What is ESG in crypto? It’s a hot question as digital money takes over. We want our investments to do good, right? ESG stands for Environmental, Social, and Governance. These are the keys for investing in crypto that helps our planet, values people, and follows top rules. Let’s dig deep and see how ESG can make our crypto choices smarter and more useful for everyone. The world of sustainable digital assets can be puzzling, but I’ve got the insight to unlock its secrets. Lean in as we explore why ESG matters in the fast-paced crypto universe.

What is ESG in Crypto?

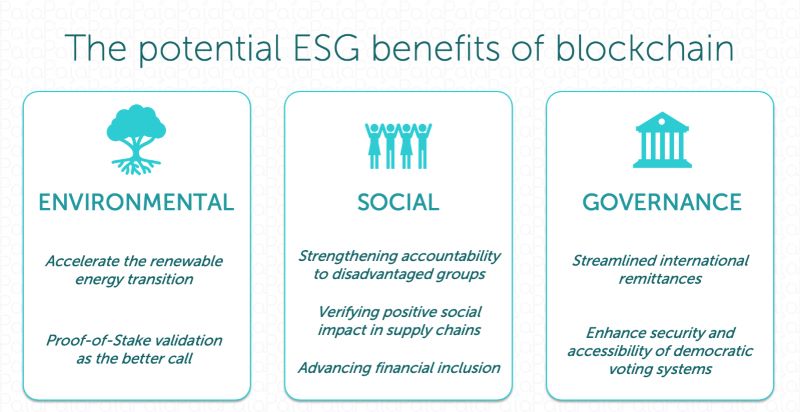

What does ESG stand for? ESG means Environment, Social, and Governance. We see these as big ideas when talking about crypto. Think of ESG like a tall tree. Its roots dive into how we treat our planet; that’s the ‘E’ for ‘Environmental.’ A company’s ‘Social’ role, the ‘S,’ is like the tree’s trunk, holding up its duties to people. Lastly, the ‘Governance,’ the ‘G,’ is the branches that reach out, making sure rules are fair and clear.

Now, what’s ESG doing in crypto? It’s all about heading towards a greener, nicer future. Imagine a world where eco-friendly vibes, honest moves, and caring for folks are baked into cryptos like Bitcoin. That’s ESG’s dream job! For instance, Bitcoin gets slack for eating up tons of power. So, we push for things like sustainable crypto mining. This helps cut back on energy gobbling, which means a happier planet.

How ESG Criteria Apply to Crypto Assets

Do all cryptos care about ESG? Not yet, but many want to spruce up their game. They need to nail ESG criteria to be the good guys in the crypto world. These criteria are like a secret code that tells you if a crypto is thinking about tomorrow. Are they keeping their carbon footsteps small? Are they being pals with the planet by using energy from the sun or wind?

As for the ‘Social’ side, it’s all about having a big heart. Crypto companies can show love by creating jobs or having cool tech that helps people. Lastly, ‘Governance’ gets into the nitty-gritty of keeping things on the up and up. Think honest business moves and no shady dealings—crystal clear, like your best friend’s pool.

People who dig ESG want to make sure their money talks and walks the right path—kind of like picking a cereal that’s good for you and tastes awesome too. That’s where ethical cryptocurrency investment steps in. By choosing cryptos that hug the ESG criteria tight, investors say “yes” to a better world.

So, when you’re looking at cryptos, peek at their ESG scores. These scores are like report cards telling you if they’re rock stars or just meh in being green and good. It’s not just about thinking of today, but also caring for tomorrow. Whether it’s green blockchain initiatives or energy-saving tricks—like the sly wink of green proof of stake—crypto can be about making a buck and being a buddy to the world.

In the end, it’s about being bold enough to stand up for what’s right. And isn’t that the kind of squad we all want to roll with? Remember, a sustainable future is not just a nice-to-have; it’s a must-have. And with that in mind, let’s turn the crypto world green, one digital coin at a time!

The Environmental Component of Crypto

Assessing the Carbon Footprint of Bitcoin and Altcoins

Most folks know Bitcoin eats up more power than whole countries. Altcoins do too, but less. Let’s talk about this energy hunger. Each Bitcoin transaction needs computers to solve hard puzzles. These computers use a lot of electricity, often from coal or gas. That means a big carbon footprint – that’s bad for our air and climate.

But here comes the good part – we’re onto it! Smart people are finding ways to use energy that doesn’t harm our planet. We can mine Bitcoin in places where there’s lots of wind or sun to make clean energy. Many coins now say they want to lower their carbon shoes. This means less icky stuff in the air and happier polar bears.

Advancing Renewable Energy Solutions in Blockchain

So, how do we make crypto green? Look at energy-efficient consensus mechanisms, like green proof of stake. It’s like a race, but instead of running, your coin takes a calm walk and uses less energy. It’s a cool way to agree on new entries in the crypto book without sweating much.

Companies also want high ESG scores. They do this by using sun, wind, and water to power up. This move makes our sky cleaner and our energy better. And guess what? Renewable energy can also save companies a chunk of change. Cha-ching! Better for Earth and pockets.

People want to invest in crypto that cares about our planet. When someone looks to put their money in, they check if it’s ESG friendly. That means finding out who’s using green energy or who’s being most careful with our home, Earth.

To keep track, we need clear reports on how green a crypto is. This is where ESG reporting for crypto assets comes into play. Think of it as a report card showing how Earth-friendly each digital coin is.

We’re seeing more eco-friendly crypto projects too. These are coins and tech that promise to keep our air clean. Some even help with other Earth cool things, like planting trees or cleaning the ocean!

Crypto’s big stairs have been tough on the environment. That’s not cool. Smart heads are now making sure they cut down on bad energy use. They’re turning to mother nature’s gifts like sunbeams and wind to get it right.

So, let’s cheer on these green moves. With good choices, we can join in on crypto fun without hurting our big blue ball, Earth. We need everyone to pick wisely and push for a happier planet. Together, we can make a difference that even our grandkids will talk about.

The Social and Governance Dimensions of Cryptocurrency

Fostering Social Responsibility in Crypto Communities

In the cryptocurrency world, “social” refers to how companies manage relationships. It means looking after the well-being of employees, users, and the broader community. For instance, sustainable cryptocurrency projects support good causes. They aim to make sure everyone wins, not just folks with big wallets.

A great example of social impact is when altcoins donate part of their profits to those in need. This helps to spread wealth and make a difference beyond the digital world. In crypto, we’re building communities that share more than just money. We build hope.

Governing Blockchain with Transparency and Ethical Standards

When we talk about “governance” in blockchain technology, we’re talking about the rules. It’s how all actions on the network stay fair and honest. This also means that everyone can see what’s going on, no secrets.

Think about it like a game where everyone can see the entire board. Governance makes sure no one cheats. Governance in blockchain is key to earning trust. It tells investors the company plays by the rules.

In crypto, ethical practices include not tricking people with hidden fees or false promises. Companies must show they are honest. Trust is hard to earn and easy to lose. Governance in blockchain technology helps keep that trust.

So, as we shape the future of money with cryptocurrency, let’s remember we’re also shaping society. Let’s build a cryptocurrency world that we’re proud to be part of — one that’s fair, transparent, and kind.

ESG Compliance and Sustainable Investment in Crypto

Identifying ESG-Friendly Digital Assets for Investment

Imagine being a superhero for the planet, just by investing. That’s what happens when you choose ESG-friendly digital tokens. Let’s dive in and learn how to spot those heroes.

What are ESG-friendly digital assets?

They are cryptocurrencies that care about our world’s future. These coins work to help the planet, people, and play by fair rules. We keep our eyes open for three signs. First, we check if they are friendly to the environment. Do they use little power? Do they cheer on renewable energy? Next, we see how they impact society. Are they fair? Do they try to make things better for everyone? Lastly, we see how they are run. Are they honest? Do they make sure everyone follows the rules?

To find these gems, look for projects using green proof of stake. They don’t need much power like the big guy, Bitcoin, so they’re more eco-friendly. Social impact altcoins take it a step further. They aim to solve real-world problems, making lives better. And don’t forget about governance in blockchain technology. The best ones are clear like glass. They let everyone know how things are done, with no secrets.

Implementing ESG Reporting and Performance Metrics in Crypto Operations

Now you know what to look for, but how do these eco-heroes show their true colors? Simple – they tell us how they’re doing. They use ESG reporting for crypto assets. This is like a report card that shows if they’re sticking to their green goals.

Every crypto company can get an ESG score. It’s like a grade that tells us how well they’re doing at helping the planet, being fair, and playing by the rules. The better their actions, the higher their score. This really matters for sustainable crypto mining operations. They’re working hard to reduce their carbon footprint. That means they’re making less pollution. It’s a big deal because mining can use a lot of power.

But it’s not just about the planet. These reports also show the social side. How? By revealing the change they make in communities. They might support education, help with health, or even make sure they include everyone in their plans. That’s what social impact means.

Of course, none of this matters if they’re not honest. So, governance is key. This ensures they stick to their word.

What about when you trade? We have to look out for ESG risks in crypto trading too. This means thinking twice. Are you investing in a coin that might harm the planet? Or one that breaks its promises?

In the end, choosing an ethical cryptocurrency investment is like planting a tree. You help our world grow into something better. So next time you’re scrolling through crypto options, think green, think kind, and think fair. Remember, your choice has power. Use it to support coins that want the best for our world. Together, we can make sure the future shines bright.

To wrap it up, we dug into ESG in crypto. We explored how it fits with caring for the earth, people, and fair play rules. We looked at the crypto world’s green moves, like using clean power for Bitcoin. We also saw ways the crypto crowd is helping society and sticking to clear, ethical guidelines.

Then, we tackled ESG in crypto investing. We learned about picking digital coins that are ESG smart. Plus, we delved into using ESG scores to choose better. In the end, ESG and crypto tell a story of change. We’re moving toward money that does good and also stands strong on values. Let’s keep pushing for crypto that’s cleaner, kinder, and super straight-up!

Dive deeper into the world of blockchain—check out Blockchain Global Network for more insights!

Q&A

- What Does ESG Stand for in Cryptocurrency?

ESG in the context of cryptocurrency refers to Environmental, Social, and Governance factors that measure the sustainability and ethical impact of investing in digital assets. This concept is paramount for investors who are keen on supporting projects that prioritize responsible practices in these key areas, which include carbon footprint reduction, fair labor practices, and transparent decision-making processes.

- How Does ESG Affect Crypto Investments?

ESG affects crypto investments by influencing the decision-making process of investors who are conscious of the broader impact of their investments. Cryptocurrencies and blockchain projects that demonstrate a commitment to ESG principles can attract more investment, as they align with the growing trend of responsible investing. Crypto projects that fail to address ESG concerns may face divestment or a lack of investor interest.

- Can Cryptocurrency Be Environmentally Sustainable?

Yes, cryptocurrency can be environmentally sustainable, particularly with advancements in blockchain technology that reduce energy consumption. Proof of Stake (PoS) and other consensus algorithms are seen as greener alternatives to the energy-intensive Proof of Work (PoW) system. Also, many crypto organizations are actively exploring renewable energy sources and carbon offset initiatives to minimize their environmental footprint.

- What Role Does Governance Play in ESG Crypto?

Governance in ESG crypto refers to the standards for running blockchain projects and maintaining their integrity. It includes ensuring transparency in decision-making, fair voting mechanisms, compliance with regulatory requirements, and protection against fraud and corruption. Effective governance is crucial for building investor trust and ensuring long-term viability in the crypto market.

- Are There Social Benefits to ESG in Cryptocurrency?

Indeed, there are social benefits to ESG in cryptocurrency. Social factors involve promoting diversity and inclusion within blockchain projects, ensuring fair labor practices, and contributing to societal development through philanthropic activities or community engagement. By integrating these social considerations, cryptocurrency projects can positively impact society and potentially expand their user base.

RELATED POSTS

ChillGuy Airdrop – A Golden Crypto Opportunity from TikTok Effects

The ChillGuy Airdrop is an...

Is Ledger Nano X Safe? Ledger Nano X vs Ledger Nano S

The Ledger Nano X is...

Cow DAO base L2 chain launch: Faster, cheaper and more scalable blockchain

The Cow DAO Base L2...

Liquid Native Restaking: Unlocking new potential in Ethereum staking

Liquid Native Restaking is emerging...

What can you get with leetcoins? Discover now!

What can you get with...

Cryptocurrency Ro Khanna and the future of regulation

Discover how cryptocurrency ro khanna...

Blast Airdrop – Tips for Earning KRO Tokens Easily

Earning KRO tokens from the...

Pebonk Kombat – The next frontier in gaming and crypto

Pebonk Kombat is revolutionizing gaming...

Blockchain Layer 1: The Foundation of Decentralized Technology and U2U Network’s Vision

Blockchain technology has revolutionized the...

What is the trading range of Kaspa standard deviation?

Are you interested in Kaspa...

The Unique Characteristics of Blockchain Technology – A Guide to Its Power and Potential

The unique characteristics of blockchain...

Exploring the Use of blockchain technology in different sectors

The use of blockchain technology...

Starknet: A Layer-2 scaling solution for Ethereum

Starknet is rapidly gaining traction...

U2U Super App: A Central Hub for Asset Management, Privacy, and Blockchain Interactions

The U2U Super App is...

Future Applications of Blockchain Technology: Beyond Bitcoin to Bold Innovations

Future applications of blockchain technology:...

Bitcoin Charlotte and 3 Expected Growth Signals

Bitcoin Charlotte is not just...