Dive into the world of Regulatory landscape for blockchain security, and you’ll find it’s like exploring a new country. It has its own rules, laws, and paths that must be followed. I’m here to be your guide through this terrain, giving you the map to navigate safely and effectively. With crypto laws changing, how you protect yourself and comply matters more than ever. In this post, we’ll go step by step through the essentials: from understanding the current rules to prepping for what the future holds. Let’s dig in and tackle the hurdles of blockchain regulation together, making sure you come out on top in this rapidly evolving space.

Understanding the Current Blockchain Regulatory Framework

Key Components of Blockchain Regulation Compliance

When you enter the world of blockchain, it’s like stepping into a maze. The walls are laws, and the paths are rules you must follow. Just like in a maze, you need a map. In blockchain, that map is called regulation compliance.

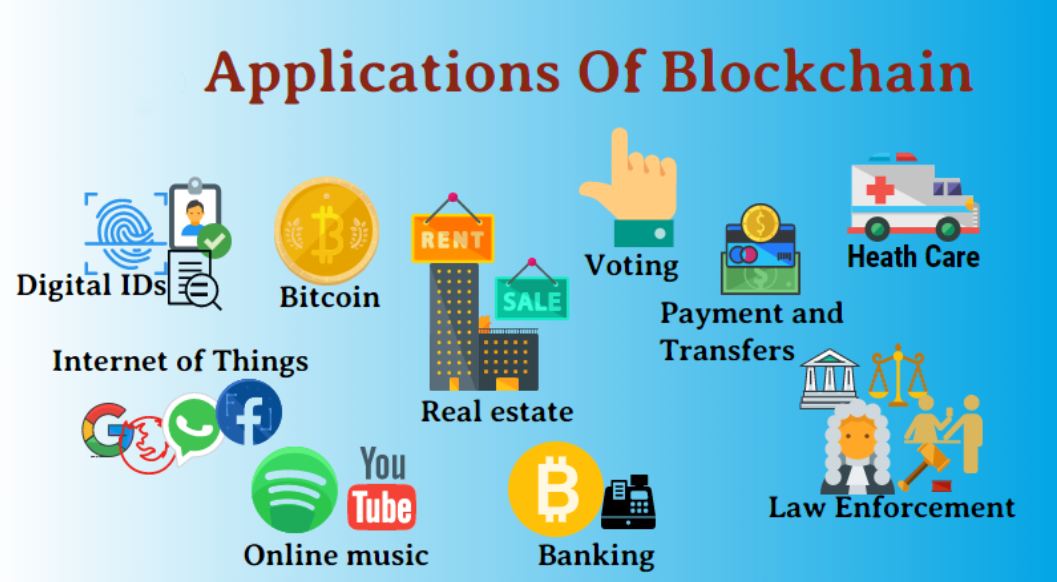

Compliance means doing right by the rules set to keep everyone safe. In blockchain, compliance includes rules about knowing your customers (KYC) and fighting money crimes (AML). Laws also guide how companies share data and protect your secrets. The goal is to play fair and keep trust in the system.

Impact of Crypto Security Laws on User Protection

Think of crypto security laws as a shield. They are there to protect your money and your info. Without these laws, bad guys could steal or cheat, and no one would trust the system. Security laws guard your digital coins, just like laws in the real world protect your home and bank money. They help make sure no one can take what’s yours without your okay.

Trust is key in the crypto world. To trade or invest, you must trust that your digital coins are safe. That’s why these laws are so important. They keep that trust solid so everyone can use and enjoy the benefits of blockchain and crypto.

These laws impact you in many ways. They help keep your investment safe, they make sure businesses play by the rules, and they help track down bad actors. If we didn’t have these laws, the world of blockchain would be like a game with no rules. It would be chaos, and nobody would want to play.

So, when you dive into blockchain, remember the rules are there for a reason. They may seem like a lot, but they’re the map that helps us navigate the maze. They let us explore this awesome new world of blockchain with peace of mind, knowing there’s a system in place looking out for us all.

By following the map of regulation compliance, we can all help make sure blockchain stays a safe space to explore and grow.

The Intersection of Legal and Technical: Ensuring Smart Contract Compliance

Overcoming Smart Contract Compliance Issues

Smart contract issues can be tough. Like a puzzle, they need all pieces in the right place. To stay on track, we must look at the law closely. This is how we help smart contracts do their job well and by the rules. Think of them as digital contracts locked to run when certain things happen.

For smart contracts to work, they require both legal smarts and tech skills. We need to know the laws that apply to them. This means looking at securities law in the blockchain space. Are these smart contracts like stocks or bonds? This matters because it changes how we handle them. Keeping these contracts in line means fewer headaches for everyone later.

Now, what about crossing borders with these smart contracts? They often interact across many places. Each place might see them differently. We aim to avoid legal snags by sorting out these cross-border blockchain supervision issues early on.

We try hard to fit in with blockchain regulation compliance. Why? To keep things smooth and secure. To do this, we often work with those who make the rules. These folks come from financial regulatory bodies and blockchain. Together, we shape the rules to be fair and clear.

Integrating AML and KYC Standards in Blockchain Systems

Money laundering is a no-go in the cryptoworld. That’s why AML – or anti-money laundering – standards are key. We weave these rules into blockchain systems. It’s like adding safety to the very heart of crypto.

Knowing your customer or KYC is just as crucial. It keeps blockchain honest by making sure we know who uses it. The KYC standards are like a guest list. They help us spot who should and should not be there. This keeps everything on the level.

It’s not always simple, but it’s super important. Ensuring that AML and KYC rules live in the blockchain helps everyone. It’s a way to make sure that the cryptoworld is safe for real business.

DLT, short for Distributed Ledger Technology, also needs these AML and KYC checks. Blockchain is just one type of DLT, and all types need these safety steps.

How do we protect data while doing all this? We lean on data protection laws for blockchain. They are like rules that keep personal info safe. We must follow them to stay out of trouble and keep trust high.

In a nutshell, the blockchain world winds through a maze of laws. But with the right map, we can navigate it. We always work to stick to blockchain governance standards, such as smart contract compliance issues. This helps us go beyond just following rules. We build trust and make sure blockchain is a solid place for doing business.

One thing is sure: the path of blockchain and law is always changing. We stay ready to shift and adapt. As the fintech regulatory landscape moves, so do we. Keeping up with security token regulatory requirements and more means we never stop learning – and that’s just how we like it!

Cross-Border Challenges in Blockchain Security

Navigating Decentralized Ledger Frameworks and Cryptocurrency Exchange Regulations

When you deal with blockchain, you’re not just working with one country’s rules. Often, you have to think about different rules from around the world. This is hard because rules can be very different from one place to the next. For example, a blockchain could have data from people in the United States, where the rules are one way, and people in Japan, where the rules are another way. This mix-up can make it tough to keep all the laws in check.

One big thing to keep an eye on is how money moves across borders. Many countries want to make sure they know where money is coming from and going to. This is to stop bad things like money laundering. So, countries have AML and KYC rules that you must follow. Guess what? These rules are not all the same everywhere. This can make it hard for blockchain companies to make sure they’re doing things right.

Countries are also wrestling with how to manage digital cash, like Bitcoin. They’re trying to figure out if it’s like regular cash, a stock, or something else. Depending on what they decide, the rules might change. This is important because it could affect how much tax you pay or what info you have to share. The tax thing is especially tricky. You see, if you use digital cash to buy something, some places might say, “Hey, you should pay tax on that!” But other places might say, “No tax needed here.” So, a blockchain has to be really smart to handle this tax puzzle all over the world.

Now let’s talk about the computer part of blockchain, the smart contracts. These are like pinky promises, but made with computer code. They automatically do things when conditions are met. Smart contracts are cool but can get folks into trouble if they don’t follow the law. So, if you make a smart contract, you have to make sure it follows the rules not just in one place, but maybe lots of places. That can be a really big job.

To get through this maze of rules, you need a good map. And that’s what compliance auditing is. It’s like checking your homework to make sure you got all the answers right before you turn it in. And if you find a problem, you fix it quick. That way, you don’t get in trouble later.

Strategies for Blockchain Compliance Auditing and Risk Management

First thing’s first, know the rules. If you’re playing a board game for the first time, you’d read the instructions, right? Same with blockchain. Before you do anything, learn as much as you can about the rules where you live and in other places where your blockchain might go.

Next, keep things tidy. This means making sure you have all the right papers and permissions. It’s like when you clean your room so you can find your toys later. If someone asks, “Hey, did you do this the right way?” you can show them your clean, organized room and they’ll know you did.

After that, chat with smart lawyer folks who know a lot about this stuff. These brainy people can give you advice and stop problems before they start. Imagine they’re like guides in a video game who know where all the secret paths and traps are.

Lastly, always stay ready for changes. Rules about blockchain can change just like the rules in your favorite game can get updates. So, always keep an eye out for news and be ready to switch things up if you need to.

By doing these things, we can keep blockchains safe and sound, even when they hop from place to place. It’s not always easy, but hey, what fun thing ever is?

The Future of Blockchain Governance and Digital Asset Regulations

Preparing for Changes in Cryptocurrency Regulatory Guidelines

New rules for crypto are coming. We must get ready. Cryptocurrency regulatory guidelines change often. Governments want to protect everyone’s money. Lawmakers meet to make these new rules. They look at how to stop bad guys and keep the crypto world safe. When they decide on a new rule, we all have to follow it.

First off, what’s a crypto security law? Think of it as a set of rules. These keep our digital coins safe. Because of these laws, you know your money won’t disappear overnight. A new law might say a token is a security. This means it has to follow certain rules. This can include how you tell others about your token and what info you share.

Here’s where it gets tricky. The new rules don’t stop at one place. They reach across the world. That’s cross-border blockchain supervision. People in suits have to check how different countries see these rules. They want to see if someone is not playing by the rules. And if they aren’t, they need to handle it. This could mean working with other countries to solve the problem.

So, what’s all this mean for you? Well, if you’re into blockchain, pay attention. New changes could affect how you invest or build stuff with blockchain. Always keep an eye on the news for the latest updates. Talk to experts if you need help.

To stay safe in crypto, you must know who you’re dealing with. That’s know your customer (KYC) and anti-money laundering (AML) in crypto. Say you run a crypto exchange. You need to make sure your users are real. You have to keep bad money out of your platform. If you don’t, you could get in big trouble with the law.

We can’t forget about data protection laws for blockchain. Let’s be honest. No one wants their personal stuff to leak online. New laws like GDPR matter to blockchain too. They say how data should be handled and kept safe.

The Role of Financial Regulatory Bodies in Shaping Blockchain Innovation

Who makes all these crypto rules? The big players are called financial regulatory bodies. They’re like referees in a basketball game. They keep things fair and in order. The rules from these groups help to shape how blockchain grows. They can encourage new ways to use blockchain. Sometimes they may say no to certain ideas if they’re too risky.

To keep up with blockchain technology legal aspects, these bodies work hard. They look at things like blockchain governance standards and how a blockchain works. They also check on security token regulatory requirements. This stuff is super important. It’s what keeps your blockchain investments on the right side of the law.

In the end, these groups aim to find balance. They want to see blockchain help the world. But they have to keep everyone’s money safe. They’re always trying to strike the right balance. This way, innovation can happen without putting people at risk.

Watching these changes is key. They’ll define how we use blockchain in the future. So stay tuned, folks. The world of blockchain law is always on the move!

In this post, we’ve explored the complex world of blockchain regulations. We started by breaking down the current rules, showing how they aim to protect users through crypto security laws. Then we tackled the legal-tech mashup, discussing ways to keep smart contracts in line with the law and how to include AML and KYC practices within blockchain.

Crossing borders, we dove into the issues that come with the global nature of blockchain and how to handle them through audits and careful risk management. Finally, we looked ahead, anticipating shifts in regulation and the impact of financial authorities on future blockchain innovation.

I hope my insights have shed some light on the often murky realm of blockchain regulation. As laws evolve, staying informed is crucial for anyone involved in the blockchain space. Keep an eye on these developments—they’re shaping the digital world we’re all a part of.

Q&A :

What are the current regulations governing blockchain security?

With blockchain technology rapidly evolving, various governments and international bodies are seeking to establish a set of regulations to ensure the security and integrity of blockchain systems. Current regulations often focus on anti-money laundering (AML), know your customer (KYC), data protection, and the security of transactions. Specifics can vary significantly between jurisdictions, and compliance might involve following guidelines from financial regulatory bodies, data protection agencies, and dedicated blockchain initiatives. It’s crucial for businesses and users in the blockchain space to stay informed about the changing regulatory landscape to ensure they remain compliant.

How does the regulatory environment affect blockchain innovation?

The regulatory environment can have a significant impact on blockchain innovation. On one hand, clear and supportive regulations can foster an environment that promotes the safe development and adoption of blockchain technology. On the other hand, overly restrictive or ambiguous regulations may hinder the growth of blockchain projects by introducing uncertainty, compliance difficulties, and potentially stifling creative approaches to problem-solving. Many in the industry argue for balanced regulation that protects consumers without hampering the innovation that blockchain technology offers.

What challenges are there in regulating blockchain security?

Regulating blockchain security presents various challenges due to its decentralized nature, the rapid pace of technological advancement, and the global reach of blockchain networks which transcend traditional jurisdictional boundaries. Identifying accountability, enforcing regulations across different jurisdictions, and keeping up with the technical complexities of blockchain technology are some of the primary difficulties that regulators face. Furthermore, ensuring that regulations remain technology-neutral and do not become obsolete as blockchain technology evolves adds another layer of complexity to the regulatory challenge.

Are there any international standards for blockchain security?

While there is not yet a globally recognized set of standards specifically for blockchain security, several international organizations are working on frameworks and guidelines to address it. The International Organization for Standardization (ISO) has been developing standards that include aspects of blockchain security. Additionally, groups like the International Telecommunication Union (ITU) have initiatives focused on security, privacy, and trust in digital financial services, which encompass blockchain technologies. As the technology matures, the development of more comprehensive and widely-accepted international standards is expected.

What should businesses know about compliance and blockchain security?

Businesses engaging with blockchain technology should be aware that compliance goes beyond just understanding the current laws and regulations. They must be proactive in monitoring and preparing for new regulatory measures that may impact how they operate their blockchain-related services. This includes regular risk assessments, implementing robust security practices, data protection procedures, and potential reporting requirements. Staying ahead in compliance can protect the business from legal repercussions and establish a strong reputation for security and reliability in the blockchain community.

RELATED POSTS

Deflationary Currency – How it works and its impact on the Economy

In today’s evolving financial landscape,...

What is blockchain: Unlocking the Future of Secure Transactions Technology

What is blockchain? Explore the...

Security Challenges in DeFi: Navigating the Uncharted Waters Safely

Protect Your DeFi Applications from...

Security of Proof of Work: Is Your Cryptocurrency Safe?

Security of Proof of Work...

Emerging Trends in Blockchain Security: Next-Gen Safeguards Unveiled

Emerging trends in blockchain security:...

Sonic Labs Airdrop – Discover the Super HOT Token Burn Mechanism

One of the highlights of...

Wormhole Airdrop – Take Advantage of 3 Valuable Investment Opportunities

Wormhole Airdrop is not only...

Bitcoin Unveiled: A Peer to Peer Electronic Cash System

Discover the Genesis of Bitcoin:...

GameFi Revolution: How Blockchain Merges with DeFi for Gaming Gold

GameFi blends Blockchain and DeFi...

Challenges Facing Current Consensus Mechanisms: Are We Stuck?

Challenges facing current consensus mechanisms:...

DoS Attacks on Blockchain: Protecting Your Crypto from Cyber Threats

Protect Your Blockchain Network: Learn...

Security Measures: Outsmarting Blockchain Attacks with Cutting-Edge Defenses

Enhance your blockchain security with...

What is Bitcoin Lightning Network? Revolutionizing Crypto Transactions

What is Bitcoin Lightning Network?...

Economic Bubble in Crypto – 3 Experiences to deal with it

In the volatile cryptocurrency landscape,...

Blockchain Technology Images – Visualizing the Future of Digital Innovation

Ever wondered how Blockchain Technology...

Enterprise Blockchain Emergence: Unlocking Top Security Requirements

Addressing specifics of #blockchain model...