ACA Coin is a vital cryptocurrency within the Acala Network ecosystem, a prominent DeFi platform built on Polkadot. Aimed at developing decentralized financial applications, ACA Coin not only facilitates transaction fee payments but also plays a role in governance and provides liquidity for DeFi services. This article will help you explore “What is ACA Coin?”

What is Acala Network?

Acala Network is a blockchain network built on the Polkadot platform, with the goal of providing decentralized financial (DeFi) services to users. It supports payments, borrowing, stablecoin issuance, and yield farming. Acala operates through a closed ecosystem, allowing users to engage in financial activities without relying on traditional financial institutions.

With Acala, users can access financial tools such as the aUSD stablecoin (a USD-pegged stablecoin), enabling them to store assets in a stable currency. Additionally, Acala supports staking, allowing users to contribute assets to the platform in exchange for rewards, as well as other financial transactions like borrowing and lending.

Key components of Acala Network

Acala Network is a DeFi platform built on the Polkadot ecosystem, offering flexible and optimized financial services. To accomplish its goals, Acala Network comprises several key components, which contribute to the power and flexibility of the ecosystem. Below are the main components of Acala Network:

aUSD Stablecoin

A standout feature of Acala Network is the aUSD stablecoin, issued by the platform. aUSD is designed to maintain a stable value, helping users minimize the risks of price volatility in DeFi transactions. This stablecoin can be used for trading, collateral in loans, and is supported by a flexible collateral system.

Features of aUSD:

- Stable Value: aUSD maintains its value close to USD, thanks to a stability mechanism backed by collateral.

- Used as Collateral: Users can use assets as collateral to mint aUSD or use aUSD in decentralized financial transactions.

- DeFi Ecosystem Use: aUSD is utilized in services such as lending, borrowing, staking, and yield farming within the Acala platform.

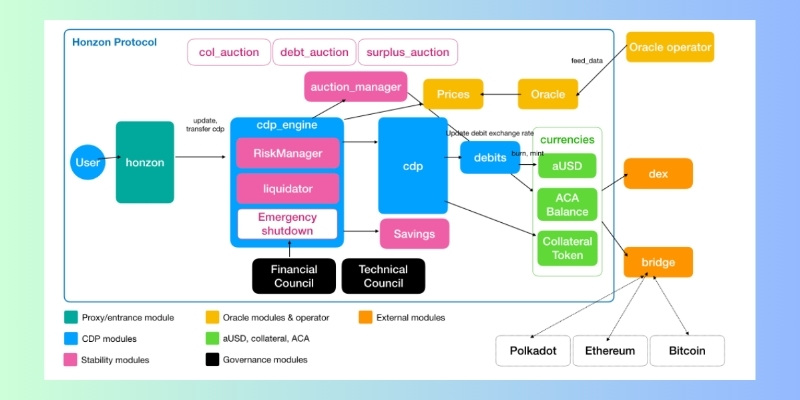

Honzon Protocol

The Honzon Protocol is the primary protocol responsible for issuing the aUSD stablecoin on Acala. This protocol enables users to use their assets as collateral to mint aUSD. Honzon Protocol uses asset management mechanisms and other tools to ensure the stability of aUSD while minimizing risks.

How it works

- Users deposit valuable assets (such as DOT or ACA) into the Honzon system as collateral.

- The protocol then issues an amount of aUSD equivalent to the value of the collateral.

- Users can use aUSD for financial transactions or redeem collateral once aUSD is repaid.

Homa Protocol

The Homa Protocol is a vital part of Acala, allowing users to participate in staking and yield farming within the ecosystem. Through Homa, users can stake their assets and earn rewards, while still retaining the ability to use their staked assets in other transactions.

How Homa works

- Users can stake assets (e.g., DOT or ACA) in Homa.

- Homa issues staked tokens (such as LDOT for Polkadot), which can be used in other DeFi transactions or re-staked to earn additional rewards.

- Users maintain access to their assets without needing to withdraw from the system.

Nominated Proof of Stake (NPoS) Governance

Acala uses the Nominated Proof of Stake (NPoS) mechanism for platform governance and operation. With NPoS, ACA token holders can participate in the decentralized governance process of the system. The community has the power to vote and make decisions about updates, protocol changes, and platform developments.

Rights and responsibilities

- Stakers: Those who stake ACA tokens can vote for validators and participate in key governance decisions.

- Validators: Validators are responsible for validating transactions and ensuring the security of the network.

Parachain and Polkadot integration

Acala is a parachain on Polkadot, meaning the platform can connect and interact with other parachains within the Polkadot ecosystem. This capability allows Acala to expand its operations, enhance flexibility in developing financial products, and improve interoperability between different blockchains.

Benefits of Polkadot integration

- Interoperability: Acala can easily communicate with other parachains on Polkadot, facilitating cross-platform transactions and financial services.

- Scalability: Polkadot provides Acala the infrastructure to scale and develop new DeFi products without being limited by the constraints of a single blockchain.

Acala DeFi Hub

Acala offers a DeFi hub where users can access a variety of decentralized financial services. This hub includes tools like lending, borrowing, yield farming, and other financial instruments, all supported by the aUSD stablecoin system.

Features of the Acala DeFi Hub

- Lending/Borrowing: Users can lend or borrow assets in a decentralized environment.

- Yield Farming: Users can participate in yield farming programs to earn profits from staked assets.

What is ACA Coin?

ACA Coin is the native token of Acala Network, playing a crucial role in the operation and support of activities on the Acala platform.

Key metrics of ACA Coin

- Token name: Acala Network

- Token symbol: ACA

- Blockchain: Polkadot

- Token type: Utility, Governance

- Total supply: 1,000,000,000 ACA

- Circulating supply: Updated Later

- Token standard: Updated Later

- Contract address: Updated Later

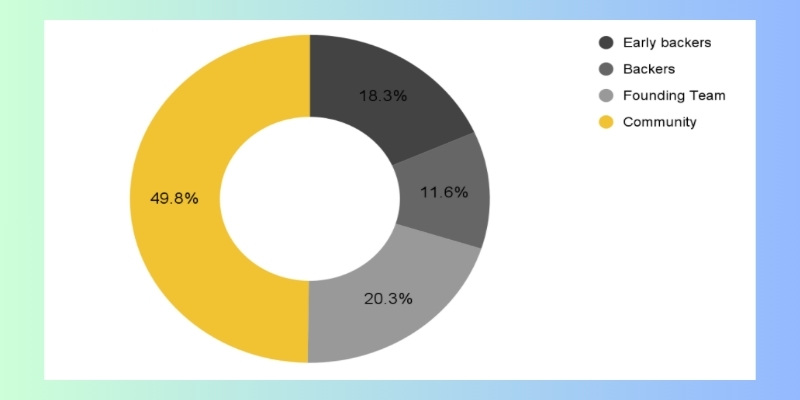

ACA Coin distribution

ACA Coin is distributed in a clear ratio to ensure the sustainable development of the platform. This distribution strategy helps maintain stability and encourage active participation from stakeholders in the ecosystem.

- Early backers: 18.33%

- Investors: 11.56%

- Founding team: 20.25%

- Community: 49.76%

ACA Token sale and Parachain auction

Acala Network held a parachain auction on Polkadot to raise community support. Participants in the Crowdloan campaign received ACA Coin as rewards. The token distribution from the auction follows a clear schedule.

- Vesting: 80% of ACA from the auction will be distributed linearly over the duration of the parachain slot lease.

- Total reward: 17% of total ACA supply will be allocated to reward auction participants.

- Conversion rate: The average conversion rate is DOT 1:3 ACA, but may vary based on the participant’s contribution.

- Liquidity: 20% of ACA from the auction will be unlocked immediately for use in Acala’s DeFi applications.

Applications of ACA Coin

ACA Coin plays a vital role in both governance and utility within the Acala Network.

Governance: ACA Coin holders can participate in platform governance, including voting on critical issues such as:

- Network fees.

- Election of Acala’s governance council members.

- Approval of updates and protocol changes.

Utility: ACA Coin also serves practical uses within the Acala ecosystem:

- Transaction fee payments: Users can pay transaction fees using ACA.

- Staking and rewards: ACA can be staked to earn rewards and help secure the network.

- Collateral: ACA can be used as collateral for engaging in DeFi services on Acala.

Development team of Acala Network

Acala Network is developed by the Acala Foundation, a non-profit organization aiming to build decentralized financial (DeFi) solutions within the Polkadot ecosystem. The founding team includes:

- Fuyao Jiang – Co-founder and CEO: A blockchain and cryptocurrency expert with extensive experience in DeFi platform development.

- Riutao Su – Co-founder and CTO: A blockchain technology and protocol expert.

- Bryan Chen – Community development director: Manages community and DeFi project development, connecting investors and users.

Additionally, Acala has a skilled team of engineers and blockchain experts ensuring the project’s steady growth.

Partners and investors

Strategic partners

- Polkadot: A blockchain platform enabling seamless integration with parachains.

- Kusama: A testing platform for new features.

- Chainlink: An oracle that provides off-chain data.

- SushiSwap: Collaborates on liquidity and trading.

Leading investors

- Coinbase ventures: An investment arm of Coinbase.

- Pantera capital: A fund dedicated to blockchain investments.

- Spartan group: A strategic investment fund.

- Web3 foundation: Provided support from the early stages

Development roadmap

Acala Network has a well-defined development roadmap, divided into the following phases:

Phase 1 (2019-2020)

- Project launch, foundational development, and community building.

- Release of Acala Testnet and securing investments from major funds.

Phase 2 (2021)

- Launch of Mainnet and participation in Polkadot parachain auctions.

- Issuance of ACA Coin and aUSD.

Phase 3 (2022-2023)

- Enhancing cross-chain compatibility and developing DeFi products like staking and lending.

- Expanding community and strategic partnerships.

Phase 4 (2024 and beyond)

- Comprehensive ecosystem development with improved scalability and security.

- Strengthening global collaborations to advance Acala’s growth.

ACA Coin plays a crucial role in Acala Network’s DeFi ecosystem. It serves not only as a payment tool but also as a governance token to optimize financial services and operations within the platform. With consistent growth and platform upgrades, ACA Coin is an attractive option for investors looking to enter the DeFi world and leverage the potential of Polkadot.

This article by Blockchain Global Network has thoroughly explained “What is ACA Coin?” If you have any questions, feel free to leave a comment, and we’ll assist you promptly! Best of luck!

RELATED POSTS

Easily Join the TENEO Airdrop with This Step-by-Step Guide

The TENEO Airdrop is a...

Kelp DAO Airdrop – How to Earn Money from Kelp Miles

The Kelp Miles program within...

U2U Token Price Prediction: Understanding the Factors Behind Its Future Growth

The world of cryptocurrency is...

What is Karak? Guide to joining Restaking

In the dynamic cryptocurrency market...

SEC to Host Second Crypto Meeting on April 25

The U.S. Securities and Exchange...

Peer-to-Peer Learning Unlocked: Harnessing Blockchain for Collaborative Education

Blockchain's role in peer-to-peer learning:...

Vessel Finance: The DEX with near-zero gas fees

In the ever-evolving world of...

Arch Network Airdrop: Detailed guide on how to participate

Arch Network is an innovative...

Zotto Airdrop – Accelerating Meme Coin Trading

The Zotto Airdrop is attracting...

Memefi Coin Airdrop: Airdrop Timeline and Launch of Memefi Token

The Memefi Coin Airdrop presents...

Blum Airdrop – A Ready Guide to Earning Tokens

Blum Airdrop is a fantastic...

Yala Airdrop – A Great Opportunity to Earn Free Tokens Today

Discover Yala Airdrop now –...

Kraken Launched Layer 2 Ink with $25 Million Support from Optimism

In a landmark move within...

How to join crypto airdrops for maximum returns

Crypto airdrops offer a unique...

How does blockchain technology help organizations when sharing data

Wondering “How does blockchain technology...

2024 US Election Results – Political Shock and the Future of Cryptocurrency

The 2024 US election results...