Curious about what is the cryptocurrency market? This innovative financial arena involves the trading of digital currencies that operate independently of traditional banking systems. Utilizing blockchain technology, the cryptocurrency market offers a decentralized and transparent platform for financial transactions. Explore our comprehensive guide to understand the basics of cryptocurrency, how it functions, and what makes it a unique and evolving market.

What is the Cryptocurrency Market?

Basics of Cryptocurrency

Cryptocurrency, often simplified as crypto, represents a revolutionary approach to digital currency. It leverages the power of cryptography, a sophisticated system of secure communication techniques, to ensure secure transactions and control the creation of new units. Unlike traditional currencies issued by governments, cryptocurrencies operate independently of central banks and financial institutions. This decentralized nature forms a cornerstone of their appeal, promising greater user autonomy and control over financial assets.

Definition and Decentralized Nature

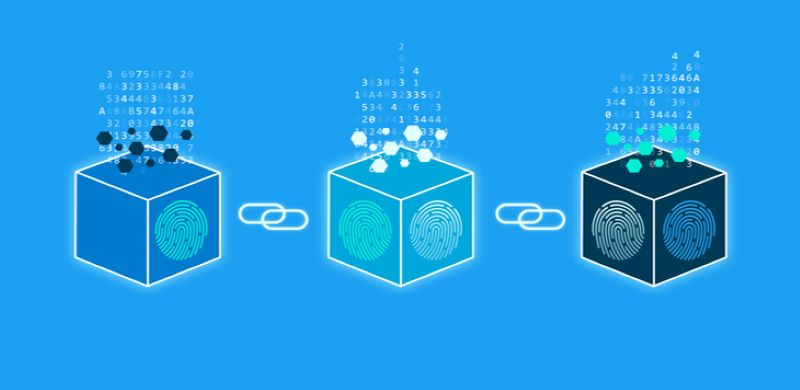

At its core, cryptocurrency is digital money designed to be used as a medium of exchange. It exists only in digital form and relies on a technology called blockchain to record and verify transactions. Blockchain, in essence, acts as a public, distributed ledger, maintaining a transparent and tamper-proof history of every transaction. This underlying technology eliminates the need for intermediaries like banks, fostering a more direct and transparent financial system.

Different Types: Coins and Tokens

The world of cryptocurrency encompasses a vast array of digital assets, each with its unique characteristics and functionalities. Broadly, these assets can be categorized into coins and tokens. Coins, such as Bitcoin and Litecoin, function as independent cryptocurrencies with their dedicated blockchains. They primarily serve as mediums of exchange or stores of value.

Tokens, on the other hand, often reside on existing blockchains, such as Ethereum’s ERC-20 standard. They represent a broader spectrum of assets or utilities, encompassing everything from governance rights within a decentralized platform to representations of real-world assets like securities or commodities.

How Transactions Work on the Blockchain

Imagine a digital ledger replicated across a vast network of computers. When you initiate a cryptocurrency transaction, it gets broadcast to this network. Specialized nodes, often referred to as miners, verify and add the transaction to a block. This process involves solving complex mathematical problems, ensuring the security and integrity of the blockchain.

Once verified and added to a block, the transaction becomes a permanent part of the blockchain’s history, visible to all participants. This transparency contributes to the trust and immutability associated with cryptocurrency transactions.

Different Facets of the Cryptocurrency Market

The cryptocurrency market, much like traditional financial markets, provides platforms where buyers and sellers can converge to trade various cryptocurrencies. These platforms can be broadly categorized as centralized exchanges (CEXs) and decentralized exchanges (DEXs). Each type offers distinct advantages and disadvantages, catering to different trading preferences and risk tolerances.

Centralized Exchanges (CEXs)

CEXs act as intermediaries, facilitating trades between buyers and sellers. They provide a user-friendly interface, often resembling traditional stock trading platforms, allowing users to buy and sell cryptocurrencies using fiat currencies or other cryptocurrencies.

How CEXs Operate and Their Advantages

CEXs typically require users to create accounts and complete Know Your Customer (KYC) verification processes, complying with regulatory standards. They offer features like order books, charting tools, and various order types, enhancing the trading experience. The centralized nature of CEXs allows for faster transaction speeds and higher liquidity, as they manage the order matching and execution process.

Examples of Popular CEX Platforms

Some of the most renowned CEX platforms include Binance, Coinbase, and Kraken. These platforms have garnered significant user bases and trading volumes, offering a wide selection of cryptocurrencies and diverse trading pairs.

Decentralized Exchanges (DEXs)

DEXs embody the decentralized ethos of cryptocurrency, aiming to eliminate intermediaries and give users direct control over their assets. They operate on blockchain networks, leveraging smart contracts to facilitate peer-to-peer trading.

The Concept of DEXs and Their Benefits

DEXs typically do not require account creation or KYC procedures, offering greater anonymity and privacy. Users retain custody of their funds throughout the trading process, reducing the risk of hacks or breaches that can occur on centralized platforms.

Key Differences between CEXs and DEXs

The core distinction lies in their approach to custody and control. CEXs prioritize user experience and efficiency, while DEXs emphasize decentralization and user autonomy. The choice between CEXs and DEXs often hinges on an individual’s trading preferences, risk tolerance, and desired level of privacy.

Weighing the Potential and Risks of Cryptocurrency Investments

The cryptocurrency market, while promising significant growth potential, presents a unique set of risks and challenges. Understanding these risks and approaching investments with caution is paramount to navigating this volatile landscape.

Advantages of the Cryptocurrency Market

Cryptocurrency investments have garnered significant attention due to their potential for high returns. The nascent nature of this asset class, coupled with its increasing adoption and technological advancements, has attracted investors seeking to capitalize on its growth trajectory.

Potential for High Returns and Investment Growth

Historically, cryptocurrencies have demonstrated remarkable price appreciation. Bitcoin, for instance, has witnessed exponential growth since its inception. This potential for high returns, however, is often accompanied by significant price volatility.

Transparency and Security of Blockchain Technology

Blockchain technology, the backbone of cryptocurrencies, provides transparency and security. Transactions are recorded on a public ledger, accessible to anyone. The immutability of the blockchain makes it difficult for malicious actors to alter or manipulate transactions.

Accessibility and Global Reach

Cryptocurrencies transcend geographical boundaries, enabling anyone with an internet connection to participate in the market. This accessibility has opened up investment opportunities to a wider audience, fostering financial inclusion.

Risks to Consider Before Investing

The cryptocurrency market is characterized by extreme volatility. Prices can fluctuate dramatically within short periods, leading to significant gains or losses. This volatility stems from various factors, including market sentiment, regulatory news, and technological advancements.

Volatility and Price Fluctuations

Investing in cryptocurrencies requires a high-risk tolerance and an understanding that investments can lose value rapidly. It is crucial to invest only what you can afford to lose and to avoid investing based solely on hype or speculation.

Regulatory Uncertainty and Potential for Scams

The regulatory landscape surrounding cryptocurrencies is evolving and varies significantly across jurisdictions. This uncertainty can create challenges for investors and businesses operating in the space.

Importance of Due Diligence and Responsible Investing

Before investing in any cryptocurrency project, conduct thorough research. Understand the project’s whitepaper, the team behind it, its market capitalization, trading volume, and community sentiment. Numerous online resources and communities provide valuable insights and analysis.

How to Navigate the Cryptocurrency Market Safely and Effectively

Navigating the cryptocurrency market requires prudence, informed decision-making, and a commitment to continuous learning. Implementing risk management strategies and staying abreast of market trends are crucial for long-term success in this dynamic landscape.

Choosing a Reputable Cryptocurrency Exchange

The first step involves selecting a reputable cryptocurrency exchange that aligns with your trading needs and security expectations. Consider factors like trading fees, security measures, user interface, available cryptocurrencies, customer support, and platform reputation.

Factors to Consider When Selecting a Platform

Research different exchanges, compare their features, and read user reviews to gain insights into their strengths and weaknesses. Opt for exchanges with a proven track record of security, regulatory compliance, and a strong reputation within the cryptocurrency community.

Security Measures and User Experience

Prioritize exchanges that employ robust security measures, such as two-factor authentication, cold storage for digital assets, and rigorous KYC/AML procedures. A user-friendly interface, intuitive trading tools, and responsive customer support can significantly enhance your trading experience.

Conducting Thorough Research

Investing in a cryptocurrency solely based on its price or hype can lead to substantial losses. Every investment decision should be grounded in thorough research and a comprehensive understanding of the underlying project.

Evaluating Different Cryptocurrencies and Projects

Evaluate the problem the project aims to solve, the technology behind it, its competitive landscape, the team’s expertise, and the project’s roadmap. Understanding these aspects will help you make more informed investment decisions.

Understanding Whitepapers, Team Credibility, and Market Sentiment

A project’s whitepaper outlines its technical architecture, vision, and goals. Scrutinize the whitepaper, assessing its feasibility, innovation, and potential impact. The credibility and experience of the team behind a project are crucial indicators of its potential for success.

Implementing Risk Management Strategies

Investing in cryptocurrencies should always be approached with a long-term perspective and a clear understanding of the associated risks. Diversifying your portfolio, investing only what you can afford to lose, and avoiding emotional trading are essential practices.

Setting Realistic Investment Goals and Diversifying Your Portfolio

Avoid putting all your eggs in one basket by spreading your investments across different cryptocurrencies and asset classes.

Importance of Staying Informed about Market Trends

The cryptocurrency market is constantly evolving. Staying informed about industry news, technological advancements, regulatory changes, and market trends will enable you to make more informed investment decisions and adapt to the ever-changing landscape. Remember, success in the cryptocurrency market requires a combination of knowledge, prudence, and a willingness to embrace the dynamic nature of this nascent asset class.

Get the Latest Blockchain Trends – Follow Blockchain Global Network and Stay Informed.

RELATED POSTS

Blockchain and AI Hub complex in Hanoi – SSI Digital Ventures Commits to Supporting 200 Million USD

SSI Digital Ventures has launched...

Exploring the Growth of the Blockchain Technology Market in 2024

The blockchain technology market is...

Why is Solana Going Up – Unveiling 3 Potentials of Solana

Why is Solana Going Up?...

The Future of Decentralized Finance: Key Trends for 2025

The decentralized finance (DeFi) landscape...

DuckChain Airdrop: Great opportunity to get free Tokens

In the context of rapid...

Launch of Grass Season 2: Exciting Airdrop opportunities

Following the remarkable success of...

Stuart Alderoty: His role at Ripple

Discover Stuart Alderoty, Chief Legal...

Trump Bitcoin reserve: A game changer for U.S. economy

The Trump Bitcoin reserve proposal...

D8X Airdrop – Opportunity to Receive Free WEETH and STUSD

Join the D8X Airdrop now...

Bitcoin Golden Cross – Strategic Investment Solution

The Bitcoin Golden Cross is not...

How does Robinhood work? The Gateway to Blockchain

In today’s rapidly evolving financial...

Unlocking Value in Play to Earn Blockchain Games

The gaming landscape is undergoing...

BoxBet Airdrop – Your Ultimate Guide to Earning BXBT Tokens

The BoxBet Airdrop is making...

Essential Blockchain Technology Example Cases You Should Know

Blockchain technology example is everywhere,...

Kishu Inu Coin: A guide to investing in this Meme Token

Discover Kishu Inu Coin, a...

Wormhole Airdrop – Take Advantage of 3 Valuable Investment Opportunities

Wormhole Airdrop is not only...