The 2024 US election results are creating a significant political shock, profoundly impacting the future of the cryptocurrency market. Trump’s victory promises to bring powerful changes to digital assets in the near future.

2024 US Election Results

Who won the 2024 US election và the voting situation

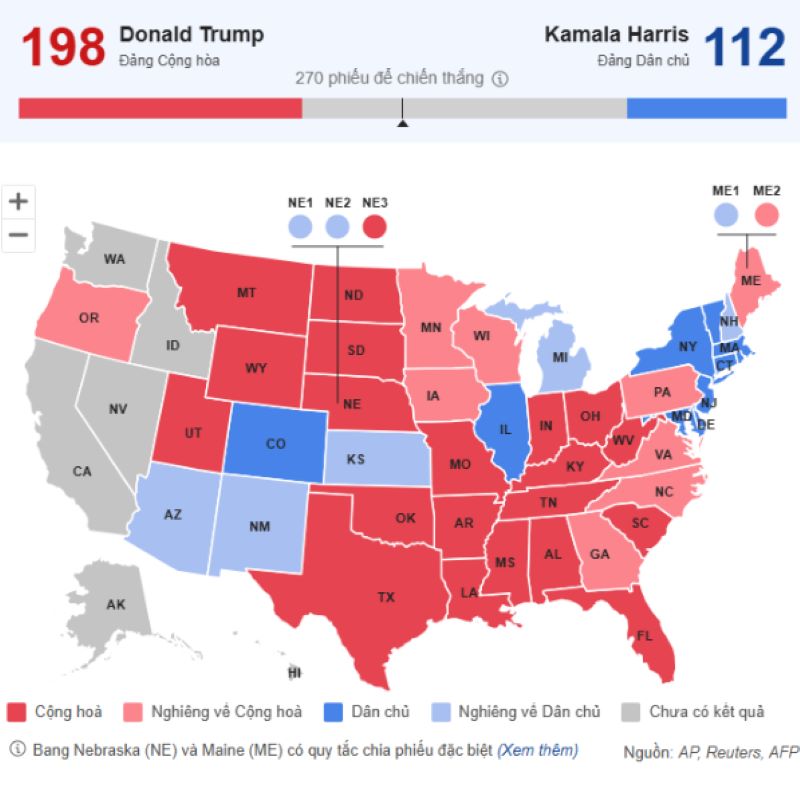

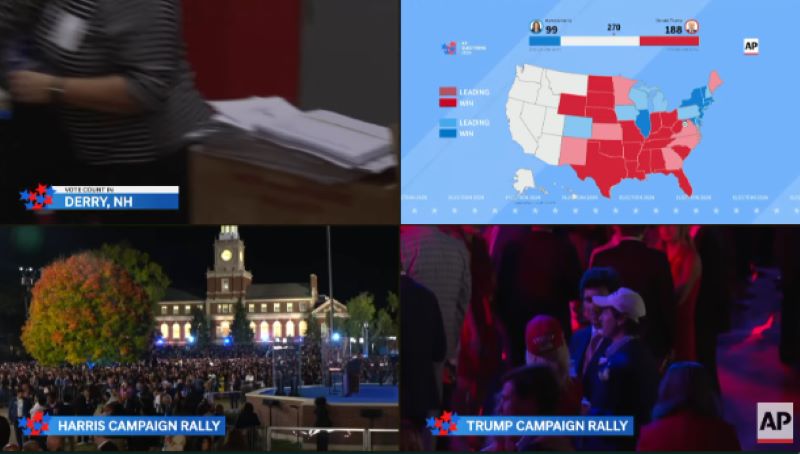

As of 11 AM on November 6, 2024, Vietnam time, the situation regarding the 2024 U.S. presidential election is unfolding with significant developments:

- Preliminary Results: Donald Trump, the Republican candidate, has secured 178 electoral votes, while Kamala Harris, the Democratic candidate, has only 99 votes. Trump is leading in several key states such as Florida and Texas, where he has won with a high percentage of the vote.

- Close Race: Polls indicate that the competition between the two candidates is very tight, especially in swing states. While Trump currently leads in electoral votes, Harris still has a chance to win in high electoral vote states like New York and California.

- Voting Situation: Polling places have closed in 41 states so far, with some battleground states like Michigan and Pennsylvania still not having clear results. Voter turnout has been notably high, particularly in Michigan and Georgia.

- Misinformation Issues: The FBI has issued warnings about the spread of misinformation related to the election, including fake videos about voting machine malfunctions.

This year’s election is considered one of the closest races in U.S. history, with many factors influencing the final outcome.

Two Key Factors Determining Donald Trump’s Victory

Trump’s Promises on Monetary and Digital Financial Policies

- Donald Trump has committed to promoting monetary and digital financial policies aimed at creating a favorable environment for the development of the cryptocurrency market. He has criticized current interest rates as being too high and promised to pressure the Federal Reserve (Fed) to loosen monetary policy if re-elected.

- This approach would not only alleviate financial burdens on consumers but also encourage businesses to invest in new technologies, including blockchain and cryptocurrencies. Trump’s strong support for Bitcoin mining and his plan to establish a national Bitcoin reserve also demonstrate his commitment to making the U.S. a leading hub for digital assets. These promises could attract interest from investors and voters, especially those seeking a more stable economy.

Voter Expectations Regarding Economy and Technology

- American voters are increasingly concerned about the economic situation and technology, particularly in the context of rising inflation and escalating living costs. Trump has asserted that if re-elected, he will implement measures such as tax cuts, regulatory rollbacks, and domestic production incentives, which are expected to bring economic recovery.

- He also emphasizes that adopting new technologies, including blockchain technology, will create job opportunities and sustainable economic growth. This voter expectation could serve as a significant motivation for Trump’s campaign as they look for a candidate capable of addressing current economic issues and fostering innovation in technology.

In summary, Trump’s promises of a cryptocurrency-friendly monetary policy combined with voter expectations for economic reform and technological advancement could be crucial factors leading to his victory in the 2024 presidential election.

The impact of the 2024 US election results on the Crypto market

Predicted Impact on the Global Blockchain Market

The outcome of the U.S. election with a victory leaning towards Donald Trump could significantly impact the global blockchain market as follows:

- Increased Investment and Development in Blockchain Technology: Trump may promote pro-cryptocurrency policies, creating a favorable regulatory environment for the development of blockchain technology. Government support could encourage businesses and investors to engage in this field, leading to increased investment in blockchain and cryptocurrency projects. According to experts, if Trump is re-elected, the price of Bitcoin could reach $125,000 by the end of the year, driven by investor optimism and the legal reforms he might implement.

- Establishing a Clear Regulatory Framework: A Trump administration is likely to appoint financial agency leaders who have a positive attitude towards cryptocurrencies, such as a crypto-friendly SEC chair. This would help create a clearer regulatory framework for digital assets, reducing legal barriers and encouraging more institutional investors to participate in the market. Regulatory clarity will enhance investor confidence and facilitate sustainable development of the global blockchain market.

- Impact on Cryptocurrency Values: When Trump was leading in the election, the price of Bitcoin surged to a new record high, reaching around $75,000. If he wins, many analysts predict that Bitcoin’s price will continue to rise sharply, potentially exceeding $90,000 shortly after the election. This optimism is expected to not only affect Bitcoin but also drive growth in other cryptocurrencies like Ethereum and major altcoins.

In summary, 2024 US election results with Trump’s victory, the global blockchain market may experience significant advancements due to pro-cryptocurrency policies, clearer regulatory frameworks, and positive impacts on cryptocurrency values.

The Surge in Value of Digital Currencies

With the results of the 2024 U.S. election leaning towards Donald Trump, the cryptocurrency market has witnessed a significant surge in value, particularly for Bitcoin and Ethereum.

- Increase in Bitcoin and Other Currencies: On November 6, 2024, the price of Bitcoin soared to a new record high of approximately $75,000. This increase reflects investor optimism regarding Trump’s potential re-election. According to data from Coinmarketcap, Bitcoin rose nearly 5% within just 24 hours, with trading volume reaching a high of $48.76 billion. Other cryptocurrencies, such as Ethereum, also recorded significant gains, reaching around $2,600, an increase of nearly 8% during the same period.

- Market Sentiment and Expectations: Market sentiment on election day shifted to “greed,” indicating increased buying pressure as investors grew confident in Trump’s chances of winning. Analysts predict that if Trump wins, the price of Bitcoin could continue to rise to as much as $90,000 shortly after the election. Conversely, if Kamala Harris wins, Bitcoin’s price might drop to around $50,000. This illustrates the cryptocurrency market’s sensitivity to political outcomes.

- Long-term Impact on the Market: This surge in value is not just an immediate reaction but could also create a sustainable growth trend for the cryptocurrency market in the future. In previous elections, Bitcoin has experienced strong returns shortly after election results are announced. If Trump implements pro-cryptocurrency policies as promised, this could bolster investor confidence and promote the development of blockchain projects.

In summary, the surge in value of digital currencies ahead of the 2024 U.S. election results with a Trump victory not only reflects investor optimism but also indicates strong growth potential for the cryptocurrency market in the future.

Promising Electronic Monetary Policy Under Donald Trump’s Administration

The victory of Trump in the 2024 US election results brings many promising prospects for his monetary policy, including:

- Establishing a Cryptocurrency-Friendly Regulatory Environment: Trump has committed to creating a clear and favorable regulatory framework for digital assets. This includes appointing financial agency leaders who have a positive attitude towards cryptocurrencies, such as a crypto-friendly SEC chair. Regulatory clarity will help reduce existing legal barriers and encourage institutional investors to participate in the cryptocurrency market, thus promoting the development of blockchain technology.

- Encouraging Bitcoin Mining and DeFi Development: Before the 2024 US Election Results, Trump has emphasized the importance of Bitcoin mining in the U.S. and plans to establish a national “Bitcoin reserve.” He also supports decentralized finance (DeFi) initiatives aimed at disrupting traditional financial models. This will not only create many job opportunities but also help the U.S. maintain its leading position in the global cryptocurrency sector.

- Enhancing Engagement with the Cryptocurrency Community: During his campaign, Trump has taken steps to reach out to the cryptocurrency community, including accepting donations in cryptocurrency and promoting new trading platforms like World Liberty Financial. This engagement not only attracts attention from cryptocurrency supporters but also creates a new voter base, particularly among young people and social media influencers.

- Impact on Cryptocurrency Values: If Trump implements these policies after 2024 US Election Results, the value of Bitcoin and other digital currencies could continue to rise sharply. Many experts predict that if Trump is re-elected, the price of Bitcoin could reach $90,000 or more, driven by investor optimism and the favorable regulatory environment he creates.

Trump’s promising electronic monetary policy could lead to significant changes in the cryptocurrency industry, from establishing a friendly regulatory environment to encouraging mining and developing new technologies. If successful, these policies could benefit the financial market and reinforce the U.S.’s position in the global technology landscape.

So, the President of the United States in 2024 is who? The results have leaned towards Donald Trump. With this victory in 2024 US election results, his pro-crypto policies could reshape regulations and boost investment in digital assets. The Blockchain Global Network emphasizes that this change may mark a pivotal moment for the industry as it navigates new political and economic contexts.

RELATED POSTS

Gala Airdrop and 6 Tips to Maximize Gala Game Rewards

To maximize rewards from the...

Unlocking Value in Play to Earn Blockchain Games

The gaming landscape is undergoing...

What is Tokenized Real Estate? – Unlocking Global Investment Opportunities

What Is Tokenized Real Estate?...

Gradient Network Airdrop – How to Earn Points and Receive Rewards

Are you ready to dive...

Reya Network Airdrop – Guide to Participate and Profit Before Launch

Do you want to profit...

Is Ledger Nano X Safe? Ledger Nano X vs Ledger Nano S

The Ledger Nano X is...

Zircuit Airdrop – Breakthrough Potential for Early Investors!

Zircuit Airdrop is not just...

Sonic Labs Airdrop – Discover the Super HOT Token Burn Mechanism

One of the highlights of...

Hemi Network Airdrop – How to Easily Earn Airdrops?

The Hemi Network Airdrop presents...

Bitcoin surges to $72,000 ahead of the U.S. elections

Bitcoin has experienced an impressive...

Kroma Airdrop Season 2 – Opportunity to Earn KRO and Explore Web3

Kroma Airdrop Season 2 is...

Grindery Airdrop – Earn G1 and GX Tokens Easily!

Grindery airdrop, supported by Binance...

How to create a Meme Coin on Pump.fun: A Simple Guide

Meme Coins are a booming...

Cryptocurrency Ro Khanna and the future of regulation

Discover how cryptocurrency ro khanna...

Memefi Coin Airdrop: Airdrop Timeline and Launch of Memefi Token

The Memefi Coin Airdrop presents...

Milena Mayorga: Influential person in El Salvador politics

Milena Mayorga, a prominent figure...