In the ever-evolving world of decentralized finance (DeFi), the demand for secure, private, and efficient trading solutions is on the rise. Vessel Finance emerges as a pioneering decentralized exchange (DEX) that harnesses the power of Zero-Knowledge Proof (ZKP) technology to deliver a superior trading experience.

What is Vessel Finance?

Vessel Finance is a DEX operating on the Scroll network, a Layer-2 solution for Ethereum. What distinguishes Vessel Finance is its seamless integration of ZKP technology, Automated Market Maker (AMM), and a limit order book, creating a transparent, secure, efficient, and user-friendly trading platform.

Core technologies of Vessel Finance

Zero-Knowledge Proof (ZKP)

ZKP is a cryptographic technique that allows one party (the prover) to prove to another party (the verifier) that they know a piece of information without revealing the information itself. On Vessel Finance, ZKP is used to verify transactions without disclosing the user’s identity or sensitive transaction details, ensuring absolute privacy and security.

Example:

Imagine you want to prove to airport security that you have a valid flight ticket without showing them the details on the ticket. ZKP allows you to do this by generating cryptographic proof that confirms you have the ticket without revealing any personal information.

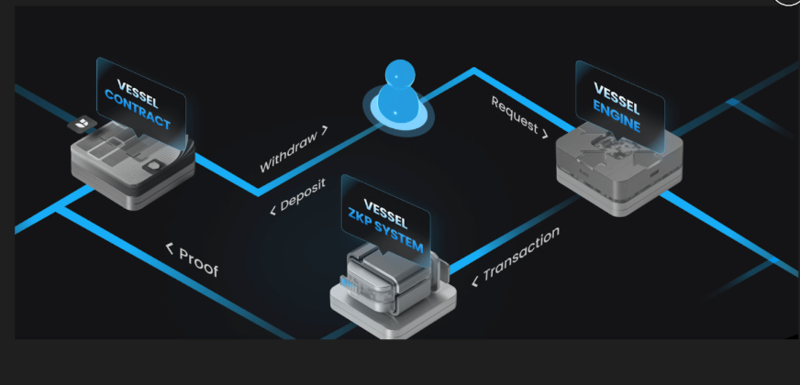

Sequencer

The Sequencer acts as the “brain” of Vessel Finance, responsible for processing and arranging transaction requests. It consists of four main components:

- Gateway: Acts as a gatekeeper, checking and filtering transaction requests, preventing malicious activities, and ensuring the security of the platform.

- Matching engine: Performs the function of matching buy and sell orders, ensuring that transactions are executed quickly and efficiently.

- Data server: Provides real-time market data to users, helping them make informed trading decisions.

- Certificate generator: Creates the necessary certificates for the transaction verification process using ZKP, ensuring accuracy and security.

Prover

The Prover is the component that ensures the integrity of the system. It is responsible for verifying the validity of transactions submitted by the Sequencer. It uses ZKP and SNARK (Succinct Non-Interactive Argument of Knowledge) to create concise, easily verifiable proofs while preventing fraudulent activities such as counterfeiting.

Smart Contracts

Smart contracts are code stored on the blockchain that act as “rules” governing the operation of Vessel Finance. They have key functions such as storing SNARK proofs, managing user funds, executing transactions, and automatically updating the platform.

Key features of Vessel Finance

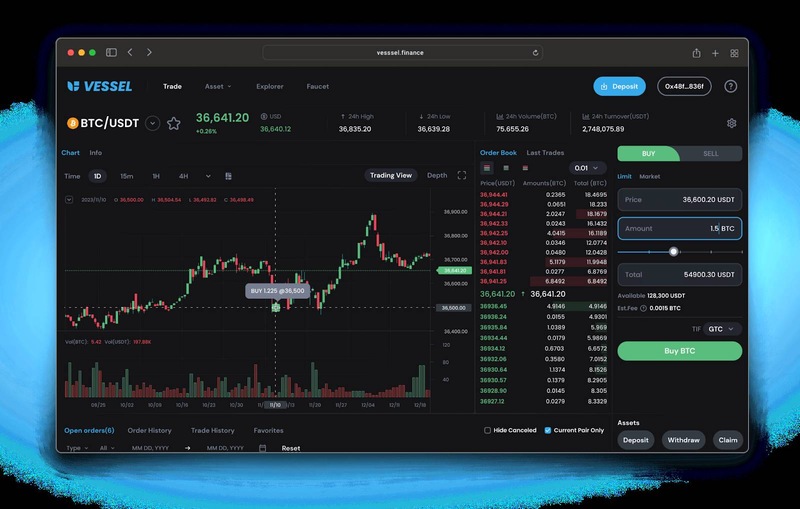

- AMM DEX: Vessel Finance integrates the AMM (Automated Market Maker) model to provide liquidity for trading pairs. AMM operates based on mathematical algorithms, automatically adjusting prices based on supply and demand in the market. The advantages of AMM are reduced slippage, passive income generation for liquidity providers, and simplified trading processes.

- Self-Custody asset management: Vessel Finance’s self-custody model gives users full control over their private keys and assets. This differs from the centralized custody model, where users have to entrust their assets to the exchange. Self-custody enhances security and minimizes the risk of asset loss due to attacks or exchange failures.

- VAELOB (Vessel’s AMM Embedded Limit Order Book): VAELOB is a unique innovation of Vessel Finance, combining AMM and a limit order book. VAELOB allows users to place limit orders at their desired price while leveraging the liquidity of AMM to partially or fully match orders. The advantages of VAELOB are optimized capital efficiency, enhanced trading flexibility, and reduced slippage.

- Decentralized governance mechanism: Vessel Finance adopts a decentralized governance model, empowering the community through the VESSEL token. Token holders can participate in making important decisions for the platform, such as proposing and voting on changes to protocols, transaction fees, and new product development. This mechanism ensures transparency, fairness, and focus on community benefits.

Vessel Token

Vessel is the native governance and utility token of the Vessel Finance ecosystem. It is built according to the BEP-20 standard on the Binance Smart Chain, offering high interoperability and low transaction fees.

Roles of the Vessel Token

Vessel plays a crucial role in the operation and development of Vessel Finance, with the following key functions:

- Governance: Vessel token holders have voting rights on important platform decisions, including protocol upgrades, transaction fees, new product development, and ecosystem growth strategies.

- Staking: Users can stake vessel tokens to earn rewards and participate in network security. Staking ensures platform stability and security while benefiting token holders.

- Farming: By providing liquidity to trading pairs on Vessel Finance’s AMM by adding Vessel tokens to liquidity pools, users will receive corresponding rewards.

- Transaction Fee Payment: Using Vessel tokens to pay for transaction fees on the platform will enjoy attractive discounts.

- Exclusive Event Participation: Vessel token holders may be given priority to participate in exclusive events, airdrop programs, and special investment opportunities.

Vessel Token information

- Token name: Vessel

- Standard: BEP-20

- Blockchain: Binance Smart Chain

- Total supply: 5,000,000,000,000 VESSEL (5 trillion)

Vessel Token allocation

- Development team: 20%

- Advisors: 5%

- Ecosystem fund: 25%

- Marketing and community development: 10%

- Private sale: 10%

- Public sale: 5%

- Liquidity: 25%

Potential of the Vessel Token

With its central role in the Vessel Finance ecosystem, the Vessel token is expected to have strong growth potential in the future. The development of the Vessel Finance platform, the expansion of the user community, and new applications of the VESSEL token will be the factors driving the value of this token.

Development Roadmap and partners of Vessel Finance

Vessel Finance continuously strives to improve the platform and expand the ecosystem, aiming to become a leading decentralized exchange in the DeFi market.

Development Roadmap

Short-term

- Optimize transaction performance, minimize latency, and enhance scalability.

- Expand the list of trading pairs, providing more options for users.

- Develop advanced trading tools to support complex trading strategies.

- Enhance security by implementing advanced security measures to protect user assets.

Long-term

- Launch derivative products, allowing trading of complex financial instruments.

- Integrate more blockchains, enhancing interoperability and reaching new users.

- Build cross-chain bridges, connecting different DeFi ecosystems.

- Develop new DeFi applications, expanding the utility of the VESSEL token.

- Build a DAO (Decentralized Autonomous Organization), giving full governance power to the community.

Partners

Vessel Finance has established strategic partnerships with many reputable organizations and projects in the blockchain and DeFi space:

- Sequoia Capital: A leading global venture capital fund that has invested in many successful blockchain projects.

- Avalanche foundation: A foundation supporting the development of the Avalanche ecosystem, a high-performance blockchain platform.

- Algorand foundation: A foundation supporting the development of the Algorand ecosystem, a blockchain platform focused on security and scalability.

- Scroll: A Layer-2 platform for Ethereum, providing scalability and reduced transaction fees.

- Other DeFi projects: Vessel Finance is collaborating with other DeFi projects to integrate products and services, creating a diverse and rich DeFi ecosystem.

Collaborating with these strategic partners helps Vessel Finance:

- Access financial and technological resources.

- Expand the network of users and partners.

- Enhance credibility and brand recognition.

- Promote the adoption and development of the ecosystem.

With a clear development roadmap and support from strong partners, Vessel Finance is on track to become one of the leading decentralized exchanges in the DeFi market.

Advantages and limitations of Vessel Finance

Advantages of Vessel Finance

- Security and privacy: Zero-Knowledge Proof (ZKP) technology is the most prominent highlight of Vessel Finance. ZKP allows transaction verification without revealing user information, ensuring anonymity and optimal data protection.

- Self-Custody of assets: Users have complete control over their assets through the self-custody feature. This eliminates the risk of entrusting assets to third parties, minimizing the risk of asset loss due to attacks or exchange failures.

- High performance: Vessel Finance can process thousands of transactions per second, surpassing many existing DEXs. This ensures a smooth trading experience, even during periods of high market volatility.

- Low costs: Operating on Layer-2 Scroll, Vessel Finance significantly reduces gas fees compared to trading directly on Ethereum.

- Diverse trading features: Vessel Finance not only supports AMM but also integrates a limit order book (VAELOB), providing flexibility and optimizing trading efficiency for users.

- Decentralized governance mechanism: VESSEL token holders have the right to participate in making important decisions for the platform, ensuring transparency and fairness.

- User-Friendly interface: The intuitive and easy-to-use interface is suitable for both novice and professional traders.

Limitations of Vessel Finance

- ZKP technology is still new: Although ZKP offers many security benefits, it is still a relatively new technology. This can make it difficult for new users to understand and use.

- Low brand recognition: Vessel Finance is a relatively new project with lower brand recognition compared to other established DEXs.

- Dependence on Layer-2 scroll development: The performance and security of Vessel Finance partially depend on the stability and development of the Layer-2 Scroll network.

- Market risks: Like other DeFi projects, Vessel Finance is affected by the volatility of the cryptocurrency market.

Vessel Finance is a promising decentralized exchange that offers a secure, private, and efficient trading solution. With its advanced ZKP technology, self-custody feature, flexible AMM model, and decentralized governance mechanism, It is contributing to shaping the future of decentralized finance. Explore Vessel Finance and experience the next generation of trading!

If you want to learn more about Vessel Finance and other prominent projects in the investment and financial market, don’t forget to follow the upcoming articles from Blockchain Global Network.

RELATED POSTS

Gradient Network Airdrop – How to Earn Points and Receive Rewards

Are you ready to dive...

Seer Airdrop: A chance to receive free SEER Tokens

Seer Airdrop is attracting the...

NebulaStride Airdrop – Tips to Maximize Income

To maximize your income from...

Starknet: A Layer-2 scaling solution for Ethereum

Starknet is rapidly gaining traction...

What is the current market price of Bitcoin? Insights into today’s fluctuating values

What is the current market...

Pencils Protocol: Optimizing DeFi yields on Scroll

In the vast landscape of...

What is KYC in Crypto? The Key to safer and transparent trading

What is KYC in Crypto...

Explore Top DePin AI Projects

Exploring the leading DePin AI...

Milena Mayorga: Influential person in El Salvador politics

Milena Mayorga, a prominent figure...

What are the key blockchain technology advancements 2025

The world of decentralized technology...

Preparing Blockchains: Quantum Computing’s Inevitable Impact

Protecting blockchain from quantum attacks:...

What is polygon crypto – The Layer 2 Solution for Ethereum

What is polygon crypto? It...

Exploring the Bitcoin Halving Cycle – Future and Price Predictions

Exploring the Bitcoin Halving Cycle...

Trump Token and Justin Sun’s Role: Unraveling the Controversy

The Trump Token, tied to...

What makes the Hash Rate higher?

Hash rate is a critical...

The Governance Token in TON: An In-Depth Analysis

The governance token in TON,...