Discover Stuart Alderoty, Chief Legal Officer at Ripple, and his influence on cryptocurrency regulation. Learn about his career, insights on the SEC, and the future of digital assets.

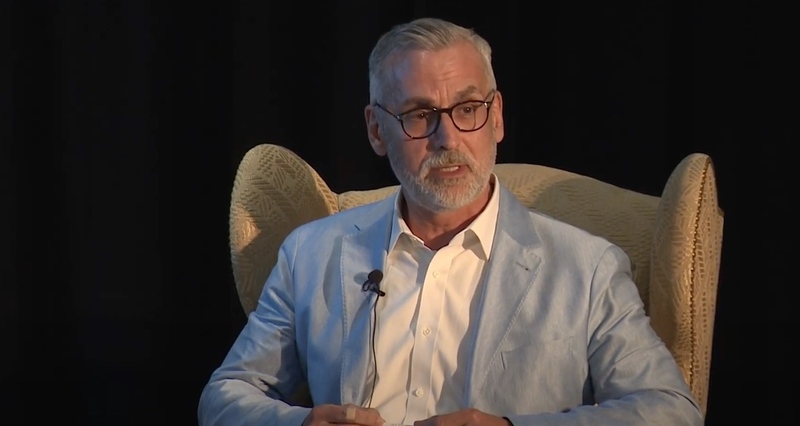

Who is Stuart Alderoty?

Stuart Alderoty stands at the forefront of cryptocurrency regulation as the Chief Legal Officer of Ripple, a pioneering company in the blockchain and digital asset space. With his extensive legal background and commitment to fostering innovation, Alderoty plays a crucial role in navigating the complex regulatory landscape that defines the financial technology industry today.

Educational background

Alderoty’s academic journey began at Rutgers University, where he earned a Bachelor of Arts degree. He furthered his education at Rutgers Law School – Newark, obtaining his Juris Doctor (JD). This solid foundation in law equipped him with the skills and knowledge necessary to address the intricate legal challenges he would encounter in his career, particularly in the fast-evolving world of digital currencies.

Career overview

Alderoty boasts over three decades of legal expertise, primarily in regulatory affairs and complex litigation. His career includes notable positions, such as Managing Partner at American Express from 2002 to 2010 and General Counsel at HSBC North America Holdings (2010-2016) and CIT (2016-2019).

In January 2019, Alderoty joined Ripple as General Counsel and Chief Legal Officer. In this capacity, he oversees global legal services, regulatory compliance, and policy initiatives, ensuring that Ripple adheres to legal standards while promoting innovation in digital payment solutions.

Stuart Alderoty’s role at Ripple

As Chief Legal Officer at Ripple, Alderoty is tasked with managing the company’s legal strategies, particularly in relation to the Bank Secrecy Act (BSA) compliance and interactions with global regulators. Ripple’s mission to revolutionize the financial system through blockchain technology aligns with Alderoty’s commitment to fostering regulatory clarity and supporting the growth of the cryptocurrency industry. His leadership is vital in building partnerships with financial institutions and regulators, aiming to create a balanced environment that encourages innovation while protecting consumers.

Legal challenges with the SEC

Stuart Alderoty has played a crucial role in navigating Ripple’s legal challenges, particularly regarding the ongoing lawsuit with the U.S. Securities and Exchange Commission (SEC). Here’s an overview of the key aspects of this legal battle:

Overview of the SEC lawsuit

In December 2020, the SEC filed a lawsuit against Ripple Labs Inc., alleging that the company raised over $1.3 billion through the unregistered sale of XRP, which the SEC classified as a security. This lawsuit accused Ripple of conducting an unregistered securities offering, claiming that the sale of XRP violated federal securities laws. The case brought significant attention to the regulatory status of cryptocurrencies and raised questions about the classification of digital assets.

Key arguments

The SEC argued that Ripple’s sales of XRP were akin to investment contracts, making them securities under U.S. law. The commission contended that Ripple’s actions misled investors and violated securities regulations. Ripple, on the other hand, maintained that XRP is a digital currency, not a security, and that its sale did not require registration.

Alderoty’s Defense strategy

Stuart Alderoty has been vocal in defending Ripple against the SEC’s claims. He argued that the SEC’s pursuit of personal charges against Ripple executives, including CEO Brad Garlinghouse and Executive Chair Chris Larsen, was misguided. Alderoty emphasized that the regulatory landscape for digital assets is still developing and that many in the industry share a commitment to compliance.

Dismissal of charges

On October 19, 2023, the SEC announced the dismissal of all claims against Garlinghouse and Larsen. Alderoty characterized this decision as a “surrender” by the SEC, indicating a significant victory for Ripple. He expressed that the SEC made a mistake by targeting the executives personally and that the dismissal validated Ripple’s position in the case.

Broader implications for the Crypto industry

The lawsuit has broader implications for the cryptocurrency sector, as it highlights the need for clearer regulatory guidelines. Alderoty has advocated for comprehensive regulations that foster innovation while protecting consumers. He believes that the outcome of the case could set important precedents for how digital assets are treated under U.S. law.

Advocacy for industry unity

Throughout the legal proceedings, Alderoty has called for unity within the cryptocurrency industry to address regulatory overreach. He emphasizes the importance of collaboration among companies to advocate for fair treatment and clearer regulatory frameworks.

Advocacy for clear Cryptocurrency regulations

Critique of SEC practices

Alderoty has been critical of the SEC’s regulatory approach, particularly its tendency toward enforcement actions without clear guidelines. He argued that the SEC’s argument in the LBRY case—suggesting that any token purchased for investment purposes could fall under securities regulation—was overly broad and detrimental to the entire cryptocurrency industry. He advocates for a regulatory environment that promotes innovation and provides clear definitions to avoid confusion.

Call for industry unity

Recognizing the challenges posed by regulatory uncertainty, Alderoty has called for unity among cryptocurrency companies. He believes that a collective effort is essential to combat regulatory overreach and to advocate for fair treatment across the industry. By fostering collaboration, Alderoty envisions a stronger voice for the cryptocurrency sector in discussions with regulators.

Insights on the future of Cryptocurrency regulation

Stuart Alderoty’s perspective on the future of cryptocurrency regulation is shaped by his extensive legal experience and his role at Ripple during a pivotal time for the industry. Here are key insights on what the future may hold for cryptocurrency regulation:

Need for clear regulatory frameworks

Alderoty emphasizes the critical need for clear and comprehensive regulations governing digital assets. The current regulatory environment is often described as murky, leading to confusion among industry participants. He argues that a well-defined framework would provide certainty for businesses and investors, fostering innovation while ensuring consumer protection.

Potential for legislative action

Alderoty is optimistic about the possibility of legislative action at the federal level. He believes that recent bipartisan efforts in Congress indicate a growing recognition of the importance of regulating cryptocurrencies in a manner that supports innovation. Such legislative efforts could establish clearer definitions and classifications for digital assets, reducing ambiguity in the market.

Impact of legal precedents

The outcomes of ongoing legal battles, particularly Ripple’s case with the SEC, will likely set significant precedents that could influence future regulations. Alderoty suggests that favorable rulings for Ripple could pave the way for a more favorable regulatory environment for other cryptocurrency projects, helping to legitimize the industry and attract investment.

Collaboration between regulators and industry

Alderoty advocates for a collaborative approach between regulators and the cryptocurrency industry. He believes that engaging with regulatory bodies can lead to more effective and sensible regulations that consider the unique aspects of blockchain technology. Such collaboration could help bridge the gap between innovation and regulation.

Focus on consumer protection

As the regulatory landscape evolves, there will likely be an increased focus on consumer protection. Alderoty highlights that while fostering innovation is essential, ensuring that consumers are protected from fraud and market manipulation must also be a priority. Clear guidelines can help instill trust in the market, encouraging more individuals to participate in the digital economy.

Global regulatory perspectives

The future of cryptocurrency regulation may also be influenced by global perspectives. As different countries adopt varying regulatory approaches, Alderoty points out that international collaboration could lead to harmonized standards. This global approach would benefit companies operating in multiple jurisdictions and help create a consistent regulatory environment.

Technological advancements and regulatory adaptation

As the cryptocurrency space continues to evolve with technological advancements, Alderoty notes that regulators must also adapt. Innovations such as decentralized finance (DeFi), non-fungible tokens (NFTs), and central bank digital currencies (CBDCs) present new challenges that require regulatory considerations. A proactive regulatory approach can help address these emerging trends effectively.

Stuart Alderoty’s contributions to Ripple and the broader cryptocurrency landscape are significant as he navigates the complex regulatory challenges facing the industry. His advocacy for clear regulations and unity within the crypto community underscores the need for a balanced approach that fosters innovation while ensuring consumer protection. As the financial technology landscape continues to evolve, Alderoty’s insights and leadership will be vital in shaping the future of digital assets.

By championing a collaborative approach to regulation, Alderoty not only enhances Ripple’s position but also helps steer the cryptocurrency industry towards a more transparent and promising future.

Continue to follow Blockchain Global Network to update new information and knowledge about the investment financial market every day.

RELATED POSTS

Solayer Airdrop – Secrets to Maximizing Profits

To maximize profits from the...

Rainbow Airdrop – A-Z Guide to Receiving Tokens

Rainbow Airdrop is an exciting...

Sonic SVM Airdrop: Eligibility, Timeline, and How to Get Involved

The Sonic SVM Airdrop presents...

GMCoin Airdrop: A great opportunity to earn free GMC Tokens

The GMCoin Airdrop offers a...

Pi Network Officially Listed on OKX – Price Fluctuations and Forecast

Pi Network has officially been...

Remis Launches: A New Era in GameFi Innovation

On February 1, 2025, Remis...

Zotto Airdrop – Accelerating Meme Coin Trading

The Zotto Airdrop is attracting...

Blockchain and AI Hub complex in Hanoi – SSI Digital Ventures Commits to Supporting 200 Million USD

SSI Digital Ventures has launched...

Cow DAO base L2 chain launch: Faster, cheaper and more scalable blockchain

The Cow DAO Base L2...

ICMP Protocol: Important protocol in network management

The ICMP Protocol (Internet Control...

AI Agents: Automation solutions for Web3 platforms

Artificial intelligence is ushering in...

Yala Airdrop – A Great Opportunity to Earn Free Tokens Today

Discover Yala Airdrop now –...

Essential Blockchain Technology Example Cases You Should Know

Blockchain technology example is everywhere,...

What is a decentralized exchange?

What is a decentralized exchange?...

Trump Token and Justin Sun’s Role: Unraveling the Controversy

The Trump Token, tied to...

Barron Trump Crypto Scam: How the DJT Token is Raising Red Flags

The Barron Trump Crypto Scam...