Are you interested in Kaspa and want to understand its price fluctuations better? Then the trading range of Kaspa standard deviation is an important factor you shouldn’t ignore. In this article, we will analyze this indicator and its implications for Kaspa investment.

What is the trading range of Kaspa standard deviation?

Before diving into the trading range of Kaspa standard deviation, let’s review some basic information about Kaspa (KAS).

Kaspa is a cryptocurrency that utilizes Directed Acyclic Graph (DAG) technology, a data structure that allows for faster and more efficient transaction processing compared to traditional blockchain technology.

Some notable features of Kaspa include:

- Fast transaction speed: Kaspa employs GHOSTDAG technology, enabling parallel transaction processing, significantly increasing transaction speed compared to traditional blockchains. This allows Kaspa to handle a large volume of transactions without network congestion. Fast transaction speed is crucial for Kaspa to compete with other blockchains and attract users.

- High scalability: Kaspa’s DAG architecture allows for easy network scaling to meet the growing transaction needs of users. Scalability is a critical factor for the growth of any blockchain. Kaspa can process thousands of transactions per second, far exceeding the capabilities of Bitcoin or Ethereum.

- Decentralization: Kaspa operates on a Proof-of-Work (PoW) consensus mechanism, ensuring network decentralization and security. PoW is a time-tested consensus mechanism that prevents attacks and ensures data integrity on the blockchain. Decentralization is one of the core principles of cryptocurrency, and Kaspa demonstrates its commitment to this principle.

Furthermore, Kaspa boasts a vibrant development community constantly improving the platform. Developers are working to expand the Kaspa ecosystem with various decentralized applications (dApps) and new features.

Understanding the trading range of Kaspa standard deviation

Before delving into what is the trading range of Kaspa standard deviation, let’s first break down two key concepts that will help us understand it better:

What is standard deviation?

Standard Deviation is a statistical measure that indicates the dispersion of a dataset relative to its mean. Simply put, standard deviation tells us how much the value of a variable (in this case, Kaspa’s price) fluctuates around the average value.

- High standard deviation: Kaspa’s price fluctuates significantly, indicating high risk.

- Low standard deviation: Kaspa’s price fluctuates less, indicating lower risk.

To illustrate, imagine tracking Kaspa’s price for 30 days. If the price changes drastically during those 30 days, with significant increases and decreases, the standard deviation will be high. Conversely, if the price fluctuates gently around a specific price level, the standard deviation will be low.

Formula for calculating standard deviation:

While you are not required to calculate the standard deviation yourself, to better understand the calculation method, here’s a brief overview of the formula:

σ = √[ Σ(xi – μ)² / (N-1) ]

Where:

- σ: Standard Deviation

- xi: Value of each data point

- μ: Mean value of the dataset

- N: Number of data points

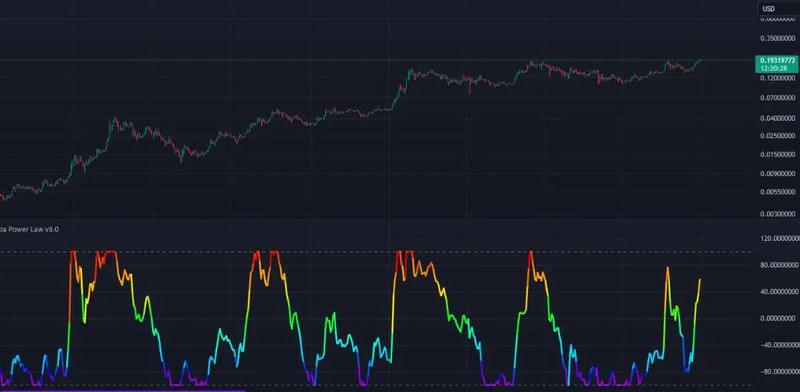

Application of Standard Deviation in Technical Analysis

In technical analysis, standard deviation is often used to calculate indicators like Bollinger Bands. These bands help traders identify potential support and resistance levels, as well as gauge price volatility. Bollinger Bands consist of:

- A middle band (usually a 20-day moving average),

- An upper band (moving average + 2 times the standard deviation),

- A lower band (moving average – 2 times the standard deviation).

What is the Trading Range of Kaspa Standard Deviation?

What is the Trading Range of Kaspa Standard Deviation?

Now, to answer what is the trading range of Kaspa standard deviation, it refers to the price range within which Kaspa fluctuates around its average value, factoring in its standard deviation. For example, if Kaspa’s average price is $0.05 and the standard deviation is $0.01, the trading range would likely be from $0.04 to $0.06 ($0.05 ± $0.01).

In this case, Kaspa’s price is expected to remain within this $0.02 range, as the standard deviation indicates the typical fluctuation around the average price.

What is trading range?

Trading Range is the price range within which an asset (like Kaspa) is traded over a specific period. It is determined by the highest and lowest prices during that period.

For example, if Kaspa’s price fluctuates between $0.04 and $0.07 in October 2024, its trading range for October is $0.03 ($0.07 – $0.04). The trading range indicates the price fluctuation range within a given timeframe.

Factors affecting trading range:

Several factors can influence an asset’s trading range, including:

- News and events: Positive or negative news about Kaspa or significant events in the cryptocurrency market can impact its trading range. For instance, news of Kaspa being listed on a major exchange could widen the trading range due to increased trading volume.

- Market sentiment: The overall sentiment of investors can also affect the trading range. In a bullish market, the trading range tends to expand, while in a bearish market, it tends to narrow.

- Trading volume: Higher trading volume tends to widen the trading range. This is because high trading volume indicates strong investor interest in Kaspa, leading to more significant price fluctuations.

- Liquidity: Kaspa’s liquidity on exchanges also influences the trading range. High liquidity allows investors to buy and sell Kaspa easily, minimizing price volatility. Conversely, low liquidity can widen the trading range due to large bid-ask spreads.

Combining the two concepts

The trading range of Kaspa standard deviation is the price range within which Kaspa fluctuates around its average value, based on its standard deviation. This range provides insight into Kaspa’s price volatility over a specific period.

For example, if Kaspa’s average price is $0.05 and the standard deviation is $0.01, the trading range of Kaspa standard deviation could be from $0.04 to $0.06 ($0.05 ± $0.01).

Why should you care about the trading range of standard deviation?

The trading range of Kaspa standard deviation offers a deeper understanding of price volatility compared to just considering the regular trading range. It combines both volatility (standard deviation) and central tendency (average value) to provide a more comprehensive picture of Kaspa’s price behavior.

Significance of Kaspa’s standard deviation trading range in investment

The trading range of Kaspa standard deviation is an essential indicator that helps investors make effective trading decisions. Here are some implications of this indicator:

Risk Assessment: A wider trading range indicates greater Kaspa price volatility and higher investment risk. Conversely, a narrow trading range suggests less volatility and lower risk.

- For example, if Kaspa’s trading range is $0.05, while Bitcoin’s is only $0.02, investing in Kaspa carries higher risk than Bitcoin.

Identifying Buy/Sell Points: Investors can utilize the trading range of Kaspa standard deviation to identify optimal entry and exit points.

- For example, when Kaspa’s price approaches the lower limit of the trading range, it might be a good buying opportunity, as the price is likely to rebound. Conversely, when the price reaches the upper limit, investors may consider selling to take profits.

Risk Management: Understanding the trading range of Kaspa standard deviation helps investors set effective stop-loss orders to limit potential losses.

- For instance, if an investor buys Kaspa at $0.05 and the trading range is $0.02, they could place a stop-loss order at $0.03 to limit losses if the price drops sharply.

Price Trend Prediction: While not a precise predictive tool, the trading range of Kaspa standard deviation can offer some clues about future price trends.

- For example, if the trading range is expanding, it could signal an impending strong upward or downward trend. Conversely, if the trading range is narrowing, Kaspa’s price might consolidate. Moreover, when Kaspa’s price breaks out of the standard deviation trading range, it could indicate a breakout and signal a new trend.

How to determine the trading range of Kaspa standard deviation

To determine the trading range of Kaspa standard deviation, you can follow these steps:

Gather Price Data: Collect Kaspa’s price data over a specific period (e.g., 30 days, 90 days). You can obtain data from reputable exchanges like Binance, Gate.io, KuCoin, or market data websites like CoinMarketCap and CoinGecko. Ensure you collect daily closing price data for the most accurate results.

Calculate the Average Price: Calculate the average price of Kaspa over the selected period.

- For example, if you collected Kaspa’s price data for 30 days, sum up all the price values for those 30 days and divide by 30.

Calculate the Standard Deviation: Use the formula or calculation tools to calculate the standard deviation of Kaspa’s price.

- You can use software like Microsoft Excel, Google Sheets, or specialized calculators for this purpose. Many websites and trading platforms also provide built-in standard deviation calculation tools.

Determine the Trading Range: Add and subtract the standard deviation from the average price to determine the upper and lower limits of the trading range.

Example:

Suppose after collecting data and performing calculations, you obtain the following parameters:

- Average price of Kaspa over 30 days: $0.05

- Standard Deviation: $0.01

The trading range of Kaspa standard deviation would be:

- Upper Limit: $0.05 + $0.01 = $0.06

- Lower Limit: $0.05 – $0.01 = $0.04 USD

Note:

- The trading range of Kaspa standard deviation is only a reference tool and does not guarantee 100% accurate prediction of price fluctuations. The cryptocurrency market is influenced by numerous factors, including unpredictable ones.

- You should combine the trading range of Kaspa standard deviation with other technical indicators like Moving Averages (MA), Relative Strength Index (RSI), MACD, etc., for a more comprehensive market view. Combining multiple analytical tools will help you make more informed trading decisions.

Kaspa’s growth potential

Kaspa is a promising blockchain project that has garnered attention in the cryptocurrency community due to its advantages and potential for widespread applications. Here are the key factors contributing to Kaspa’s growth potential:

Advanced technology

Kaspa utilizes GHOSTDAG, a variant of Directed Acyclic Graph (DAG), which enables parallel transaction processing. This results in extremely fast transaction speeds, as multiple blocks can be created simultaneously—reducing latency and increasing transaction throughput. Kaspa’s DAG architecture also offers exceptional scalability, allowing it to handle high transaction volumes without performance issues. Combined with its Proof-of-Work (PoW) consensus mechanism, Kaspa ensures robust security and decentralization, while encouraging community participation through mining.

Diverse applications

Kaspa is not just a fast and efficient payment platform; it can be applied in various fields, including:

- DeFi (Decentralized Finance): Kaspa’s fast transaction speed and low fees facilitate the development of DeFi applications, such as decentralized exchanges, lending, and staking.

- NFTs (Non-Fungible Tokens): Kaspa can support the creation and trading of NFTs, opening opportunities for artists, content creators, and digital collectors.

- GameFi (Game Finance): Kaspa can be an ideal platform for blockchain games, thanks to its fast transaction processing and scalability, providing a smooth and engaging gaming experience.

- Web3: Kaspa contributes to building a decentralized and secure Web3 platform where users have control over their data.

Community and development

Kaspa benefits from an active and passionate community of developers and users who are committed to its growth. The development team has a clear roadmap that outlines key goals, such as performance upgrades and ecosystem expansion. Additionally, Kaspa actively collaborates with other projects to enhance its reach and usability.

Market and investment

Kaspa has demonstrated strong value growth, attracting attention from investors and venture capital funds. It is listed on major cryptocurrency exchanges, providing liquidity and accessibility for trading. As it continues to grow and gain exposure, Kaspa is poised for further market success.

Considerations when investing in Kaspa

While Kaspa has significant growth potential, consider the following points when investing in this cryptocurrency:

- High volatility in the Cryptocurrency market: Kaspa’s price can fluctuate dramatically in a short period; therefore, you need a clear risk management strategy.

- Thorough research is necessary: Before investing, take the time to research Kaspa’s technology, development team, roadmap, and other essential aspects.

- Invest only what you can afford to lose: Cryptocurrency investments always carry risks; therefore, do not invest more than you can afford to lose.

- Stay updated: The cryptocurrency market changes rapidly, so stay informed to make effective investment decisions.

In conclusion, this article has provided essential knowledge about Kaspa and the trading range of Kaspa standard deviation. This is a valuable tool for investors to understand the price volatility of this cryptocurrency better. By grasping this concept and combining it with other technical indicators, you can make more informed investment decisions. To learn more about Kaspa and other crypto investment knowledge, visit the Blockchain Global Network website.

RELATED POSTS

Vessel Finance: The DEX with near-zero gas fees

In the ever-evolving world of...

Keith Grossman: The journey from media to finTech

Discover the life and career...

What is Hi PIN by PIN AI? Maximizing Your Airdrop Rewards with Hi PIN

Hi PIN by PIN AI...

Role of Blockchain Security Audits: Your Crypto Safe Haven?

Enhance Blockchain Security with Audits....

U2U Network was Honored by Asia Business Outlook – Shaping the Future of Blockchain

U2U Network was honored by...

Understanding the Stock to Flow Model – How to Optimize Investment

The Stock to Flow Model...

Primary versus secondary market – Understanding Clearly for Effective Investment

Primary versus secondary market are...

Deflationary Currency – How it works and its impact on the Economy

In today’s evolving financial landscape,...

Trump Bitcoin reserve: A game changer for U.S. economy

The Trump Bitcoin reserve proposal...

Robotics vs AI vs Machine learning – The Future of Technology

Robotics vs AI vs Machine...

Gala Airdrop and 6 Tips to Maximize Gala Game Rewards

To maximize rewards from the...

What Is an Early Ape in Crypto? Opportunities and Risks Explained

Curious about What Is an...

LooksRare NFT: A new generation NFT exchange

LooksRare NFT has quickly emerged...

DeepSeek vs ChatGPT – Who is the AI Chatbot King of 2025?

DeepSeek vs ChatGPT – The...

BulbaSwap Airdrop: A unique investment opportunity in DeFi

BulbaSwap, a decentralized exchange (DEX)...

How Base L2 Sequencers are enabling the next generation of blockchain innovation

The evolution of blockchain technology...