Exploring the Bitcoin Halving Cycle offers valuable insights into the future trends and price predictions of Bitcoin. Understanding the intricacies of the Bitcoin Halving Cycle is crucial for investors and traders as it directly impacts market dynamics and price movements. This analysis delves into past halving events, their effects on Bitcoin’s price, and what to expect in upcoming cycles, providing a comprehensive guide for strategic investment decisions.

Overview of the Bitcoin Halving Cycle

The Bitcoin Halving Cycle is a crucial event in the Bitcoin ecosystem, occurring approximately every four years or after every 210,000 blocks are mined. During this event, the reward that miners receive for mining a new Bitcoin block is cut in half. For example, when Bitcoin was launched, the reward per block was 50 BTC, and after three halvings, this number has decreased to 6.25 BTC.

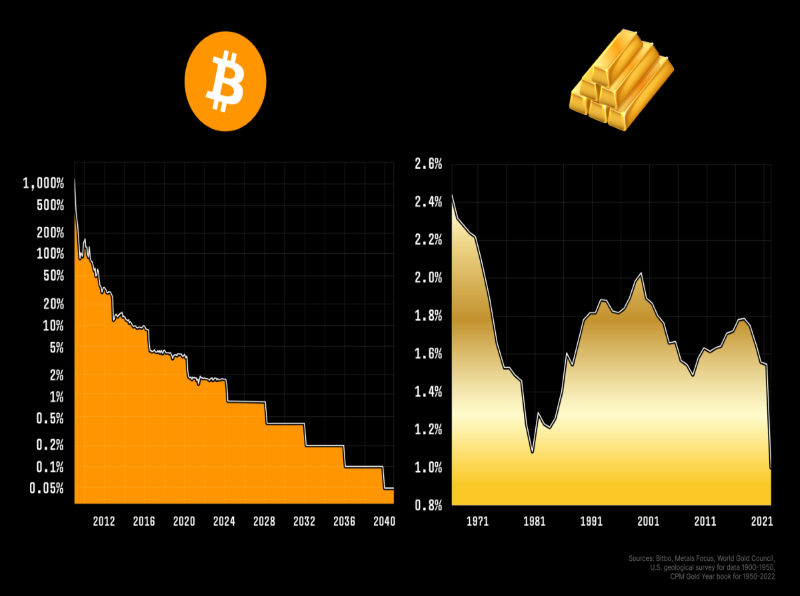

The purpose of the halving is to control the supply of Bitcoin, maintaining its scarcity and incentivizing the preservation of its value. Each halving reduces the rate at which new Bitcoins are released, helping to protect against inflation and increasing the asset’s scarcity.

The Bitcoin Halving Cycle has a significant impact on the Bitcoin market, often leading to large price fluctuations due to changes in supply and demand. This event also creates important investment opportunities, as investors often monitor and anticipate the effects of halving on the Bitcoin price.

Impact of the Bitcoin Halving Cycle on the Market

Bitcoin Price Growth

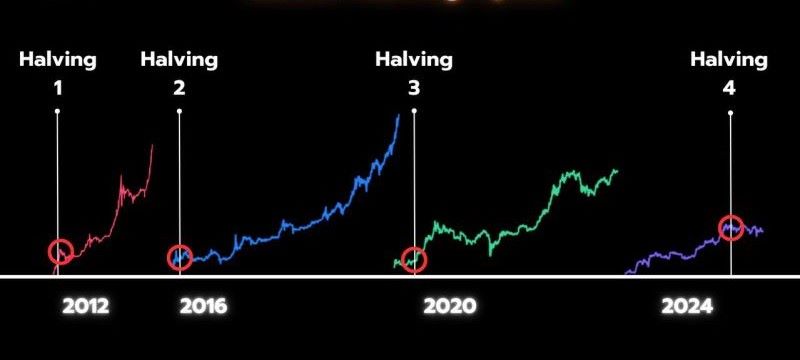

- Increased Scarcity: Each halving reduces the reward for miners, leading to a decrease in the issuance of new Bitcoins. This decrease in supply, while demand may remain constant or increase, drives up the price of Bitcoin. History has shown that after each halving event, the price of Bitcoin tends to increase significantly. For example, after the previous halvings in 2012 and 2016, the Bitcoin price experienced substantial surges.

- Market Expectations: The halving event is often anticipated by the market, and expectations of future price increases can lead to price appreciation even before and after the halving occurs. This is an important psychological factor, as investors often buy in anticipation of future price increases.

Impact on Bitcoin Mining

- Increased Mining Costs: As the reward decreases, miners face higher mining costs to maintain profitability. This can lead to less efficient miners withdrawing, reducing network strength and Bitcoin distribution.

- Increased Competition: With reduced rewards, the remaining miners have to invest more in mining equipment and technology to maintain performance. The increased competition can intensify mining difficulty and costs.

Impact on Market Sentiment

- Creating Investment Waves: The halving event often attracts the attention of investors and media, leading to a new wave of investment in Bitcoin. This can increase trading volume and price volatility.

- Strengthening Long-Term Investment: Long-term investors may view the halving event as an opportunity to invest in Bitcoin with the expectation that the price will increase in the long run. This helps reinforce confidence in Bitcoin as a valuable and stable asset.

Impact on Other Cryptocurrencies

- Increased Correlation: Bitcoin Halving Cycle can affect the prices of other cryptocurrencies, as Bitcoin often leads the cryptocurrency market. When the Bitcoin price rises, other coins may also benefit from the general trend.

- Creating a Search Wave: Investors may shift their focus to seek new investment opportunities in the cryptocurrency space when the Bitcoin price rises. This can lead to increased interest and investment in other projects and cryptocurrencies.

The Bitcoin Halving Cycle has a profound impact on the Bitcoin market and the cryptocurrency market in general. This event not only affects the price of Bitcoin but also impacts mining activities, market sentiment, and investment distribution within the cryptocurrency industry. The interplay between blockchain technology and cryptocurrencies is evident in how the halving cycle influences the entire ecosystem.

Future Predictions for Bitcoin After the Halving

Bitcoin Price Predictions

- Historical Price Growth: History shows that after each halving event, the Bitcoin price tends to experience a significant increase. For example, following the halvings in 2012 and 2016, Bitcoin’s price witnessed strong growth in the subsequent months and years. This trend is expected to continue, although there are no guarantees.

- Predictive Models: Predictive models, such as the Stock-to-Flow model, suggest that the increased scarcity caused by the halving could lead to higher prices in the future. This model analyzes the relationship between Bitcoin’s supply and price, and suggests that the price could reach higher levels as the supply decreases. The Bitcoin Halving Cycle plays a crucial role in influencing these predictions.

- Influencing Factors: Market sentiment and investor psychology play a significant role in determining the Bitcoin price after the halving. If the market believes in growth, the price may increase before and after the event. Additionally, external factors such as the global economic situation, inflation, and monetary policies can also impact the Bitcoin price. For instance, economic instability or high inflation could drive demand for Bitcoin as a store of value.

Investment Trends and Strategies

Investment Strategies Before the Bitcoin Halving Cycle

- Buying Before the Event: Many investors choose to buy Bitcoin before the halving event, based on the expectation that the price will increase. This strategy requires close monitoring of relevant indicators and news to determine the optimal buying time.

- Technical Analysis: Using technical indicators such as moving averages, Relative Strength Index (RSI), and price chart analysis to make investment decisions. Technical analysis patterns can help predict price trends and identify entry points.

Investment Strategies After the Halving

- Long-Term Investment: After the halving, many investors may opt for a long-term investment strategy, expecting price growth over an extended period. This strategy involves holding Bitcoin through volatile periods and taking advantage of price appreciation over time. The Bitcoin Halving Cycle reinforces the importance of long-term investment strategies.

- Portfolio Diversification: To reduce risk, investors can diversify their portfolios by combining Bitcoin with other assets such as different cryptocurrencies or traditional assets. This helps balance risk and capitalize on the growth opportunities of other assets.

Monitoring Market Signals

- News Analysis: Keep track of news and events related to Bitcoin and the cryptocurrency market to understand factors that may affect the price. Information like new regulations, institutional adoption, and the global economic situation can provide important signals.

- Strategy Adjustment: Be flexible in adjusting your investment strategy based on market signals and price fluctuations. Regularly evaluating and adjusting your investment strategy helps optimize profits and minimize risks.

Predicting the Bitcoin price after the halving relies on historical patterns and influencing factors, while investment strategies need to be flexible to optimize returns and mitigate risks. Monitoring market trends and signals is essential for making informed investment decisions.

understanding the Bitcoin Halving Cycle is crucial for making informed predictions about Bitcoin’s future price movements. Historically, each halving event has played a significant role in shaping market trends and influencing price increases. By analyzing past cycles and current market conditions, investors can better anticipate potential outcomes and adjust their strategies accordingly.

For more insights and updates on this topic, be sure to follow Blockchain Global Network for the latest news and expert analysis.

RELATED POSTS

Guide to voting in Project Catalyst

Ready to help build Cardano?...

Bitcoin Charlotte and 3 Expected Growth Signals

Bitcoin Charlotte is not just...

Solayer Airdrop – Secrets to Maximizing Profits

To maximize profits from the...

Smart Alaya AI Blockchain Technology – The future of the world

Curious about the game-changing potential...

The Backwoods Game: Is it the next big hit on Solana?

With engaging action gameplay, stunning...

Wewe Airdrop – Opportunities and Investment Potential in the Blockchain World

The Wewe airdrop is not...

Pi Network Officially Listed on OKX – Price Fluctuations and Forecast

Pi Network has officially been...

Rainbow Airdrop – A-Z Guide to Receiving Tokens

Rainbow Airdrop is an exciting...

What is the current market price of Bitcoin? Insights into today’s fluctuating values

What is the current market...

Staying Ahead: Essential Crypto Market News Updates

Sự biến động không ngừng...

What are the three advantages of using blockchain technology

Curious about “What are the...

U2U Super App: A Central Hub for Asset Management, Privacy, and Blockchain Interactions

The U2U Super App is...

Crypto Crashing and 3 important investment implications

Crypto Crashing has shaken the...

Key blockchain developments expected by august 2025

As we look towards the...

Pebonk Kombat – The next frontier in gaming and crypto

Pebonk Kombat is revolutionizing gaming...

Why did Gama fail Crypto?

“Why did Gama fail crypto?”...