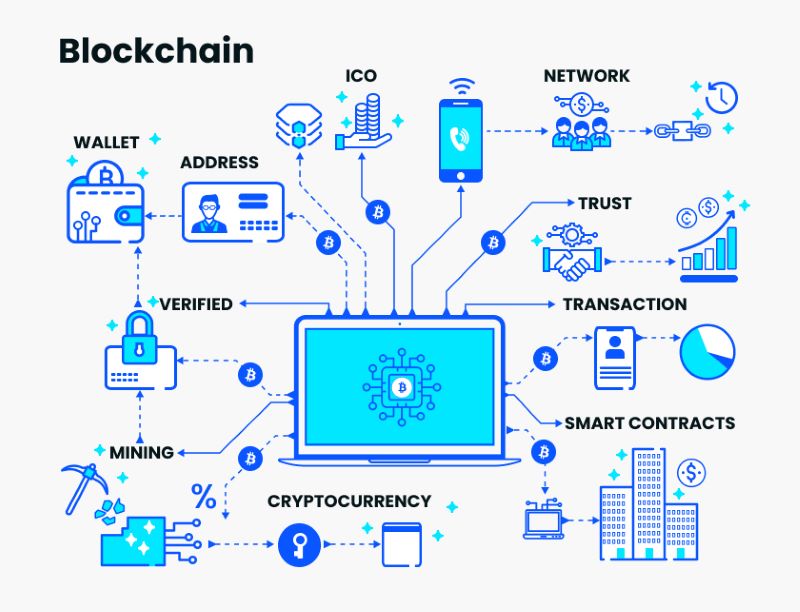

The digital world is buzzing with blockchain. With that buzz comes the need for clear regulations for blockchain technology. You’ve got this tech that can shake up everything from banking to voting. Yet, we’re wading through a swamp of confusing laws. I’m here to guide you clear of the muck. We’ll break down the legal jungle: from new rules cropping up worldwide, to making sure crypto exchanges play by the book. It’s not just about keeping your nose clean. It’s about seizing the power of blockchain while staying on the right side of the line. Strap in, because with each new coin and smart contract, the plot only thickens.

Understanding the Legal Framework for Blockchain Technologies

The Evolution of Blockchain Legislation and Cryptocurrency Laws

In the world of blockchain, laws keep changing. They have to. As tech grows, so do the rules. New cryptocurrency laws are always turning up. This keeps everyone on their toes. From Bitcoin’s birth to now, we’ve come far. Back then, no rules were set. Today, we have a maze of laws. And these laws vary from place to place.

For example, some places see crypto as cash. Others see it as property. This tiny difference can change how you pay tax. And it affects how businesses treat crypto. That’s why knowing the legal side matters so much. No one wants trouble with the law, right? Right. So, keeping up with blockchain legislation is key.

Navigating International Blockchain Policy and Regulation

Going beyond one country, blockchain policies get complex. Each country has its own ideas. This means something okay in one place might not be okay in another. So, when dealing with blockchain across borders, you’ve got to be careful.

Think of blockchain policy like traffic rules. What’s okay in your country might be wrong elsewhere. Drive on the wrong side in another country, and you’re in for a shock. Same goes for blockchain. Wrong move and you might break a law. So get to know the rules first. This way, you avoid costly mistakes.

With crypto exchange rules, things get trickier. Every exchange must follow the country’s laws it’s in. That includes anti-money laundering and know your customer rules. Remember, these are there to stop bad stuff. Like keeping dirty money out of the system. It’s like having a good security system at home. Keeps out unwanted guests.

Now, blockchain governance is like having rules at home. You set them to keep everything running smooth. In blockchain, it’s similar. These rules make sure everything’s fair and correct. But unlike home rules, breaking these can land you in big trouble.

Token issuance is another big topic. It’s like giving out special passes for a concert. But here, the passes could be worth a lot of money. And when money’s involved, you bet there are rules. So, anyone making tokens has to follow strict guidelines. It’s not just about making them, but also about how you tell others about them.

Lastly, we’ve got privacy and data protection. Everyone wants their stuff safe, right? Blockchain’s no different. There are laws to make sure personal info stays private. Think of it as having a strong safe for your secrets. Only you have the key.

In this world, staying on the right side of the law matters—big time. It keeps things fair and safe for everyone. Whether you’re just starting or knee-deep in blockchain, know the rules. It makes a world of difference.

Remember, the laws aren’t here to stop fun. They’re here to keep the playground safe, fun, and open for everyone. So let’s keep learning, and let’s play by the rules.

Compliance and Governance in the Blockchain Ecosystem

Establishing Crypto Regulatory Compliance for Exchanges and Platforms

Keeping up with laws for crypto is tough but key for any exchange or platform. We must meet all rules to stay safe and serve people right. This means getting the right licenses and following all the steps governments ask for. For exchanges or anyone running a crypto service, this is your first big job. Every country has its own set of rules, and often, they don’t match up. So, it’s crucial to know where you work and what they want. In the US, for example, the SEC might call your token a security. This means you need to follow special rules made for stocks and bonds. If you skip this, you could get into big trouble, like fines or worse.

Many might ask, what does crypto regulatory compliance mean? It’s simple: it’s all the rules that crypto services need to follow to be legal. For exchanges, this includes how to keep records, report trades, and make sure customers are real people, not bad actors. It’s not easy, but it helps keep things fair and stops crime. Done right, it makes trust and keeps business going smooth.

Integrating Anti-Money Laundering and KYC Policies in Blockchain Operations

Next up, we’ve got rules against dirty money. No one wants their platform used for shady stuff. Here’s where Anti-Money Laundering (AML) and Know Your Customer (KYC) rules come in. They help you spot and stop bad money moves. AML rules make you watch for sketchy things and tell the law if you spot them. KYC is about knowing who uses your service. You need IDs and sometimes more. What’s this for? To make sure your users are who they say they are. This stops crooks from slipping through.

Say someone asks you, why are KYC and AML important for blockchain? You’d tell them they keep our money world clean. They block folks who want to hide where money comes from or what it’s for. For blockchain businesses, this means checking everyone with care. Getting this right stops big issues down the road.

Running a blockchain service isn’t just tech work. It’s knowing all the laws and rules. It’s making sure you do your part to keep the game fair and legal. When rules change, and they will, stay sharp. Update your plans and teach your team. Work with lawyers if you can. This stuff matters a lot. It’s how you build trust and stick around for the long haul.

Remember, following these rules helps us all. It makes sure new tech like blockchain grows right. It helps keep trust and security in the digital coins we use. Compliance isn’t always fun, but it’s the strong base for a clean crypto space.

The Challenges and Considerations in Blockchain Implementation

Assessing Blockchain Regulatory Challenges and Reporting Obligations

Figuring out the rules for blockchain can be tricky. Every country has its own laws. You need to know these rules to keep your blockchain project on track. There’s a lot to think about, like how to handle money, who your customers are, and what you tell the government.

What are blockchain regulatory challenges?

Blockchain faces many legal challenges. These include issues like privacy, how to use blockchain fairly, and making sure it’s in line with financial regulations. These challenges can change based on where you are and what you’re doing with blockchain.

What are blockchain reporting obligations?

Blockchain reporting obligations are the must-do tasks for people using blockchain. They need to tell regulators about their activities. This ensures they follow anti-money laundering (AML) and know your customer (KYC) laws.

Recognizing Intellectual Property Rights and Data Protection in Blockchain

Blockchain also has to respect ideas and private info. Smart contracts and tokens can run into intellectual property issues. You must protect other people’s data on your blockchain too.

How does intellectual property apply to blockchain?

Intellectual property in blockchain means making sure that creations, like software or tokens, don’t steal someone’s original ideas. If you create something on blockchain, you should have the right to own your work.

How does blockchain deal with data protection laws?

Blockchain must keep personal data safe. This is tough because blockchain spreads info across many places. Yet, it needs to follow privacy laws to protect user info and be trusted.

So, working with blockchain means knowing a lot about the rules. You have to understand both the tech and the law. This helps you build things that are not only cool but also legal.

The Future of Blockchain Regulation and Innovation

Stablecoins, CBDCs, and Their Emerging Regulatory Landscape

Stablecoins and Central Bank Digital Currencies (CBDCs) shape our money’s future. But what laws apply to them? Both need clear rules for safety and trust. A stablecoin’s value is pegged to something stable, like dollars or gold. This makes them less volatile than other digital currencies. CBDCs, on the other hand, are digital forms of a country’s currency, backed by the government.

As an expert, I see that big countries are now exploring CBDCs. This could change how we use money. It’s not just about making payments easy. It’s about keeping money safe and making sure it’s real. That’s where the legal framework for digital currencies comes in. We need laws to stop bad uses like money laundering. This keeps the system clean for everyone.

For crypto regulatory compliance, each country has its own set of rules. Some countries are strict, while others are open to these new techs. International blockchain policy adds another layer. It’s complex! This is because laws often lag behind tech advances. But, to keep investment safe, laws must evolve with tech.

Adapting to Blockchain Technology Trends and Future Legal Considerations

Adapting to blockchain trends is like running to catch a fast train. The tech moves fast, and so must the laws. Blockchain governance focuses on how these systems work. It’s about keeping things in order and making sure people play fair.

Decentralized finance regulations aim to protect users in a world where banks are not always in control. New digital asset regulations emerge as new blockchain applications appear. It’s a race to stay updated. Legal pros must be sharp and quick-thinking. We’re like the bridge linking new tech to the old world of law.

Blockchain compliance standards help everyone know what to do. They give us a playbook to follow. But remember, the rules are always changing. That includes everything from the way we issue tokens, to how we report what happens on the blockchain. Knowing your customer on crypto — that means checking who is using these services — keeps criminals out. They can’t hide on our watch.

Security token oversight is another big topic. A security token is like a digital stock—it represents ownership. They must follow strict investment rules. As for smart contract legal implications, just think of it as a computer program that deals with money or contracts. It must do so legally without risk.

In the end, growth and safety in blockchain aren’t enemies. With smart rules and sharp minds, we can have both. The blockchain world is like a wild forest full of unknowns. As an expert, I help clear the path so innovation can move ahead, but safely, without harming the forest.

Law is complex. Blockchain is complex. But together, they’re leading us into a future where our money works smarter, not harder. We just need to make sure we write the rulebook in a way that supports progress and protects people. That’s our goal every single day.

In this post, we took a deep dive into blockchain’s legal world. We started with how laws around blockchain have grown and how different countries deal with it. Next, we tackled the rules exchanges must follow and how to keep blockchain clean with anti-money laundering and “know your customer” rules. After that, we looked at the hard parts of using blockchain, like reporting to the government and respecting ownership and privacy laws.

Lastly, we peeked at what’s coming for blockchain, thinking about new types of digital money and what laws they might face. We’re standing at the edge of a new tech era, full of promise and legal puzzles. As an expert, I say keeping up with these changes is key. We all want innovation, but we also need to play by the rules to make blockchain work for everyone. Let’s stay alert, learn more, and pave the way for a future where blockchain can shine.

Q&A :

What are the current regulatory standards for blockchain technology?

With blockchain technology rapidly evolving, regulatory standards are attempting to keep pace to ensure security, stability, and legal compliance. Different jurisdictions have different regulations, but some common standards involve Know Your Customer (KYC) and Anti-Money Laundering (AML) laws, as well as guidelines for Initial Coin Offerings (ICOs), securities trading, and data protection. Organizations like the Financial Action Task Force (FATF) and various securities commissions around the world are involved in shaping these regulations.

How do regulations impact blockchain innovations?

Regulations can significantly impact blockchain innovations by either nurturing the technology’s growth or stifling its development, depending on how they are framed. Effective regulations can protect consumers and promote trust in blockchain systems, encouraging more widespread adoption. However, overly strict or unclear regulations may hinder innovation and drive blockchain companies to more regulation-friendly jurisdictions. Therefore, the balance between rigid control and entrepreneurial freedom is crucial.

What efforts are being taken to standardize blockchain regulation globally?

Global standardization efforts for blockchain regulation are ongoing. International bodies like the International Organization of Securities Commissions (IOSCO) and the FATF are engaging with regulators across different countries to formulate consistent regulatory frameworks. These bodies aim to establish global standards to combat fraud and enhance the security of blockchain transactions while also recognizing the need for sufficient flexibility to accommodate the industry’s rapid growth and innovation.

How do blockchain regulations vary by country?

Blockchain regulations can vary greatly by country. Some countries, such as Malta and Switzerland, have positioned themselves as blockchain hubs with friendly regulations to attract businesses. Meanwhile, nations like China have taken a more regulated approach, especially concerning cryptocurrencies. The United States is still developing a comprehensive approach, with individual states like Wyoming taking the lead on creating blockchain-friendly environments. It is vital for blockchain businesses to understand and comply with the specific regulatory landscape of each jurisdiction in which they operate.

What are the potential consequences of non-compliance with blockchain regulations?

Non-compliance with blockchain regulations can lead to severe consequences for individuals and companies, including hefty fines, legal action, and reputational damage. In some cases, non-compliant entities may be barred from operating in certain jurisdictions or shut down entirely. These outcomes underline the importance of staying informed about the regulatory requirements relevant to blockchain technology and ensuring adherence to all applicable laws and standards.

RELATED POSTS

Blockchain Basics: Unlocking the Mysteries of Modern Cryptography

Understanding the Cornerstones of Blockchain...

What is the purpose of blockchain technology?

What is the purpose of...

Ethereum Launch Unveiled: What’s New in the World of Crypto?

Discover the Launch of Ethereum...

What is a bull trap? Signs and Strategies to Protect Your Investments

What is a bull trap?...

How to Avoid Crypto Wallet Scams: Foolproof Strategies for Digital Safety

How to avoid crypto wallet...

Cost of Crypto Hacks: Are Your Investments Really Safe?

Understanding the financial impact of...

Unveiling Blockchain: Surprising Uses Beyond Cryptocurrency

Applications of blockchain technology go...

Exploring DLT in Blockchain: Navigating the Tech of Tomorrow

Understanding the Fundamentals of DLT...

Can Blockchain Revolutionize Voting? Unpacking Fraud Prevention Potential

Can blockchain prevent voter fraud?...

Solutions for Scaling Blockchain Networks: Unlocking Next-Level Potential

Discover solutions for scaling blockchain...

Blockchain Revolution: Blockchain Use Cases In Financial Services

Explore how blockchain is revolutionizing...

Public Key vs Private Key Cryptography: Unlocking the Secrets of Digital Security

Understanding the Basics of Public...

Blockchain Security Unveiled: Is Your Digital Fortress Impenetrable?

How secure is blockchain? Unpacking...

The Impact of Blockchain Technology in Supply Chain Management

Blockchain technology in supply chain...

Examples of blockchain transparency in action: Unveiling Impact

Examples of blockchain transparency in...

Exploring Liquid Staking in Crypto: Unlocking 24/7 Earnings Potential

"Explore liquid staking in the...