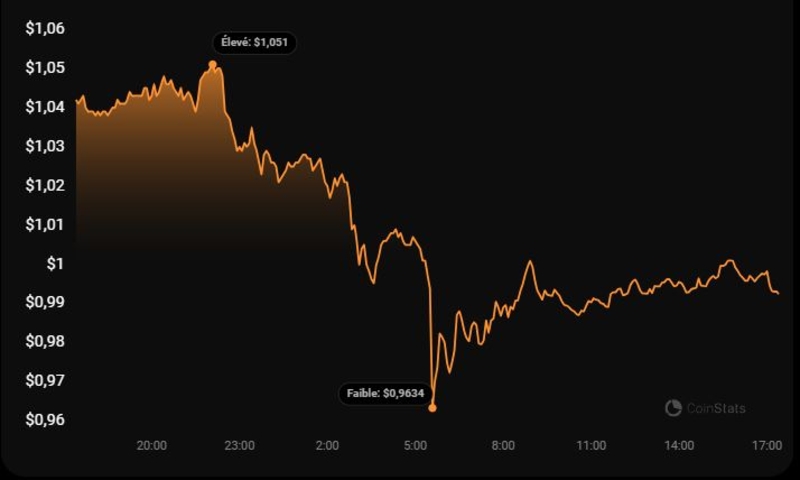

“Why did Gama fail crypto?” is a question that has sparked much debate in the crypto community. The rise and fall of crypto projects can often be attributed to a variety of factors, from poor management and technical issues to failure in meeting user expectations. In the case of Gama, a combination of overhyped marketing, lack of clear long-term vision, and internal failures led to its downfall.

Lack of a clear roadmap

One of the primary reasons behind the downfall of Gama in the crypto world is the lack of a clear roadmap. When a crypto project launches without a well-defined plan for its development and future growth, it can quickly lose direction, fail to meet community expectations, and ultimately collapse. Roadmaps are essential in the crypto space, as they provide a blueprint for success and help investors, developers, and users understand the project’s goals, timelines, and the steps required to achieve them. Without such a roadmap, a project can appear disorganized or unreliable, making it difficult to build trust with potential investors and users.

In the case of Gama, “Why did Gama fail crypto?” can partly be attributed to its failure to establish a transparent and achievable roadmap. Many successful crypto projects outline a detailed timeline, with milestones and objectives that help build anticipation and confidence in the market. Gama’s lack of such structure left stakeholders uncertain about the project’s long-term vision and its ability to execute its plans effectively. This uncertainty led to a loss of confidence among its community, investors, and developers, ultimately contributing to its downfall.

In the highly competitive and fast-evolving crypto market, having a clear and realistic roadmap is crucial. As “Why did Gama fail crypto?” illustrates, any crypto project that lacks a concrete and actionable plan is at a severe disadvantage. Moving forward, it is important for new projects to prioritize the creation of a clear roadmap to ensure long-term success and stability in the crypto space.

Poor technology and security issues

“Why did Gama fail crypto?” is a question that highlights several critical issues that led to the project’s downfall, including poor technology and security concerns. In the crypto space, the integrity of technology and the security of user funds are non-negotiable factors that determine the success or failure of a project. Unfortunately, Gama faced both of these challenges. The platform’s technological infrastructure was not robust enough to handle the scale and complexity of transactions required in the crypto ecosystem. This led to frequent system downtimes, poor performance, and ultimately a loss of trust among users and investors.

Security issues further exacerbated the situation. In the crypto world, hacks and vulnerabilities can be disastrous, and Gama was no exception. Security flaws allowed for exploits, resulting in significant losses for users. These breaches eroded the community’s confidence in the project’s ability to safeguard their investments, causing many to abandon the platform. The lack of timely and effective responses to these incidents showcased the project’s inability to maintain the basic security standards expected from any serious crypto initiative.

The question of “Why did Gama fail crypto?” can be partially answered by pointing to these fundamental issues. Without a strong technological backbone and reliable security measures, Gama could not ensure a safe and smooth experience for its users, leading to its eventual decline. In an industry where trust is paramount, technological incompetence and security vulnerabilities are often fatal, and Gama’s failure to address these weaknesses ultimately caused its downfall.

High operating costs

“Why did Gama fail crypto?” is a question that often brings attention to the platform’s inability to manage its financial health, particularly its high operating costs. In the competitive crypto space, where profit margins can be slim, operational efficiency is critical for long-term success. Unfortunately, Gama struggled with excessive expenses across various aspects of its platform.

One of the most significant factors contributing to these high costs was the platform’s infrastructure. Running blockchain nodes, maintaining a decentralized network, and ensuring fast transaction speeds all require substantial resources. These operational costs compounded over time, making it difficult for Gama to scale profitably. Unlike more efficient blockchain platforms, Gama lacked a streamlined approach to managing these expenses, which quickly became a burden.

Furthermore, Gama’s marketing and customer acquisition costs were also a major contributor to its financial struggles. While acquiring users and investors is essential, the project failed to optimize its marketing strategies. Instead, it relied heavily on expensive, less effective promotional methods that did not yield the desired results. This mismatch between spending and returns ultimately drained the project’s financial reserves.

These high operating costs played a significant role in the failure of the platform. “Why did Gama fail crypto?” can partly be answered by examining how the project’s inability to control its expenses led to its collapse. Without a sustainable financial model, Gama was unable to maintain operations or reinvest into developing critical features that could have helped it compete in the crypto space. As a result, the project’s overburdened budget and lack of financial sustainability contributed heavily to its demise.

High competitive pressure

One significant factor that contributed to the downfall of Gama in the crypto space is high competitive pressure. The crypto industry, especially in the realm of GameFi and DeFi, is highly saturated with numerous platforms vying for user attention, investment, and market share. In such a competitive environment, platforms must continuously innovate and offer unique value propositions to stand out. Unfortunately, “Why did Gama fail crypto?” can partially be attributed to its inability to differentiate itself from its competitors.

At the time of Gama’s launch, the market was already flooded with established platforms offering similar services, often with better technology, larger user bases, and stronger marketing strategies. The lack of a distinct edge made it difficult for Gama to attract and retain users. Other crypto projects were better equipped to address user needs, offering faster transaction speeds, more robust security features, and better scalability.

Additionally, Gama’s failure to establish partnerships with key players in the crypto ecosystem further exacerbated its struggle against intense competition. Partnerships and integrations with popular DeFi platforms or cross-chain compatibility are often crucial to gaining traction in the space. However, Gama lacked the necessary collaborations, leaving it isolated and less appealing to potential users.

This high competitive pressure ultimately played a major role in the question, “Why did Gama fail crypto?” Without the ability to distinguish itself in such a cutthroat market, Gama was unable to gain a meaningful foothold. Its failure to adapt and innovate in the face of competition led to its eventual decline.

The collapse of Gama serves as a critical lesson for both investors and developers in the crypto space. By highlighting the dangers of excessive hype, lack of transparency, and technical shortcomings, “Why did Gama fail crypto?” underlines the importance of sound management and realistic expectations. As the market continues to evolve, it is essential to learn from these mistakes to ensure future success. Stay updated on the latest insights by following Blockchain Global Network.

RELATED POSTS

Blast Airdrop – Tips for Earning KRO Tokens Easily

Earning KRO tokens from the...

Is Ledger Nano X Safe? Ledger Nano X vs Ledger Nano S

The Ledger Nano X is...

Zest Protocol airdrop – Don’t miss out on the hottest DeFi project

Zest Protocol airdrop is one...

DePIN Alliance Airdrop – Extremely HOT VTIS 2024 Event

DePIN Alliance Airdrop – Highlight...

CoinList and U2U Network – Partnering to Build the Future of Decentralized Infrastructure

The cryptocurrency market is witnessing...

Easily Join the TENEO Airdrop with This Step-by-Step Guide

The TENEO Airdrop is a...

Bitcoin Golden Cross – Strategic Investment Solution

The Bitcoin Golden Cross is not...

Network3 Airdrop – Potential Profits in the Future

Network3 Airdrop offers potential profit...

In-Depth Analysis of ERC20 Airdrop Tools

Looking for the best ERC20...

Deflationary Currency – How it works and its impact on the Economy

In today’s evolving financial landscape,...

What is a Doji Candle? Learn to identify market uncertainty

What is a Doji candle...

Top 3 Secrets behind Bitcoin Peak that you must know

The rise and fall of...

Inflation is down why isnt crypto rallying today?

Inflation is down why isnt...

What are the three advantages of using blockchain technology

Curious about “What are the...

Fundamental vs technical analysis in cryptocurrency investment

Fundamental vs technical analysis plays...

U2U Listing: A milestone event for U2U Network

On December 10, 2024, the...