On-Chain Analysis Drawbacks: What Investors May Be Overlooking

Crypto folks, listen up! We all love digging into blockchain data, but the disadvantages of on-chain analysis are what may trip us up without warning. Yes, those charts and graphs are cool, but they can also lead us astray. Think about the times you’ve scratched your head over strange data spikes or wallet moves that just didn’t add up. It’s not just you—it’s the unexpected hiccups hiding in on-chain analysis. Let’s unpack these sneaky pitfalls together, so your hard-earned crypto doesn’t face a nasty surprise. Stay sharp, because what you don’t know about these drawbacks can hurt your investments!

Understanding the Limitations of On-Chain Analysis

Cryptocurrency Analysis Limitations

Let’s talk straight about on-chain analysis. It’s got its issues. Sure, it helps us track and study blockchain transactions, but it’s not without flaws. One of the biggies is privacy. On a blockchain, everyone can see your transactions. Now you might think that’s good for catching bad guys, but what about regular folks who don’t want the world to peek into their wallets? That’s a big blockchain privacy concern and something we can’t ignore.

The thing is, blockchain is all about balance. We want to keep things clear but also secure. Think of it like living in a glass house—nice view, but where do you change your clothes? We need to protect financial privacy on the blockchain while keeping an eye on what’s happening. It’s a tough line to walk.

Scaling these efforts is another head-scratcher. As more people join in, the blockchain gets busier and busier. This can lead to network congestion, which can throw off your on-chain analysis. Imagine you’re playing detective, but the evidence keeps getting mixed up—that’s what congestion does to blockchain data.

Then there are the smarts behind the scenes—smart contracts. They’re like vending machines for all kinds of deals on the blockchain. But like any machine, they can break. When they do, it messes with your analysis big time.

Data Interpretation Errors in Blockchain

Ever play that game of telephone as a kid? You whisper something, and by the end, it’s all warped? That can happen with on-chain data, too. Sometimes we see what we want to see, or we miss the mark. We call this data interpretation errors in blockchain. It’s when the info you get is out of whack with what’s really going down.

Let’s say you’re tracking money moves to spot illegal stuff — like laundering. But folks who know the blockchain game can trick the system. They can make their shady money look clean. We call this on-chain data manipulation, and it’s a sneaky problem.

And here’s the kicker: the blockchain tells us a lot, but not everything. Some data is off-chain, hidden away. That means your analysis isn’t getting the full story. Imagine trying to solve a puzzle, but you’re missing a bunch of pieces. That’s on-chain analysis trying to keep up with the clever tricks folks play.

Even the tools we use, like blockchain forensic techniques, have their limits. They’re getting better, sure, but they’re not perfect. It’s like trying to catch a fish with a net that’s got holes. You’ll get some, but plenty slip through.

So there you have it — on-chain analysis has its downsides. We work hard to get it right, staying sharp as the blockchain world evolves. But like anything, it’s about knowing the limits and not betting the farm on it. Keep an open mind, and always look at the big picture.

Privacy Versus Transparency in Blockchain

Blockchain Privacy Concerns

We all value our privacy, don’t we? Oddly, when we dive into the world of crypto, we can’t always keep things to ourselves. On-chain analysis tries to keep our trades safe, but there’s a big question: Just how much should everyone else get to see?

Think about it. Every time you send or get crypto, it’s like leaving digital footprints. And these footprints stick around forever. That’s the blockchain, a record of all the deals ever made. Neat and tidy, sure, but also pretty open for anyone to snoop around.

Now, privacy matters. We don’t let others peek into our bank accounts, right? But with blockchain, things get tricky. For one, we’ve got blockchain privacy concerns. That’s people getting fidgety about who sees their trades. You’ve got a right to keep your money matters quiet. But at the same time, everyone wants a safe market. A place where bad guys don’t mess things up for us.

Financial Privacy on Blockchain

Safe and private. That’s the balance we’re after with our money. Blockchain promises to shake up our ideas of what that means. Can we get both? It’s a tightrope walk, where each step must be just right.

Here’s the heart of it: financial privacy on blockchain. We all want to know our cash and coins are out of the wrong hands. We’re talking hackers, scammers, and the likes. That’s why we need to track where every penny goes. But when we do, does that mean everyone else knows too?

Then, there’s how we handle this info. On-chain data can get tricky. How we read and use it, well, that can lead us astray. Sometimes, things don’t add up. We think we see patterns, but they might just be echoes or ghosts. This isn’t just confusing; it can be risky, leading us to make bad calls.

Now, let’s hash out something else – on-chain vs off-chain analysis. The first is all public, out in the open. The second, well, that’s behind closed doors. It’s more hush-hush, like our usual bank stuff. Both have their places, sure. But when we lean too hard on one, we might miss out on the full picture.

And don’t get me started about what happens when things get busy. Have you ever seen what a crowded blockchain looks like? It’s like a traffic jam, but with data. This congestion can mess with our analysis, making it tough to tell what’s what.

In the end, we have to ask: Is on-chain analysis enough to keep us safe without spilling our secrets? It’s a puzzle, one we’re still working hard to solve. We’ve got to make sure that what keeps our trades safe doesn’t also tell the world more than we’d like. But as we chase that balance, remember, we might stumble on the way. We might slip up, but let’s keep on, making sure our steps are sure and our privacy, just as it should be – ours.

The Challenges of Technological Evolution in On-Chain Forensics

Evolving Regulations on On-Chain Data

Tech keeps changing fast, and so do rules on on-chain data. The updates can be tough to track. This makes it hard to use the data right. Investors might not see this. They think the data is always good to use, but it’s not that simple. The changing rules can mean what was okay yesterday is not okay today. This can hurt how we look at the data and make choices.

Imagine you’re playing a game but the rules keep changing. You would be confused, right? It’s the same with on-chain analysis. When the government says new rules, the game changes. This can make investors overlook risks. On-chain data seems clear. It tells us who has crypto and where it moves. But if the rules change, understanding this data gets tricky.

Investors might end up breaking rules without knowing. They might trust the on-chain data too much. Or they might miss some risky stuff because they did not know about a new rule. People who use this data need to keep up with the laws. They need to know the data is reliable. If they don’t, they could make bad investment moves.

Smart Contract Vulnerabilities

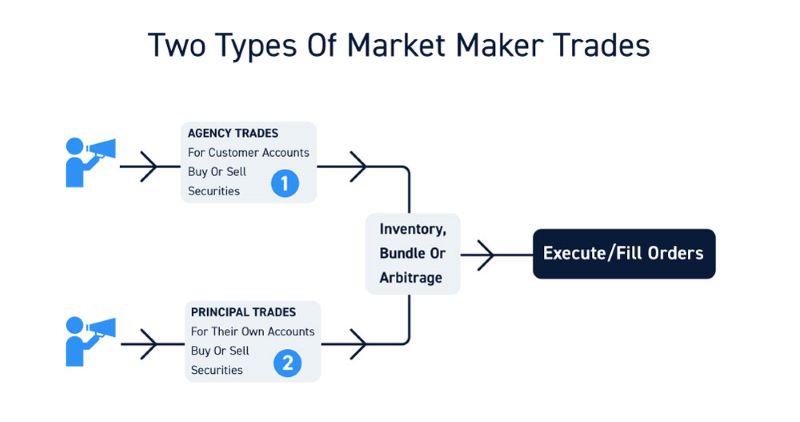

Smart contracts on the blockchain are smart, but they can have problems too. They do deals on their own when conditions are met. No need for a middle man. This sounds great, but what if there’s a bug? Bugs can let bad guys break in and steal money. These smart contracts are like locked doors. But if you make a mistake in the code, it’s like leaving a key out.

Think about building a house. If you mess up the blueprint, your house could have issues. Smart contracts are the same. If the code has even a small problem, big troubles can come. This can mean losing money or messing up the whole system. And we all know, losing money is a big no-no for investors.

The thing about smart contracts is that they are set to go on their own. This means if something goes wrong, it can happen fast and spread. Investors might not be ready for that. They see smart contracts as perfect and fast. But they might not see the possible downsides. A contract could work wrong and by the time you see it, it’s too late.

Bad guys are smart too. They look for mistakes in these contracts. They can fool the system and take your money. So, staying safe means always checking for bugs. Keep an eye out for ways bad guys might break in. And know that smart contracts are not perfect. They need watching to keep them safe.

Tech changes and smart contract bugs can trip you up if you’re not careful. Always ask questions and check the data well. Even smart contracts need a sharp eye on them. Remember, on-chain analysis can help but it has challenges. Investing is a game where knowing the rules and the game plan matters a lot.

Keep these things in mind and you’ll be on top of your game. Happy investing!

Balancing Investor Awareness with On-Chain Data Dependability

Bias in On-Chain Analysis

When you look into blockchain, you count on on-chain analysis to guide you. But here’s the thing: it can trick you with bias. Bias means the data is tilted one way. This happens when the methods we use to look at blockchain data lean in favor of a certain result. This means we may not get the full picture. We see what the bias lets us see. This can twist our view of how safe a cryptocurrency is. Or it might mask the real ways people use it.

We also face bias when we guess what will happen in the market. Our tools look at past data to predict the future. But if that past data is biased, so are our predictions. We might see a trend that’s not really there. Think of it as wearing colored glasses. They change the color of everything you see. If our glasses are biased, we won’t see the true colors of the market. And that’s a big risk for anyone investing in crypto.

On-Chain Analysis Inaccuracy

With on-chain analysis, we also run into problems with accuracy. Can we trust the numbers? Sometimes we can’t. Here’s why: there might be mistakes in the data. Or we might not have all the information we need. Just like a puzzle missing pieces, our understanding won’t be complete. This can throw us off.

But that’s not all. Think about smart contracts – they set the rules for some blockchain stuff. If they have flaws, our data might be wrong from the start. Also, as more people use blockchain, it gets packed. This congestion can delay transactions. It can even change the info we collect. This messes with our analysis in real-time.

Plus, some things happening off the chain don’t show up in our data. But they can still affect the value of a cryptocurrency. So, even if our on-chain data looks okay, we’re not seeing the whole picture.

Finally, there’s change to think about. Rules for crypto are always changing. Each time a rule changes, it can shift the data we see. If we’re not quick to catch these changes, we may make choices based on old news.

So, here’s the takeaway: On-chain analysis is a powerful tool. But we have to use it with care. It has blind spots and can lead us astray if we’re not careful. As someone who digs through blockchain data, my job is to watch for these tricks. To help make sure that we’re all seeing the true story of what’s happening on the chain. And that means working every day to get better at spotting bias and testing our tools for accuracy. Because in the end, what we want is a clear and honest picture of where our crypto is going.

In our dive into on-chain analysis, we saw its limits, like how tough it can be to get its data right. We also looked into the tug-of-war between privacy and open records on the blockchain. It’s clear that keeping financial privacy is hard with all eyes on the blockchain.

We talked about how tech changes bring new rules and risks, too. Smart contracts are super handy but they’re not without their flaws. They can be a weak spot if not made right.

Lastly, we must know that on-chain data isn’t perfect—it has bias and errors. When we use on-chain reports to make choices, we should do so with care, knowing these points.

To sum it up, on-chain analysis is a tool with a lot of upsides but it’s not fool-proof. It’s key to pair it with other info and keep an eye out for shifts in tech and rules. This will help us make smarter choices in the crypto world.

Q&A :

What are the key downsides to using on-chain analysis in cryptocurrency?

On-chain analysis, despite its growing popularity among cryptocurrency enthusiasts and analysts, faces several disadvantages. Privacy concerns are paramount, as the methodology involves studying and interpreting transaction data on the blockchain, which is public. This level of scrutiny can lead to privacy infringement for users. Additionally, the reliance on historical data may not always provide accurate future predictions, considering the volatile nature of cryptocurrencies. Market manipulation is another concern, as publicly available data can be used to influence market sentiment. Furthermore, on-chain analysis requires technical expertise, potentially limiting its accessibility to everyday investors.

How can on-chain analysis affect the privacy of cryptocurrency users?

The very nature of on-chain analysis, which involves inspecting transaction histories on a public ledger, can raise significant privacy issues. Analysts can potentially link wallet addresses to real-world identities, diminishing the anonymity that many cryptocurrency users value. While the data is pseudonymous, sophisticated techniques can unravel the layers of privacy, exposing individual or company transaction patterns and holdings to anyone with the knowledge of how to look.

Does on-chain analysis contribute to market manipulation in the crypto space?

On-chain data is public and accessible to anyone, which means that it can potentially be used to sway the market. Traders might engage in activities that paint a distorted picture of supply and demand to influence others’ investment decisions. Since on-chain analysis is a tool for interpreting these data points, it can unwittingly be part of a manipulation tactic, especially when bad actors disseminate false or misleading interpretations of on-chain metrics.

Are there limitations to the predictive power of on-chain analysis?

While on-chain analysis provides a wealth of information regarding transactions and the movements of cryptocurrencies, it has its limits in forecasting market trends. Its effectiveness is constrained by the historical nature of blockchain data and the ever-evolving market conditions that are influenced by factors outside the scope of the blockchain. Events such as regulatory changes, technological advancements, and macroeconomic factors are not reflected in on-chain data, thus limiting its predictive power.

Is on-chain analysis accessible to all levels of crypto investors?

On-chain analysis often requires a blend of technical knowledge and an understanding of the cryptocurrency market, which might not be readily available to all investors, especially beginners. The learning curve can be steep, and the tools needed to conduct thorough on-chain analysis might be complex or expensive. Accessibility remains an issue for those who lack the time or resources to delve into the intricacies of the blockchain and interpret the vast amount of data accurately.