Imagine having the key to everyone’s digital vault. So, what is a 51% attack? It’s a real threat where a single entity gains control over most of a blockchain’s mining power, endangering its security and trust. Understanding this risk is vital in protecting your crypto assets from potential harm.

Understanding the Mechanics of a 51% Attack

Exploring How Hash Power Concentration Can Lead to Major Vulnerabilities

Picture a game where one team starts making all the rules. That’s what happens in a 51% attack on a blockchain. The blockchain runs on rules everyone must follow. But what if someone got more than half of the power? They could change the rules to suit them.

The power here is hash power, the key to adding new blocks of transactions. More hash power means more control. If someone has over half, they can block new transactions or reverse old ones. This is double spending in crypto. It means spending the same coin twice. It’s like being able to spend the same dollar bill over and over at different shops.

The Role of Mining Pools in Facilitating Majority Attacks on Blockchains

Now, where do people get so much power? The answer is mining pools. These are groups of miners who combine their power. They do this to have a better shot at adding new blocks. When they win, they share the reward.

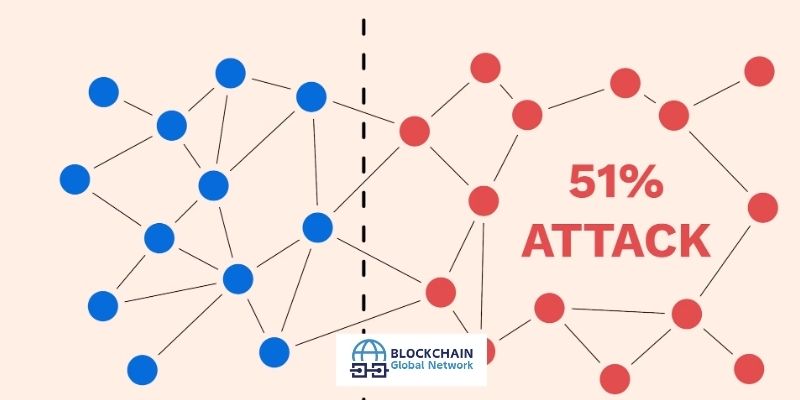

But there’s a catch. A big mining pool could get too powerful. Imagine one pool gets too big and ends up with over half the power. That’s when they can push around the rest and have control. This is what we call a majority attack in blockchain.

So, how do we keep this from happening? We work to keep the power spread out. That’s network decentralization importance. It means no one has enough power to boss everyone else around.

To stay safe, blockchains need rules that protect against these big pools. These are blockchain security measures. Think of them as guardrails that keep the game fair for everyone.

In the end, if someone tries to take over, it can shake trust in blockchain technology. People need to know that their crypto is safe and that the rules won’t suddenly change. That trust is what holds everything together. Small miners, big pools, and everyone who uses crypto all rely on this trust.

Now you know how a 51% attack can happen and why we all have a stake in stopping it. It’s a teamwork that could keep the game fair and safe for everyone involved.

The Consequences of a 51% Attack on Blockchain Integrity and Value

How Double Spending Erodes Trust in Cryptocurrency Platforms

When someone controls more than half of a blockchain’s mining power, we call it a 51% attack. This attack can break trust in crypto. Trust matters because it’s the backbone of crypto. Without trust, crypto can’t survive. Double spending hits at this very trust.

Here’s how it works. With lots of mining power, one group can change the blockchain. They can spend the same crypto twice, in simple words. This is double spending. It’s like spending the same dollar bill at two shops. Not fair and not safe.

People use crypto for its security. Double spending ruins this idea. If a blockchain gets hit with double spending, people lose faith. They might stop using that crypto, which drops its value. That’s a tough break for everyone invested in it. So, keeping mining power spread out is key. It stops any one group from taking over.

Assessing the Impact of Majority Attacks on Cryptocurrency Market Prices

A 51% attack can shake the whole cryptocurrency market. Let’s look at what happens to market prices during a majority attack. To start, majority attack in blockchain is another name for a 51% attack, cause it’s about control.

When attackers have the power, they can mess with transactions. They hold the key to what gets confirmed. Other miners can’t beat them. It’s a race they always win. If they double spend, that can crash the market. People panic; prices fall. It’s all connected.

To prevent these attacks, we need strong security around blockchain. That means keeping an eye on mining pool dominance. If one mining pool gets too big, that’s trouble. We also need to fix any loopholes in how blockchain decides what’s true – that’s the consensus mechanism flaws.

Keeping crypto safe from a 51% attack is a big deal. It helps everyone who uses, mines, or trades in crypto. It keeps the whole market healthy. After all, if we can’t trust our blockchain, what’s left? That’s why we work on finding and stopping these attacks, no matter how tough they are. We safeguard our networks, and we keep our crypto safe for the day ahead.

Prevention and Mitigation: Strategies to Defend Against 51% Attacks

The Significance of Network Decentralization and Blockchain Security Measures

Think of a blockchain like a town. To keep it safe, you need many guards rather than just a few. This is network decentralization. It means spreading power across many people. For blockchain security, it’s a big deal. We keep our crypto town safer with more guards. We make sure no single group can call the shots.

Why does this matter? If one group grabs too much power, they can hurt the blockchain. They can steal, redo, or mess with transactions. This is the ugly side of blockchain security vulnerabilities. The town is in chaos, and trust in cryptocurrency attacks takes a hit.

So, what do we do? We amp up blockchain security measures. We use tech and rules to keep our guards honest and strong. By setting up roadblocks, we stop any would-be town controllers. This is like locking doors and watching all roads. It’s key to safeguarding against network attacks.

But there’s more! With tech advancing, attacks get smarter. It’s like robbers learning to pick locks. We have to stay ahead. We monitor the town. We look for signs of trouble. When we see them, we act fast!

In short, it’s all about having lots of guards and solid walls. This keeps the town, our blockchain, free from any single ruler.

Leveraging Consensus Mechanisms to Thwart Hashrate Control Risks

Now, onto the heart of our crypto town: consensus mechanisms. Think of these as the town meetings where everyone agrees on what goes in the town record. There are different ways to run these meetings.

First up, we have Proof of Work. This is where guards prove they’ve done their job. They solve puzzles, and the first one gets to record. It’s hard work, but it keeps our record honest.

But there’s a catch. If someone controls more than half the guards, they own the meeting. They twist the record. This is a majority attack in blockchain. It’s when one boss uses mining pool dominance to hurt us all.

How do we stop this? Change the meeting rules. We can shift to Proof of Stake. Here, guards put their own cash down as a promise. If they mess up, they lose their cash. It’s a strong way to keep guards on the straight and narrow. It lowers Proof of Work vulnerabilities.

And there’s more! We can mix Proof of Work and Proof of Stake. This is like having two locks on our door. It makes taking over much harder.

Let’s not forget, we need to keep an eye on those guards. If they start to team up, that’s miner collusion. It’s bad news. We need rules and watchers to stop this.

To wrap up, think of blockchain security like a game of team tug-of-war. The more people pulling on both sides, the safer we are. We use tech and rules to keep things fair. And we always watch for rule-breakers. By doing this, we keep our crypto town free, fair, and trusted.

Detection and Response: Ensuring Crypto Network Resilience

Signs of an Impending 51% Attack and How to Detect Them

Imagine you own a fort. You keep watch, making sure no one takes over. A 51% attack on blockchain is like a siege, where a group aims to control the network. They need more than half of the network’s mining power to do this.

To spot an attack, monitor the hash rate. A sudden spike can warn us. It shows a group is gathering power. Also, watch for miners joining forces. This could mean trouble. High hash power in one pool is a sign too. It can disrupt the balance we need.

But we won’t get scared. We stay alert and keep tabs on the network. If we see these signs, we act fast to protect our blockchain fort.

Crypto Exchanges and Stakeholders: Formulating an Effective Response to Network Disruptions

When our fort is under threat, everyone must play their part. Crypto exchanges and people with stakes in the network must have plans ready. If an attack hits, they must act quickly to keep things running smoothly.

These responses can range from halting trades to switching to a safer network version. It’s like closing the fort gates or moving everyone to a secret chamber. Crypto folks must talk and agree on these plans to stay ready.

Together, they can stop attackers and keep the network safe. It ensures crypto keeps its promise of trust and security. We all have a role. We all help keep our crypto fort unbreakable.

We just dug deep into what a 51% attack means for cryptos. Big power in a few hands can break trust in blockchain. We learned that if some miners join forces, they could double spend and mess up the value big time. But it’s not all doom and gloom. We have defenses like making the network wide and having good security moves. Better rules for how miners agree can stop power grabs. Being on the lookout for attacks and knowing how to handle them keeps crypto strong.

We can’t stop all attacks, but being smart and ready keeps our digital coins safer. Let’s keep our crypto world strong and trusty by staying sharp together.

Join us at Blockchain Global Network and stay ahead in the crypto revolution!

Q&A

What exactly is a 51% attack in cryptocurrency?

A 51% attack refers to a situation where a single entity or group gains control of more than half of a cryptocurrency network’s mining hash rate, which is its computing power. This majority control allows the attackers to manipulate the network, potentially causing double-spending of coins and obstructing other users’ transactions.

How does a 51% attack threaten blockchain security?

Blockchain security relies heavily on decentralization and the difficulty of altering past transactions. A 51% attack undermines these principles, allowing attackers to revise transaction history and prevent new transactions from being confirmed, compromising the integrity and trust in the blockchain.

Can a 51% attack be prevented or mitigated?

While it’s challenging to prevent a 51% attack entirely, there are mitigation strategies such as increasing the number of honest nodes, implementing more robust consensus mechanisms, like proof of stake (PoS) instead of proof of work (PoW), and using network monitoring tools to detect unusual spikes in mining power.

What cryptocurrencies are most vulnerable to a 51% attack?

Cryptocurrencies with a smaller network and lower hash rate could be more susceptible to 51% attacks, as it requires less computational power to gain majority control. Newer or less popular coins, or those with a less distributed mining pool, are typically at greater risk.

Has a successful 51% attack occurred in the past?

Yes, there have been several instances where a 51% attack was successfully conducted. One of the most noteworthy examples includes attacks on networks such as Ethereum Classic, where multiple double-spend attacks resulted in significant financial loss.

RELATED POSTS

Don’t miss out on the DogX, Airdrop to X users

“DogX, Airdrop to X users”...

Challenges of Blockchain in Healthcare: Revolution or Roadblock?

Navigating data security and patient...

Reya Network Airdrop – Guide to Participate and Profit Before Launch

Do you want to profit...

Challenges Facing the Future of Blockchain: What Lies Ahead?

Challenges facing the future of...

Key Challenges in Blockchain Research: Navigating the Uncharted Digital Terrain

Key challenges in blockchain research:...

Kraken Launched Layer 2 Ink with $25 Million Support from Optimism

In a landmark move within...

Unveiling Cryptocurrency’s New Frontier: What is NFT?

What is NFT cryptocurrency? Learn...

Blockchain Trends and Predictions: The Future of Tech Unveiled

"Blockchain trends and predictions: Embracing...

Cryptocurrency Analysis Method: Unveiling Market Trends with Precision

"Gain insights into cryptocurrency analysis...

Solayer Airdrop – Secrets to Maximizing Profits

To maximize profits from the...

How does DALLE work? A Comprehensive guide to AI Art generation

How does DALLE work? This...

Lost Private Key in Blockchain: Unlocking Digital Dilemmas

Lost your private key in...

Humanity Protocol Airdrop: Step-by-step guide to participate

Humanity Protocol is an innovative...

What are distributed systems? Bridging the Gap Between Efficiency and Complexity

In today’s digital age, the...

What Is a Crypto Exchange? Exploring Different Types and Their Functions

Looking to invest in the...

Security of Consensus Mechanisms: Unlocking the Fort Knox of Blockchain Safety

Enhance Blockchain Security: Mitigating Consensus...